Home /

Expert Answers /

Accounting /

how-would-this-be-solved-nbsp-garrett-boone-flint-enterprises-39-vice-president-of-operations-need-pa440

(Solved): how would this be solved? Garrett Boone. Flint Enterprises' vice president of operations, need ...

how would this be solved?

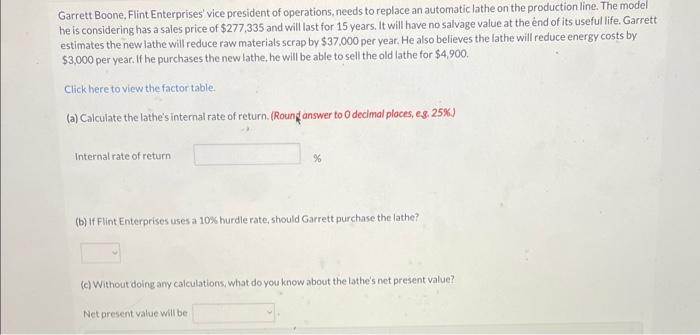

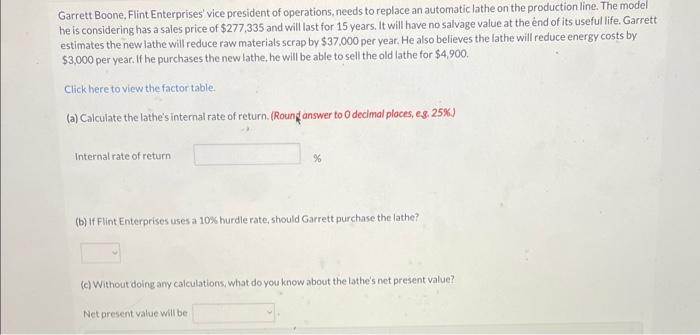

Garrett Boone. Flint Enterprises' vice president of operations, needs to replace an automatic lathe on the production line. The model he is considering has a sales price of \( \$ 277,335 \) and will last for 15 years. It will have no salvage value at the end of its useful life. Garrett estimates the new lathe will reduce raw materials scrap by \( \$ 37.000 \) per year. He also believes the lathe will reduce energy costs by \( \$ 3,000 \) per year. If he purchases the new lathe, he will be able to sell the old lathe for \( \$ 4,900 \). Click here to view the factor table. (a) Calculate the lathe's internal rate of return. (Round answer to 0 decimal ploces, eg, 25\%) Internal rate of return \( \% \) (b) If Flint Enterprises uses a 100 hurdle rate, should Garrett purchase the lathe? (c) Without doing any calculations, what do you know about the lathe's net present value? Net present value will be

Expert Answer

Net Cash outflows for the purchase of new equipment : = $ 277,335 - $ 4900 = $ 272,43