Home /

Expert Answers /

Accounting /

i-need-help-asap-advanced-scenario-8-julia-oakley-directions-using-the-tax-software-complete-the-t-pa366

(Solved): I need help ASAP Advanced Scenario 8: Julia Oakley Directions Using the tax software, complete the t ...

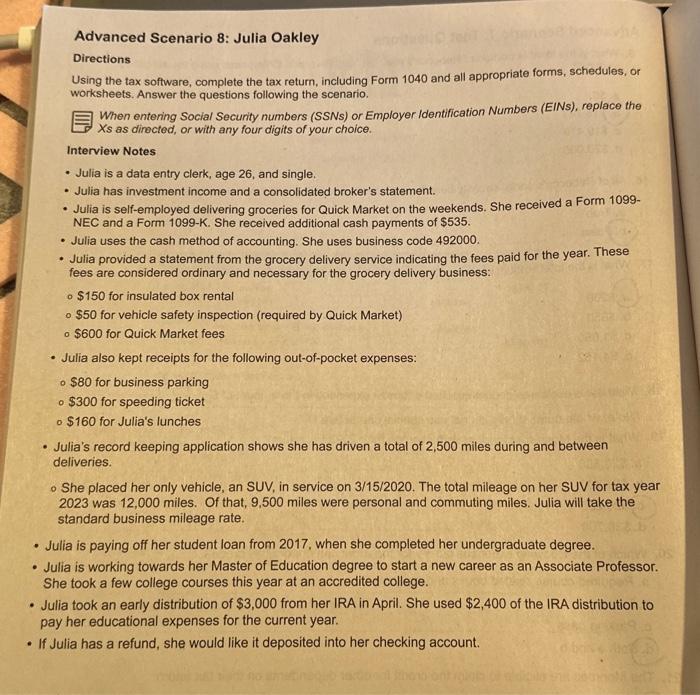

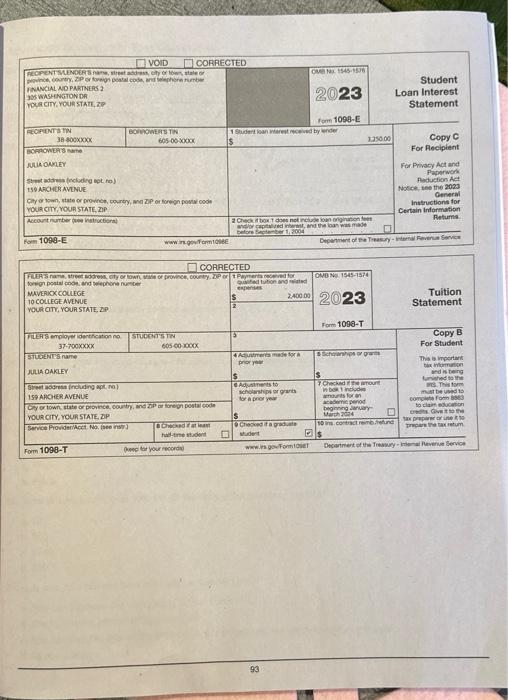

I need help ASAP

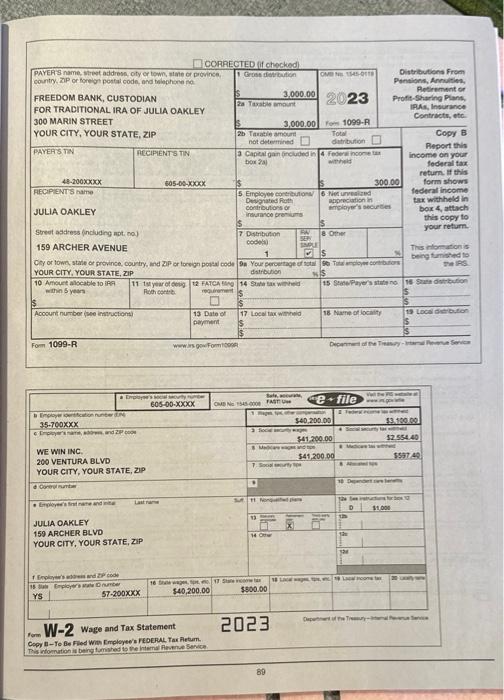

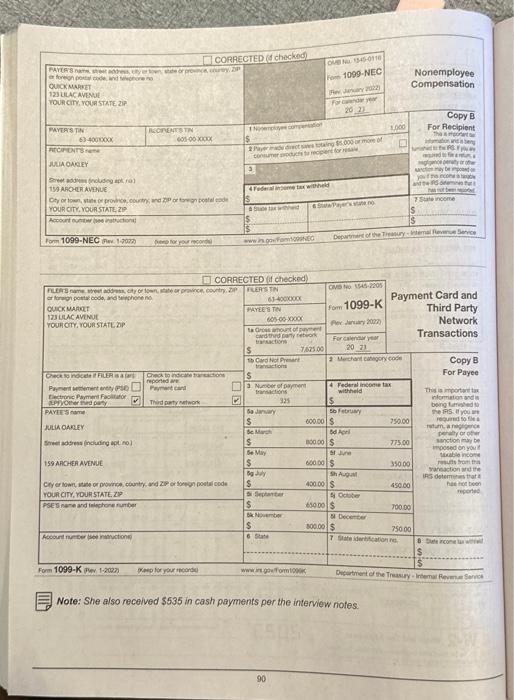

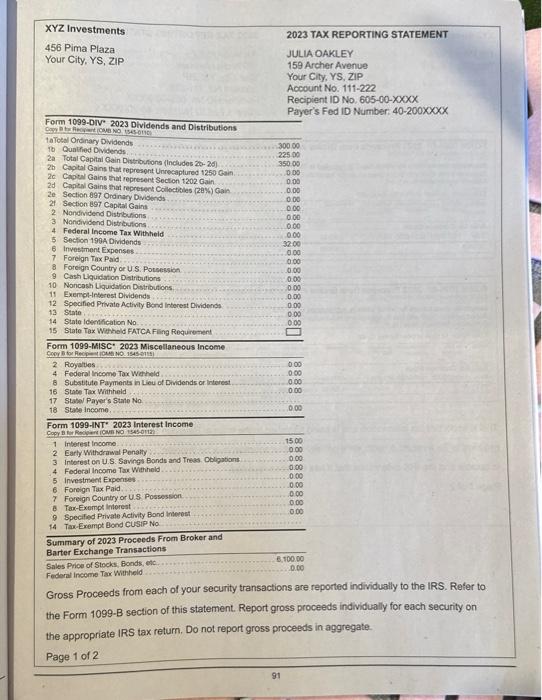

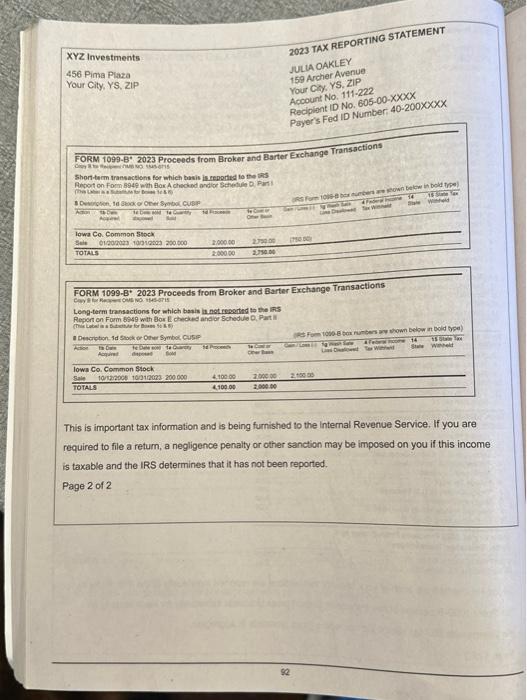

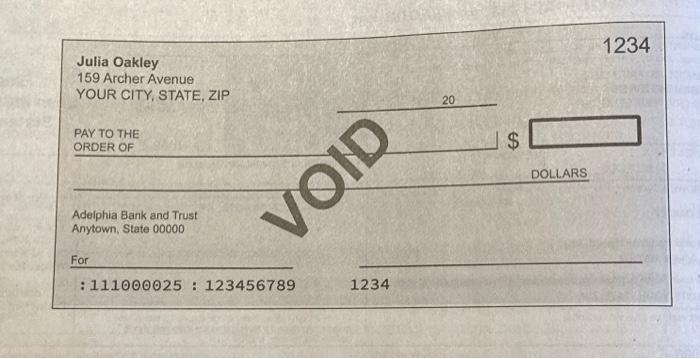

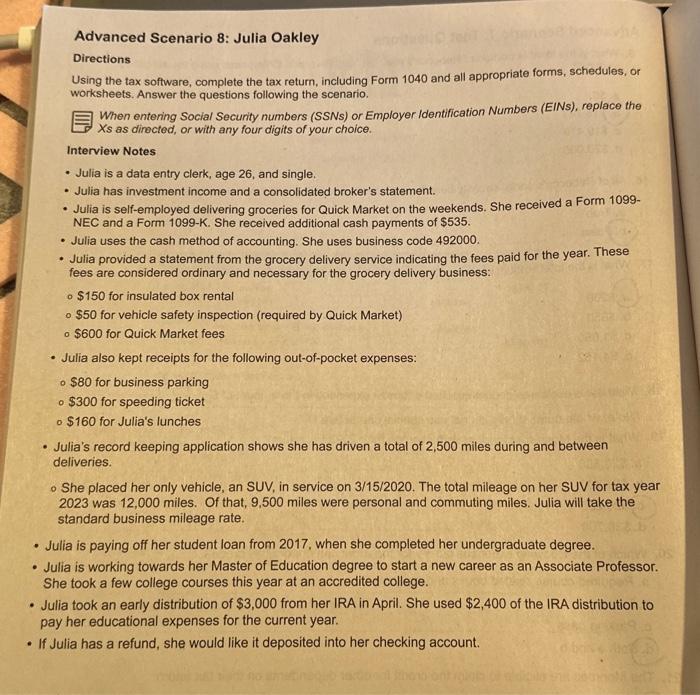

