Home /

Expert Answers /

Finance /

how-do-i-calculate-costs-after-tax-number-from-year-0-to-10-and-why-are-the-answers-repeated-for-f-pa486

(Solved): How do I calculate costs after tax number from year 0 to 10? And why are the answers repeated for f ...

How do I calculate costs after tax number from year 0 to 10? And why are the answers repeated for fcf (excluding cca tax shields) and how do i calculate the npv excluding cca tax shields, PV CCA tax shields and NPV at 11%? Also, what are things I should know when doing capital budgeting questions that will help me understand it?

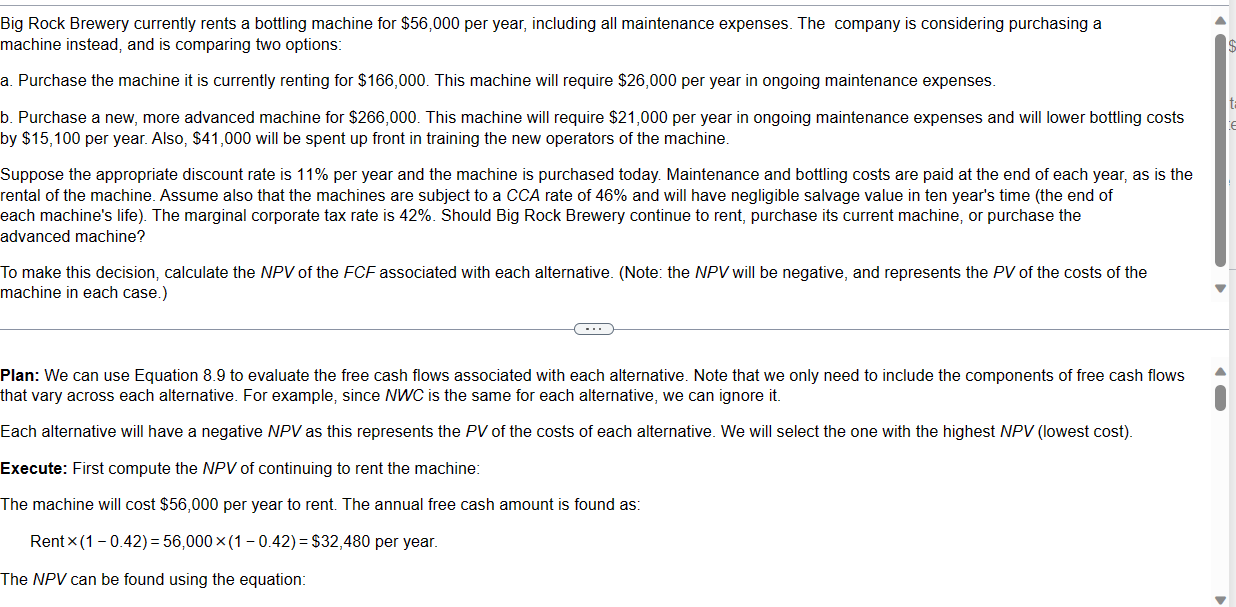

Big Rock Brewery currently rents a bottling machine for per year, including all maintenance expenses. The company is considering purchasing a nachine instead, and is comparing two options: a. Purchase the machine it is currently renting for . This machine will require per year in ongoing maintenance expenses. . Purchase a new, more advanced machine for . This machine will require per year in ongoing maintenance expenses and will lower bottling costs oy per year. Also, will be spent up front in training the new operators of the machine. Suppose the appropriate discount rate is per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the ental of the machine. Assume also that the machines are subject to a CCA rate of and will have negligible salvage value in ten year's time (the end of each machine's life). The marginal corporate tax rate is . Should Big Rock Brewery continue to rent, purchase its current machine, or purchase the advanced machine? To make this decision, calculate the NPV of the FCF associated with each alternative. (Note: the NPV will be negative, and represents the of the costs of the nachine in each case.) Plan: We can use Equation 8.9 to evaluate the free cash flows associated with each alternative. Note that we only need to include the components of free cash flows hat vary across each alternative. For example, since NWC is the same for each alternative, we can ignore it. Each alternative will have a negative NPV as this represents the of the costs of each alternative. We will select the one with the highest (lowest cost). Execute: First compute the NPV of continuing to rent the machine: The machine will cost per year to rent. The annual free cash amount is found as: Rent per year. The NPV can be found using the equation:

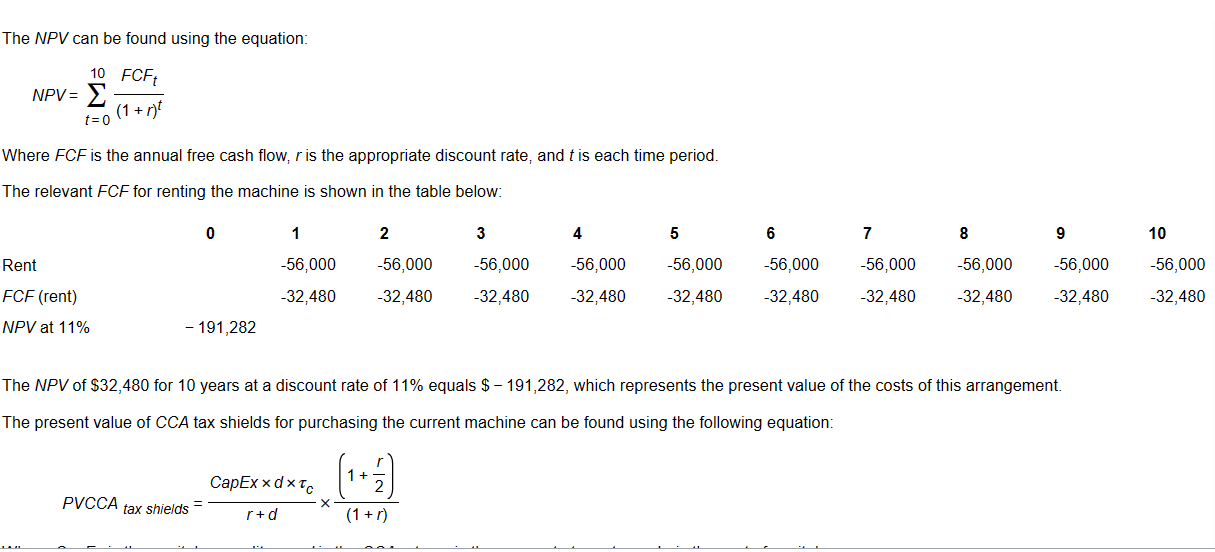

The NPV can be found using the equation: Where is the annual free cash flow, is the appropriate discount rate, and is each time period. The relevant for renting the machine is shown in the table below: Rent FCF (rent NPV at The NPV of for 10 years at a discount rate of equals , which represents the present value of the costs of this arrangement. The present value of tax shields for purchasing the current machine can be found using the following equation:

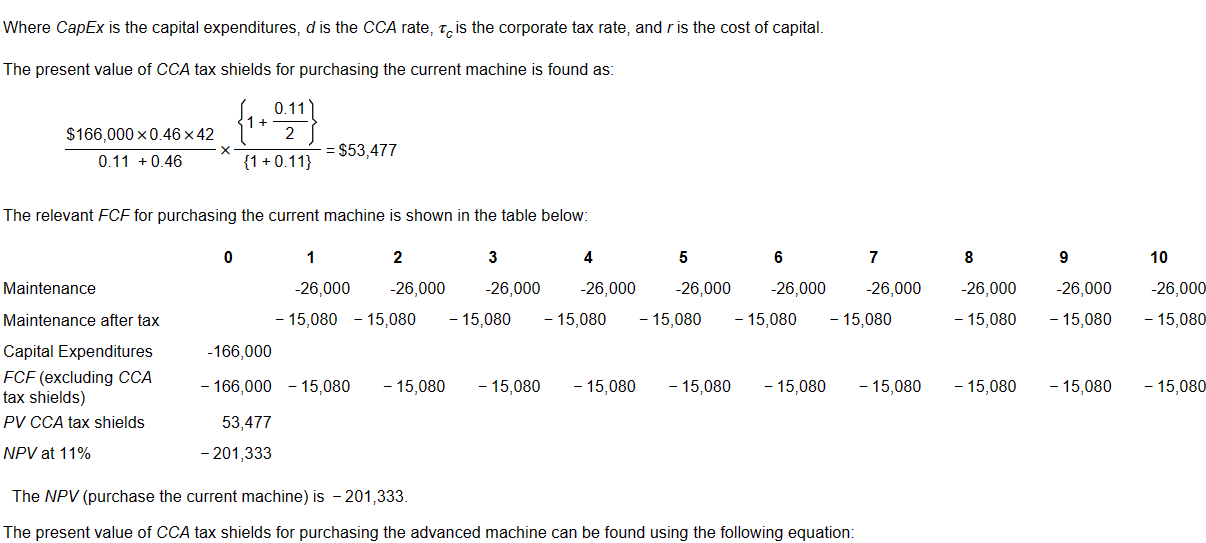

Where CapEx is the capital expenditures, is the CCA rate, is the corporate tax rate, and is the cost of capital. The present value of tax shields for purchasing the current machine is found as: The relevant for purchasing the current machine is shown in the table below: The NPV (purchase the current machine) is . The present value of tax shields for purchasing the advanced machine can be found using the following equation:

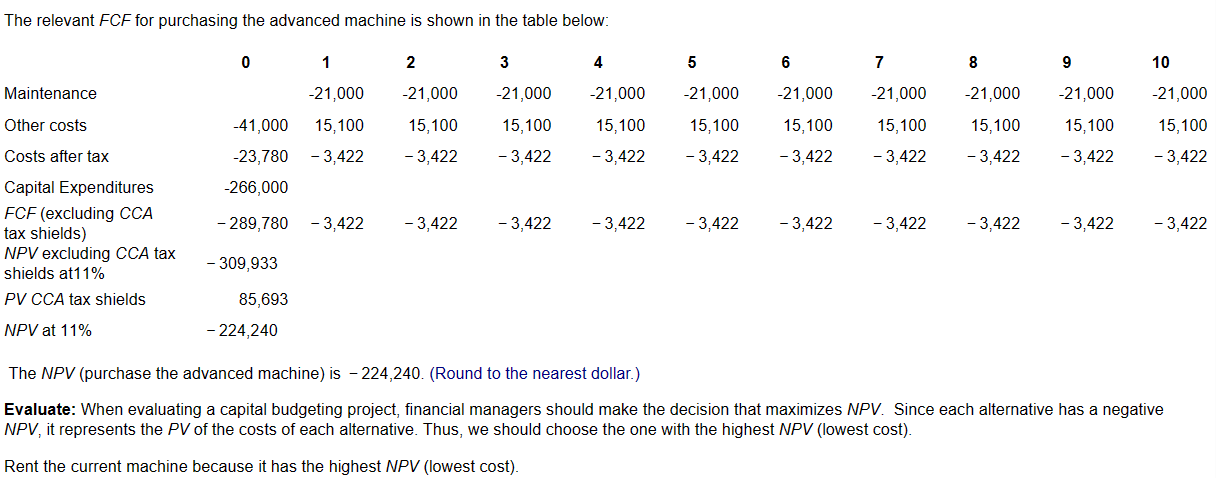

The relevant for purchasing the advanced machine is shown in the table below: The NPV (purchase the advanced machine) is . (Round to the nearest dollar.) Evaluate: When evaluating a capital budgeting project, financial managers should make the decision that maximizes NPV. Since each alternative has a negative , it represents the of the costs of each alternative. Thus, we should choose the one with the highest NPV (lowest cost). Rent the current machine because it has the highest NPV (lowest cost).