Home /

Expert Answers /

Finance /

in-march-2020-daniela-motor-financing-dmf-offered-some-securities-for-sale-to-the-public-unde-pa261

(Solved): In March 2020, Daniela Motor Financing (DMF), offered some securities for sale to the public. Unde ...

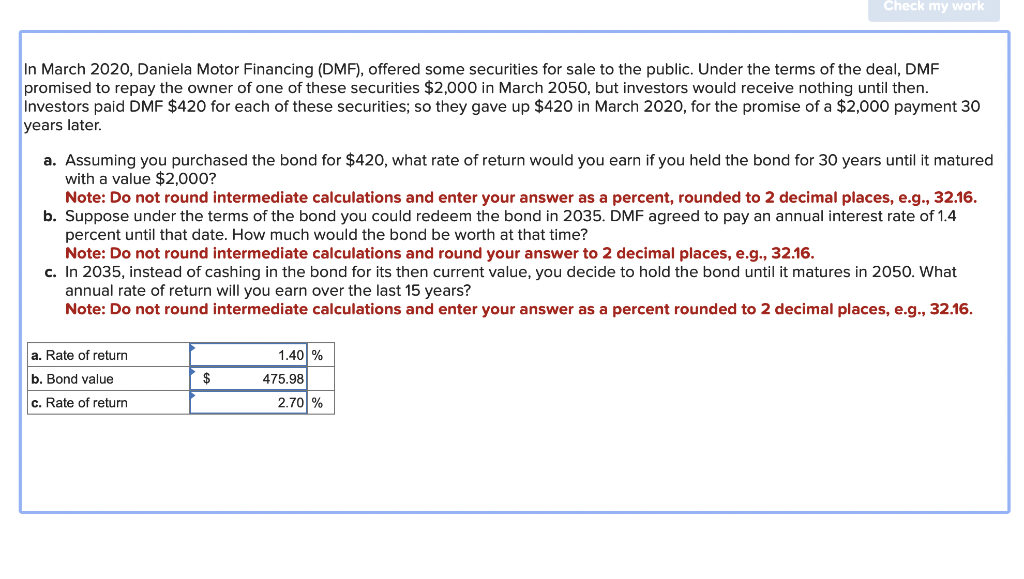

In March 2020, Daniela Motor Financing (DMF), offered some securities for sale to the public. Under the terms of the deal, DMF promised to repay the owner of one of these securities \( \$ 2,000 \) in March 2050 , but investors would receive nothing until then. Investors paid DMF \( \$ 420 \) for each of these securities; so they gave up \( \$ 420 \) in March 2020 , for the promise of a \( \$ 2,000 \) payment 30 years later. a. Assuming you purchased the bond for \( \$ 420 \), what rate of return would you earn if you held the bond for 30 years until it matured with a value \( \$ 2,000 \) ? Note: Do not round intermediate calculations and enter your answer as a percent, rounded to 2 decimal places, e.g., \( 32.16 . \) b. Suppose under the terms of the bond you could redeem the bond in 2035 . DMF agreed to pay an annual interest rate of \( 1.4 \) percent until that date. How much would the bond be worth at that time? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. In 2035, instead of cashing in the bond for its then current value, you decide to hold the bond until it matures in 2050 . What annual rate of return will you earn over the last 15 years? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., \( 32.16 . \)