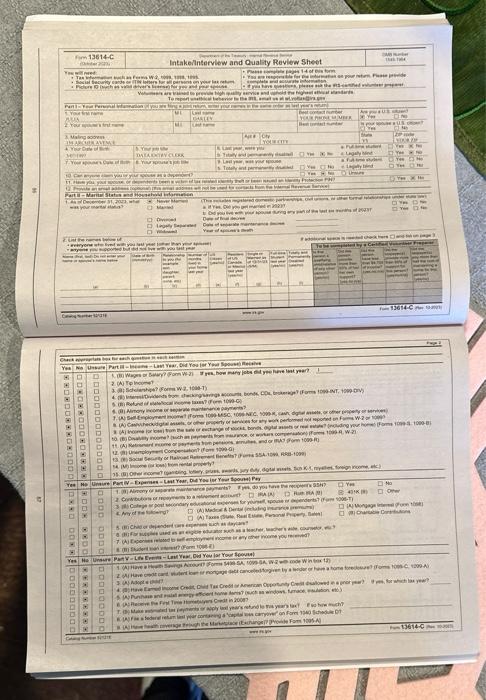

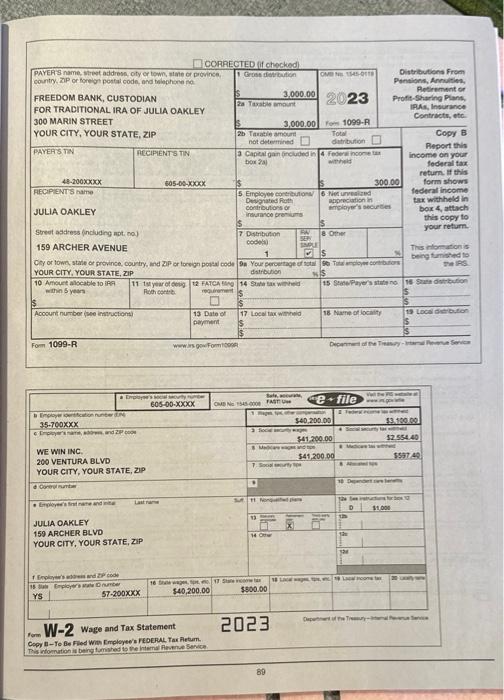

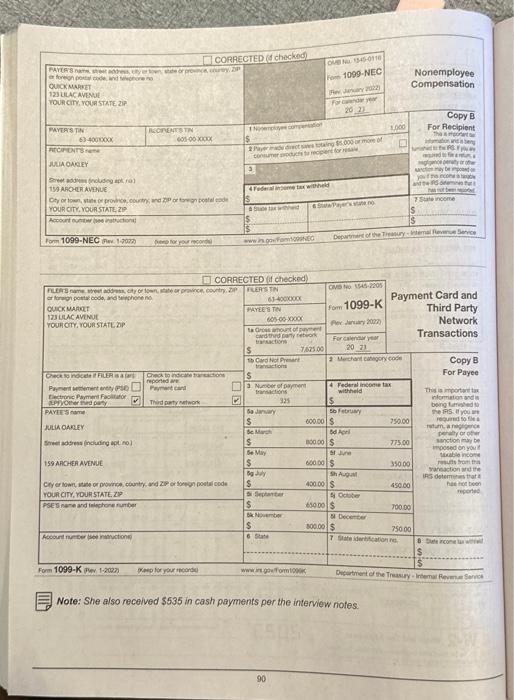

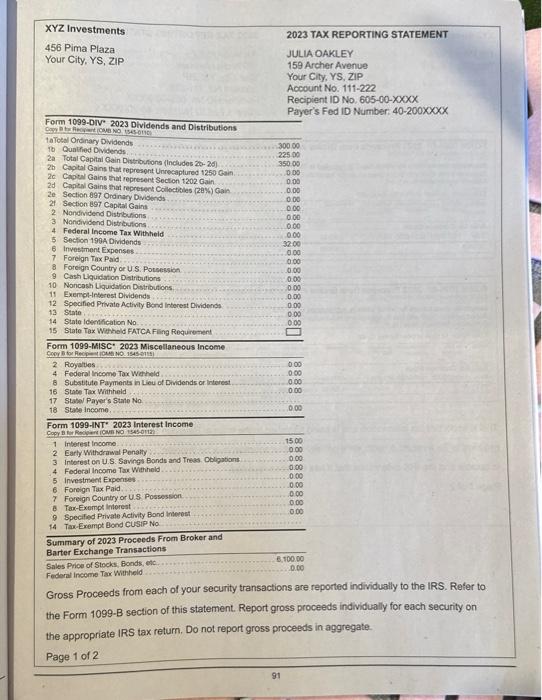

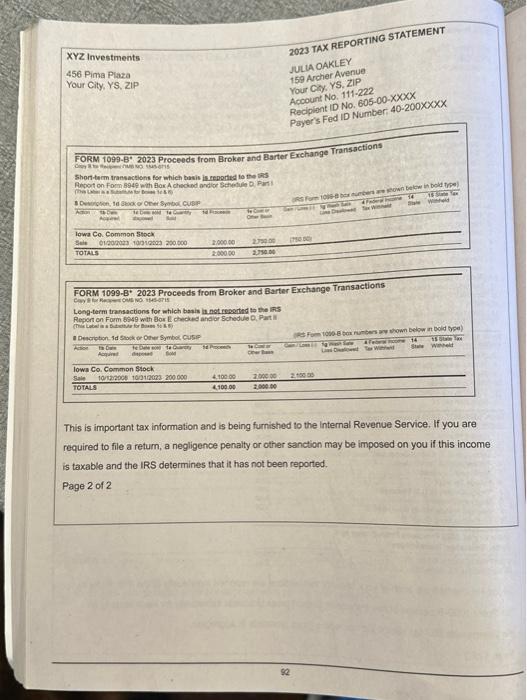

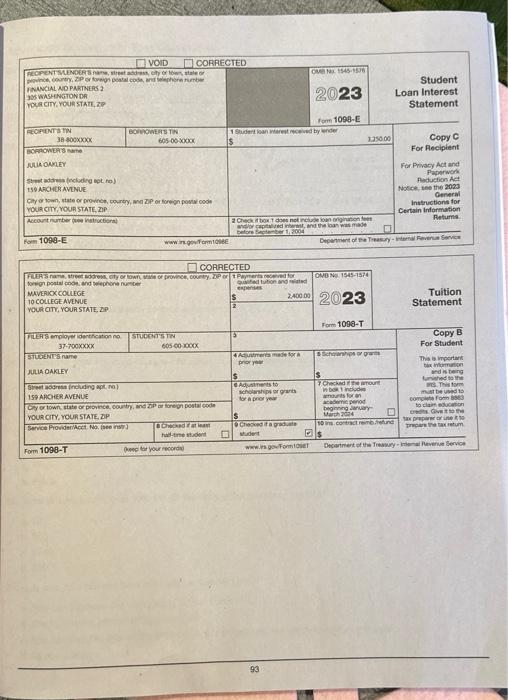

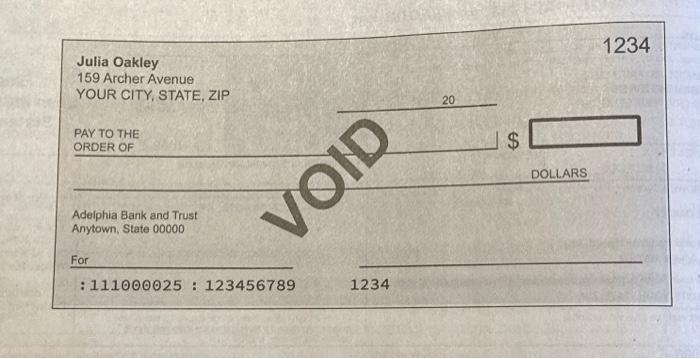

Advanced Scenario 8: Julia Oakley Directions Using the tax software, complete the tax retum, including Form 1040 and all appropriate forms, schedules, or worksheets. Answer the questions following the scenario. When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINs), replace the Xs as dirocted, or with any four digits of