(Solved): Identify the critical economic assumption underlying the scenario analysis conducted in Exhibits B1- ...

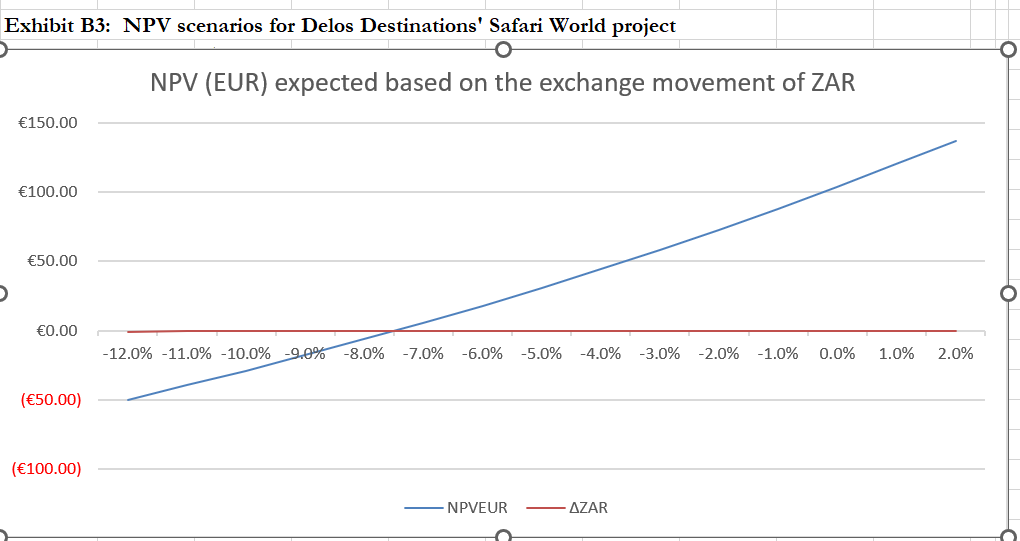

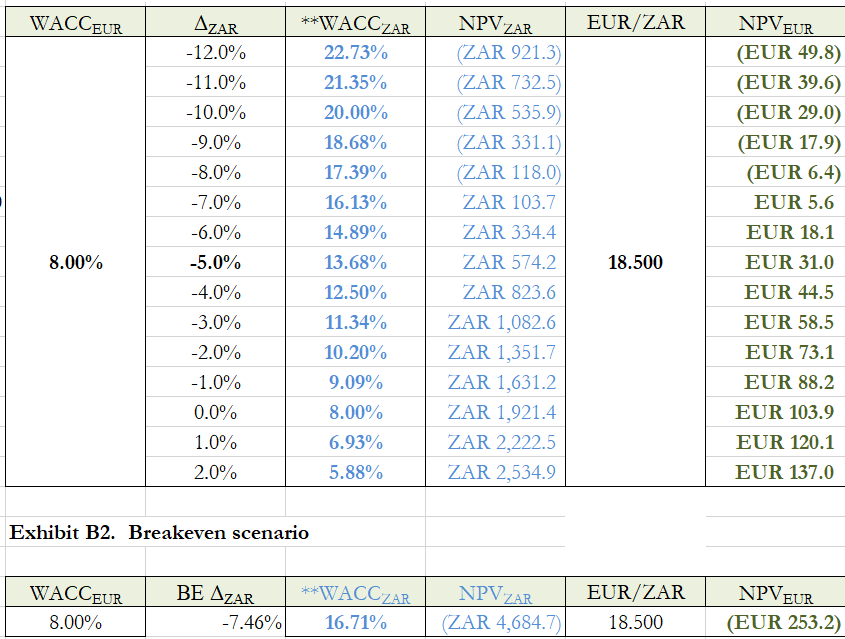

Identify the critical economic assumption underlying the scenario analysis conducted in Exhibits B1-B3. ?

Discuss whether this assumption is realistic for estimation and analysis of cash flows generated by a resort hotel and hospitality operation in South Africa that caters to international tourists. Specifically, are the ZAR cash flows shown in Exhibit A likely to be independent of deviations from the base case scenario of 5% depreciation per year, or correlated (positively or negatively) with such deviations? Explain why or why not. Identify whether the EUR-equivalent NPV of the project is likely to be more sensitive or less sensitive to the rate of change of the ZAR's value compared to the analysis shown in Exhibits B1-B3. Briefly conjecture as to how more realistic assumptions about exchange rates and components of operational cash flows might be factored into the analysis?

Expert Answer

Specifically, are the ZAR cash flows shown in Exhibit A likely to be independent of deviations from the base case scenario of 5% depreciation per year