Home /

Expert Answers /

Accounting /

if-an-amount-is-zero-enter-34-0-34-a-determine-the-amount-and-the-character-of-the-recognized-gain-pa519

(Solved): If an amount is zero, enter " 0 ". a. Determine the amount and the character of the recognized gain ...

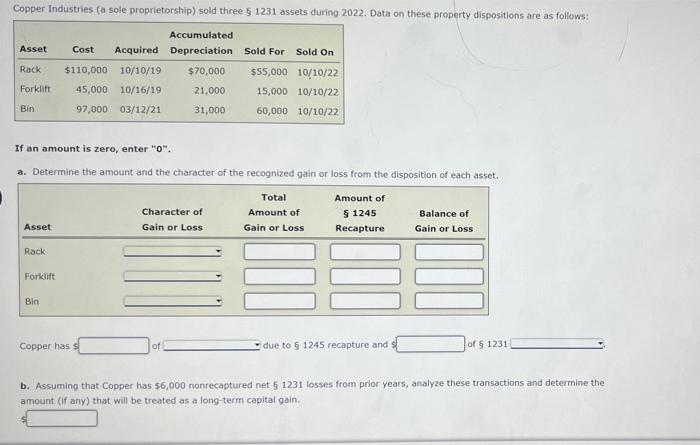

If an amount is zero, enter " 0 ". a. Determine the amount and the character of the recognized gain or foss from the disposition of each asset. Copper has 5 due to 51245 recapture and \( \$ \) of \( \S 1231 \) b. Assuming that Copper has \( \$ 6,000 \) nonrecaptured net 51231 losses from prior years, analyze these transactions and determine the amount (if any) that will be treated as a long-term capital gain.

If an amount is zero, enter "o", a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset. b. Assuming that Copper has \( \$ 6,000 \) nonrecaptured net \( \$ 1231 \) losses from prior years, analyze these transactions and determine the amount (if any) that will be treated as a long-term capital gain.

If an amount is zero, enter " 0 ". a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset. Copper has 5 Aue to \( \$ 1245 \) recapture and 1 of \( \S 1231 \) b. Assuming that Copper has 5 51231 losses from prior years, analyze these transactions and determine the amount (If any) that will be trea al gain.

If an amount is zero, enter "o", a. Determine the amount and the character of the recognized gain of loss from the disposition of each asset: b. Assuming that Copper has \( \$ 6,000 \) nonrecaptured net \( \$ 1231 \) losses from prior years, analyze these transact amount (if any) that will be treated as a long-term capital gain.