your choice. Interview Notes - Julia is a data entry clerk, age 26, and single. - Julia has investment income and a consolidated broker's statement. - Julia is self-employed delivering groceries for Quick Market on the weekends. She received a Form 1099NEC and a Form 1099-K. She received additional cash payments of . - Julia uses the cash method of accounting. She uses business code 492000. - Julia provided a statement from the grocery delivery service indicating the fees paid for the year. These fees are considered ordinary and necessary for the grocery delivery business: - \$150 for insulated box rental - \$50 for vehicle safety inspection (required by Quick Market) - \$600 for Quick Market fees - Julia also kept receipts for the following out-of-pocket expenses: - \$80 for business parking - \$300 for speeding ticket - \$160 for Julia's lunches - Julia's record keeping application shows she has driven a total of 2,500 miles during and between deliveries. - She placed her only vehicle, an SUV, in service on 3/15/2020. The total mileage on her SUV for tax year 2023 was 12,000 miles. Of that, 9,500 miles were personal and commuting miles. Julia will take the standard business mileage rate. Julia is paying off her student loan from 2017, when she completed her undergraduate degree. Julia is working towards her Master of Education degree to start a new career as an Associate Professor. She took a few college courses this year at an accredited college. Julia took an early distribution of from her IRA in April. She used of the IRA distribution to pay her educational expenses for the current year. If Julia has a refund, she would like it deposited into her checking account.

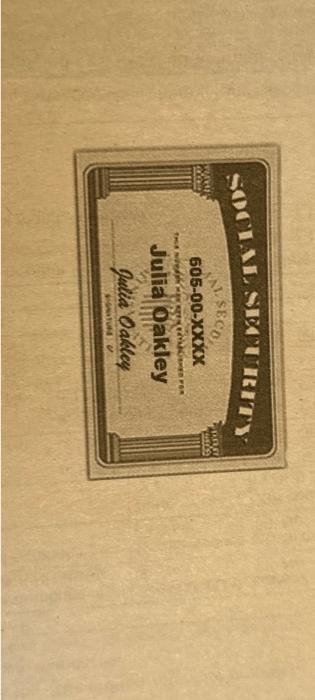

\begin{tabular}{|c|c|c|} \hline fim & Intakerlnterview and Quality Review Sheot & trevinter \\ \hline \end{tabular}

