Home /

Expert Answers /

Accounting /

if-a-company-is-using-accrual-basis-accounting-when-should-it-record-revenue-a-when-cash-is-rece-pa250

(Solved): If a company is using accrual basis accounting, when should it record revenue? A. when cash is rece ...

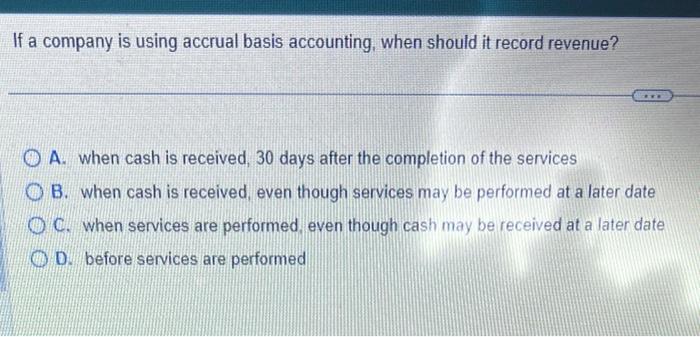

If a company is using accrual basis accounting, when should it record revenue? A. when cash is received, 30 days after the completion of the services B. when cash is received, even though services may be performed at a later date C. when services are performed, even though cash may be received at a later date D. before services are performed

Expert Answer

In accrual accounting, revenue is recorded as soon as ser