Home /

Expert Answers /

Accounting /

if-you-could-type-out-the-formulas-for-each-cell-that-would-be-amazing-thank-you-begin-tab-pa803

(Solved): If you could type out the formulas for each cell that would be amazing. Thank you. \begin{tab ...

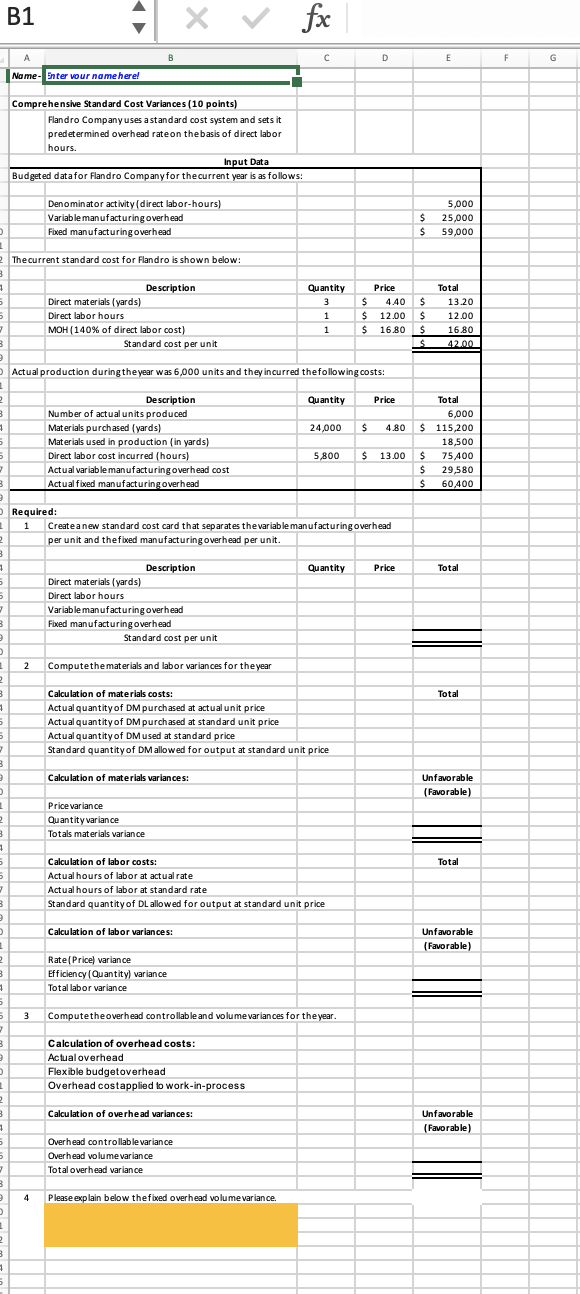

If you could type out the formulas for each cell that would be amazing. Thank you.

\begin{tabular}{l} B1. \\ \hline \end{tabular} Required: 1 Createa new standard cost card that separates thevariable manufacturing overhead per unit and thefbed manufacturing overhead per unit. \begin{tabular}{|l|l|l|l|} \hline \multicolumn{1}{|c|}{ Description } & Quantity & Price & \multicolumn{1}{|c|}{ Total } \\ \hline Direct materials (yards) & & & \\ \hline Direct labor hours & & & \\ \hline Variable manufacturing overhead & & & \\ \hline Fbed manufacturingoverhead & Standard cost per unit & & \\ \hline \end{tabular} 2 Compute thematerials and labor variances for theyear Calculation of materials costs: Actual quantity of DM purchased at actual unit price Actual quantity of DM purchased at standard unit price Actual quantityof DMused at standard price Standard quantity of DMallowed for output at standard unit price Calculation of materials variances: Unfavorable (Favorable) Pricevariance Quantity variance Totals materials variance Calculation of labor costs: Actual hours of labor at actual rate Actual hours of labor at standard rate Standard quantity of DL allowed for output at standard unit price Calculation of labor variances: Unfavorable Rate(Price) variance Efficiency (Quantity) variance Total labor variance 3 Computetheoverhead controllable and volumevariances for theyear. Calculation of overhead costs: Actual overhead Flexible budgetoverhead Overhead costapplied to work-in-process Calculation of overhead variances: Unfavorable Overhead controllablevariance Overhead volumevariance Total overhead variance 4 Please explain below the fbed overhead volumevariance.

Expert Answer

The fixed overhead volume variance is a type of overhead variance that measures the difference between the actual fixed overhead cost incurred and the fixed overhead cost that would have been incurred based on the standard predetermined overhead rate and the actual number of units produced. It is also known as the fixed overhead capacity variance.The given question is about a company called Flandro that uses a standard cost system to set predetermined overhead rates based on direct labor hours. The question asks to create a new standard cost card, calculate materials and labor variances, and overhead controllable and volume variances for the year. Additionally, the question asks to explain the fixed overhead volume variance, which measures the difference between actual fixed overhead costs incurred and the fixed overhead costs that would have been incurred based on the standard predetermined overhead rate and the actual number of units produced.