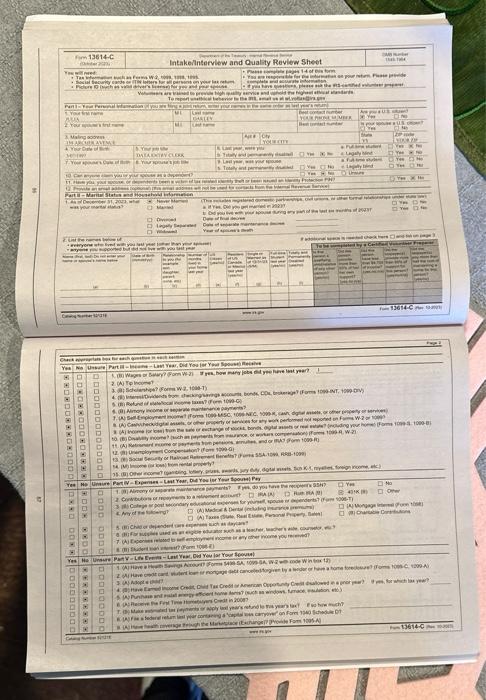

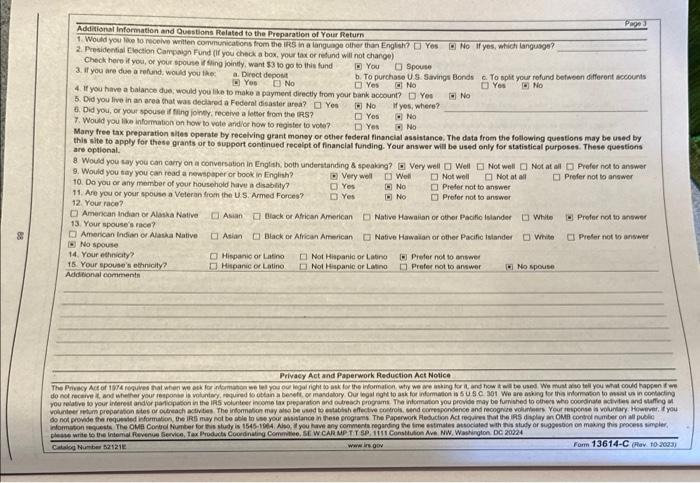

Additional Information and OuesBons Related to the Preparation of Yoir Return 2. Presidential Clection Carpeagn Fund (if you check a box, your tax or retund will not change) Check hero it you, or your spouse it sing jointly, want lo po to this fund 3. If you are die a refund, would you the: a. Diroct depont (1) You Spoute (-) Yas CI No b. To purchase U.S: Savings Bonds c. To spts your refund betwean different sceounts Yes (a) No Yet [iv) No 4. If you hive a balance due, would you the to make a payment directly from your bank acoount? Yes (o) No 5. Did you live in an area that was declared a Federat disaster area? Yes 0 No if yos, where? 7. Would you liae information on how to wote andilor how to register to vote? . Y Yes . No Many free tax preparation sites operste by recelving grant money or other federal financial assistance. The data from the following questions may be used by this site to apply for these grants or to support continued recelpt of financial funding. Your answer will be used only for statistical purposes. These questions are eptional. 8 Would you say you can carry on a conversatoon in Englah; both understanding s speakong? \& Very well Weil Not weil Not at al Prefer not to answer 9. Would you tay you can read a newspoper or book in English? very weal D. Woti Not woll Not at al Prefer not to answer 10. Oa you cr any mamber of your household have a disablity? res (6) No Prefer not to answer 12. Your race? res [0] No Prefer not to answer Amerkan indan er Alaska Native Asian Black or African American Native Hawailan or other Pacifio Islander While Profer not to answer 13. Your spouse's race? Amerioan lindian or Alatka Nattive Asian Btack or African American Native Hawalian or other Pacifio tutander vinte Preder not to answer No spouse 14. Your ethinicity? Hispanie or Latino Not Rupanic or tateno Prefer not to answee 15. Your spove's ethnicity? Hispanic or Latino Not Hispanic or Lahno Prefer not to answer No spovise Addicional commenti Privacy Act and Paperwork Reduction Act Notice.

