Home /

Expert Answers /

Accounting /

how-much-will-they-pay-in-total-premiums-if-steven-purchases-a-policy-today-and-begins-using-the-po-pa577

(Solved): How much will they pay in total premiums if Steven purchases a policy today and begins using the po ...

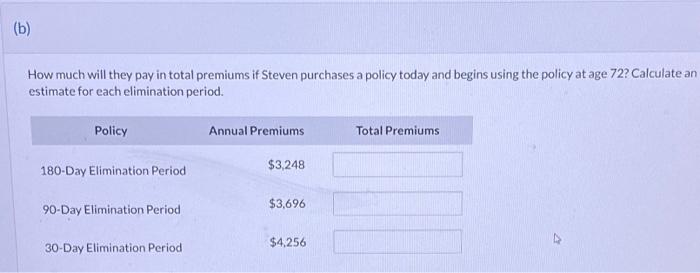

How much will they pay in total premiums if Steven purchases a policy today and begins using the policy at age 72 ? Calculate an estimate for each elimination period.

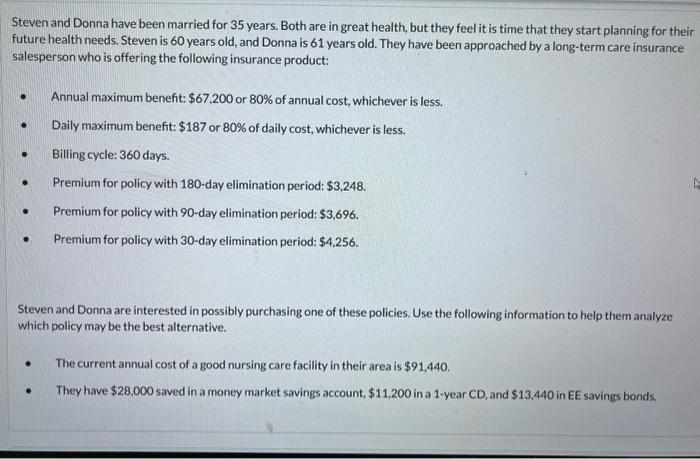

Steven and Donna have been married for 35 years. Both are in great health, but they feel it is time that they start planning for their future health needs. Steven is 60 years old, and Donna is 61 years old. They have been approached by a long-term care insurance salesperson who is offering the following insurance product: - Annual maximum benefit: or of annual cost, whichever is less. - Daily maximum benefit: or of daily cost, whichever is less. - Billing cycle; 360 days. - Premium for policy with 180-day elimination period: . - Premium for policy with 90-day elimination period: . - Premium for policy with 30-day elimination period: . Steven and Donna are interested in possibly purchasing one of these policies. Use the following information to help them analyze which policy may be the best alternative. - The current annual cost of a good nursing care facility in their area is . - They have saved in a money market savings account, \$11,200 in a 1-year , and in savings bonds.

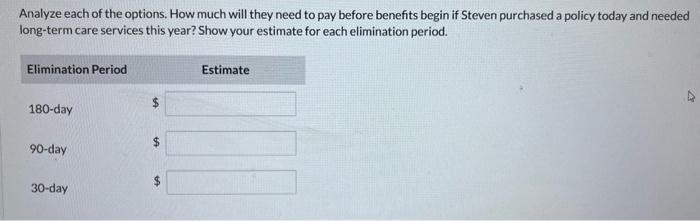

Analyze each of the options. How much will they need to pay before benefits begin if Steven purchased a policy today and needed long-term care services this year? Show your estimate for each elimination period.