Home /

Expert Answers /

Accounting /

how-to-do-this-ledger-accounts-current-attempt-in-progress-on-october-31-2024-the-account-balances-pa756

(Solved): How to do this ledger accounts Current Attempt in Progress On October 31, 2024, the account balances ...

How to do this ledger accounts

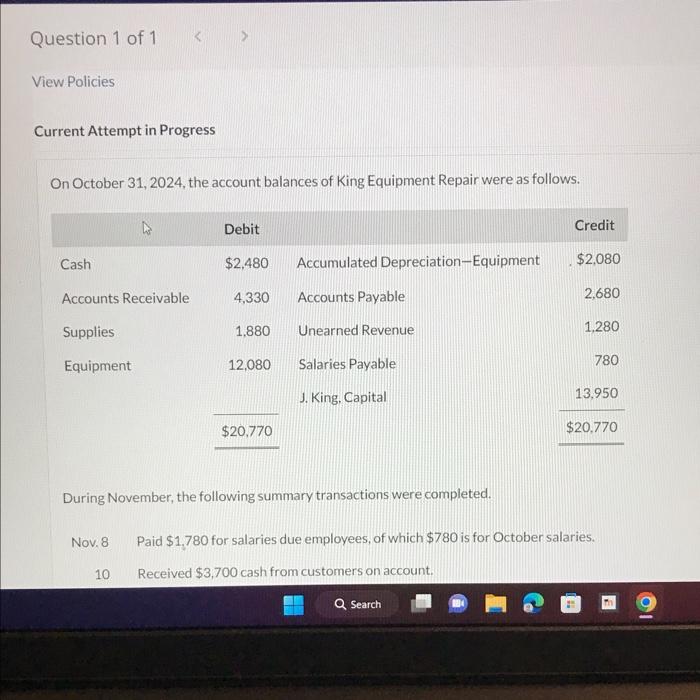

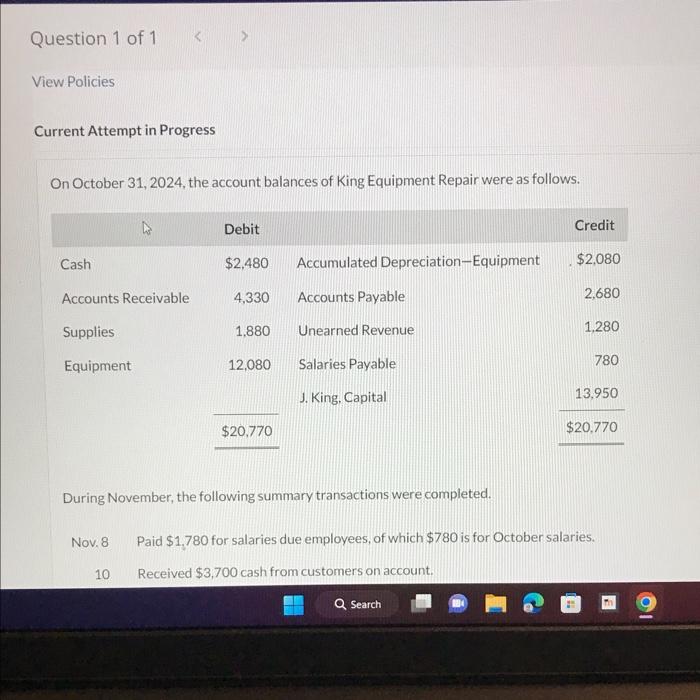

Current Attempt in Progress On October 31, 2024, the account balances of King Equipment Repair were as follows. During November, the following summary transactions were completed. Nov. 8 Paid for salaries due employees, of which is for October salaries. 10 Received cash from customers on account.