Note: She also received in cash payments per the interview notes.

Gross Proceeds from each of your security transactions are reported individually to the IRS. Refer to the Form 1099-B section of this statement. Report gross proceeds individually for each security on the appropriate IRS tax retum. Do not report gross proceeds in aggregate. Page 1 of 2

This is important tax information and is being fumished to the internal Revenue Service. If you are required to file a retum, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. Page 2 of 2

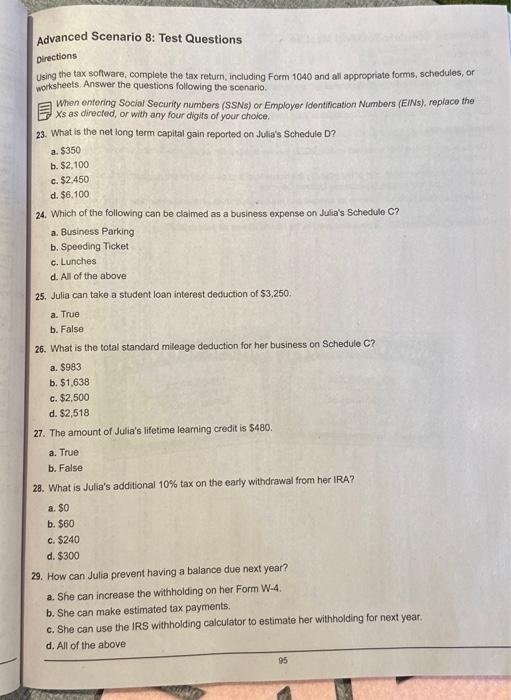

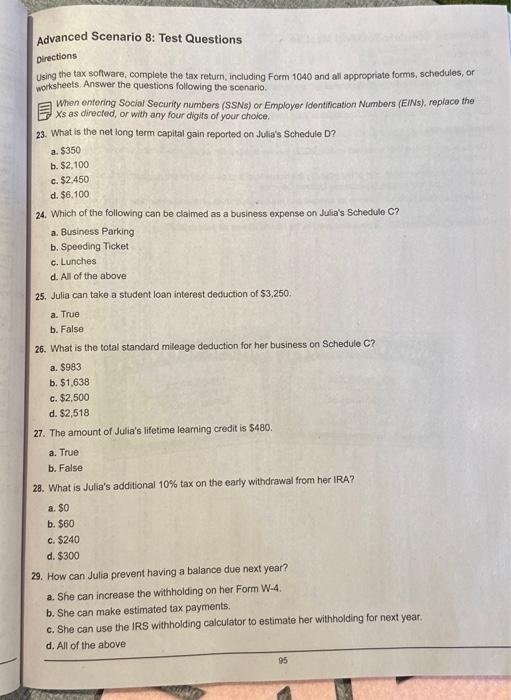

Advanced Scenario 8: Test Questions Directions Using the tax software, complete the tax return, including Form 1040 and all appropriate forms, schedules, of worksheets. Answer the questions following the scenario. When enfering Social Security numbers (SSNs) or Employer identification Numbers (EINs), replace the Xs as directed, or with any four digits of your chaice. 23. What is the net long term capital gain reported on Julia's Schedule D? a. b. c. d. 24. Which of the following can be claimed as a business expense on Julia's Schedule C? a. Business Parking b. Speeding Ticket c. Lunches d. All of the above 25. Julia can take a student loan interest deduction of . a. True b. False 26. What is the total standard mileage deduction for her business on Schedule ? a. b. c. d. 27. The amount of Julia's lifetime learning credit is . a. True b. False 28. What is Julia's additional tax on the early withdrawal from her IRA? a. b. c. d. 29. How can Julia prevent having a balance due next year? a. She can increase the withholding on her form W-4. b. She can make estimated tax payments. c. She can use the IRS withholding calculator to estimate her withholding for next year. d. All of the above