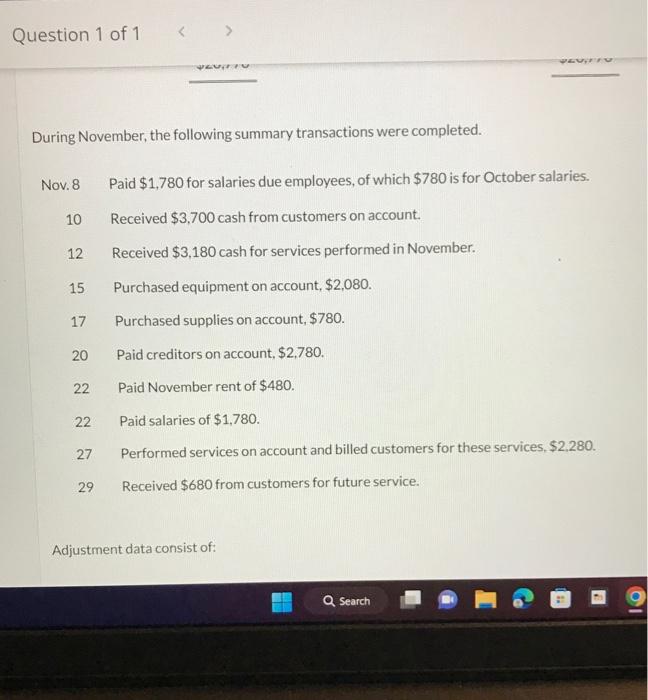

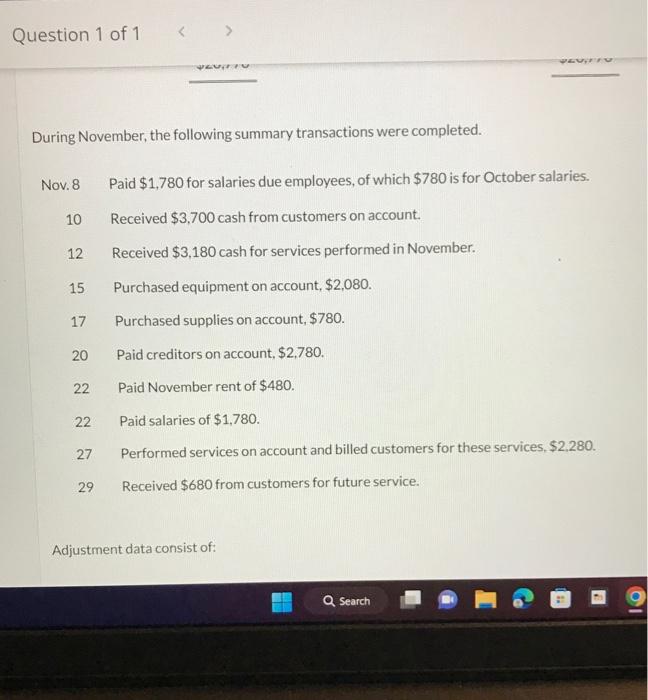

During November, the following summary transactions were completed. Nov. 8 Paid for salaries due employees, of which is for October salaries. 10 Received cash from customers on account. 12 Received cash for services performed in November. 15 Purchased equipment on account, . 17 Purchased supplies on account, . 20 Paid creditors on account, . 22 Paid November rent of . 22 Paid salaries of . 27 Performed services on account and billed customers for these services, . 29 Received from customers for future service. Adjustment data consist of:

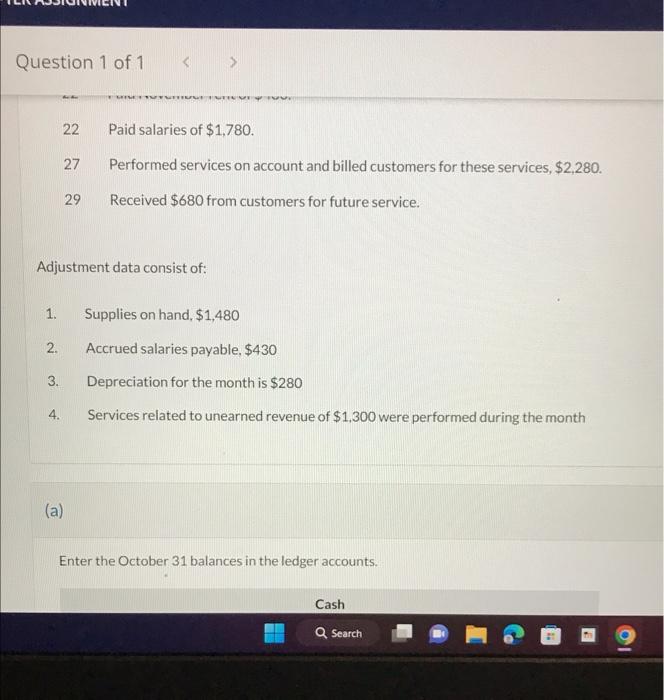

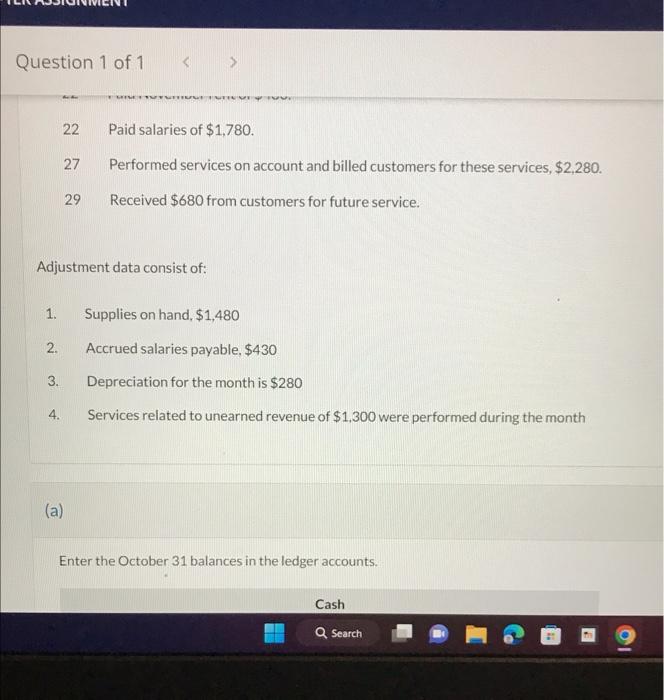

22 Paid salaries of . 27 Performed services on account and billed customers for these services, . 29 Received from customers for future service. Adjustment data consist of: 1. Supplies on hand, 2. Accrued salaries payable, 3. Depreciation for the month is 4. Services related to unearned revenue of were performed during the month (a) Enter the October 31 balances in the ledger accounts.

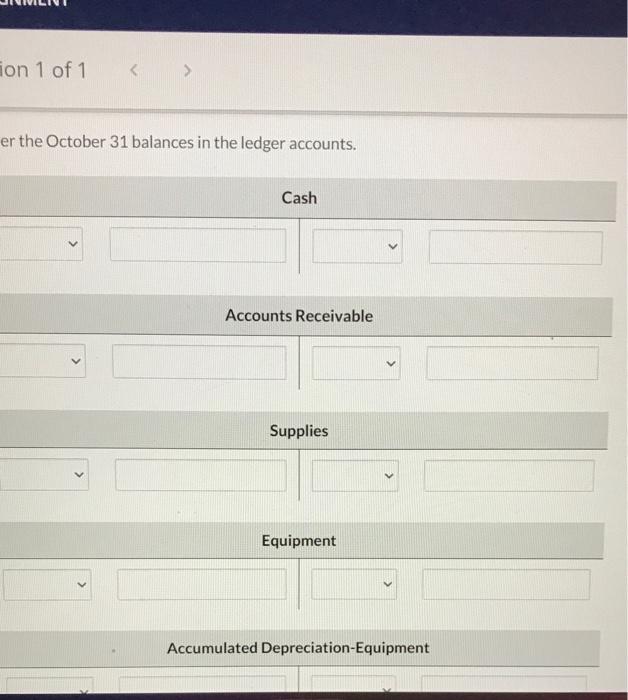

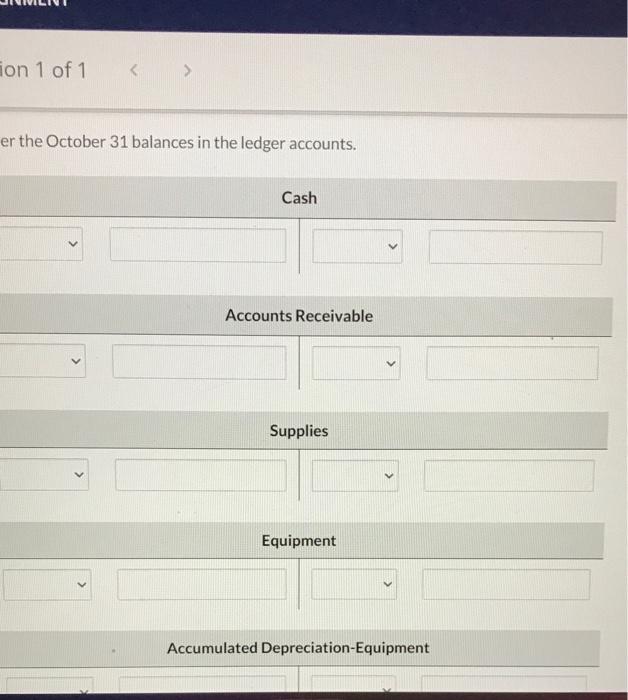

er the October 31 balances in the ledger accounts.

Expert Answer

Enter the October 31 account balances in the ledger account