Home /

Expert Answers /

Accounting /

halogen-laminated-products-company-began-business-on-january-1-2024-during-january-the-followin-pa831

(Solved): Halogen Laminated Products Company began business on January 1,2024 . During January, the followin ...

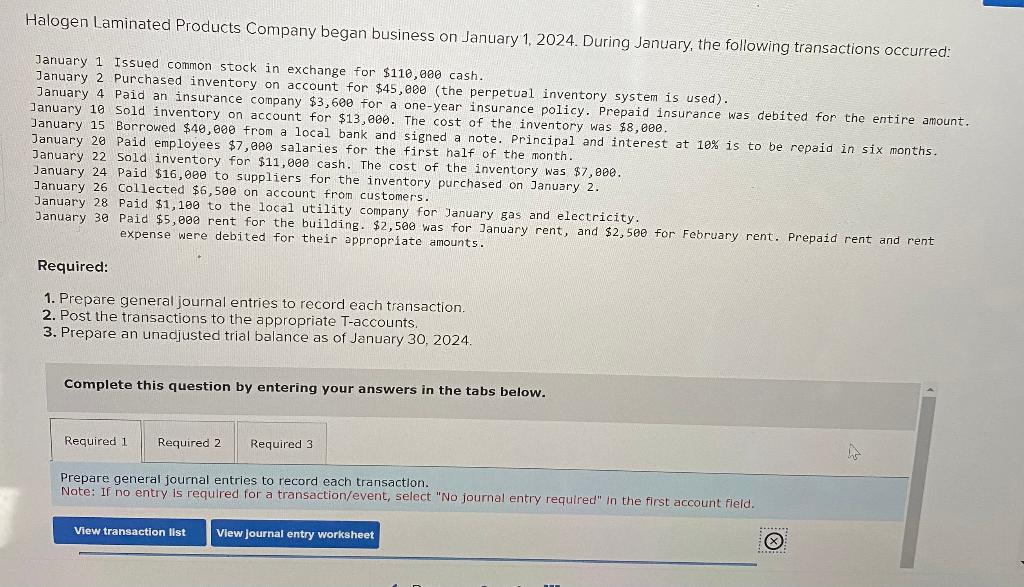

Halogen Laminated Products Company began business on January 1,2024 . During January, the following transactions occurred: January 1 Issued common stock in exchange for \( \$ 110,000 \) cash. January 2 Purchased inventory on account for \( \$ 45,000 \) (the perpetual inventory system is used). January 4 Paid an insurance company \( \$ 3,600 \) for a one-year insurance policy. Prepaid insurance was debited for the entire amount. January 10 Sold inventory on account for \( \$ 13, \theta 00 \). The cost af the inventory was \( \$ 8, \theta 0 \theta \). January 15 Borrowed \( \$ 40,000 \) from a local bank and signed a note. Principal and interest at \( 10 \% \) is to be repaid in six months. January 20 Paid employees \( \$ 7,000 \) salaries for the first half of the month. January 22 sold inventory for \( \$ 11, \theta 00 \) cash. The cost of the inventory was \( \$ 7,000 \). January 24 Paid \( \$ 16,000 \) to suppliers for the inventory purchased on January 2 . January 26 collected \( \$ 6,500 \) on account from customers. January 28 Paid \( \$ 1,100 \) to the local utility company for January gas and electricity. January 30 Paid \( \$ 5,000 \) rent for the building. \( \$ 2,500 \) was for January rent, and \( \$ 2,500 \) for February rent. Prepaid rent and rent expense were debited for their appropriate amounts. Required: 1. Prepare general journal entries to record each transaction. 2. Post the transactions to the appropriate T-accounts. 3. Prepare an unadjusted trial balance as of January \( 30,2024 . \) Complete this question by entering your answers in the tabs below. Prepare general journal entries to record each transactlon. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fleld.

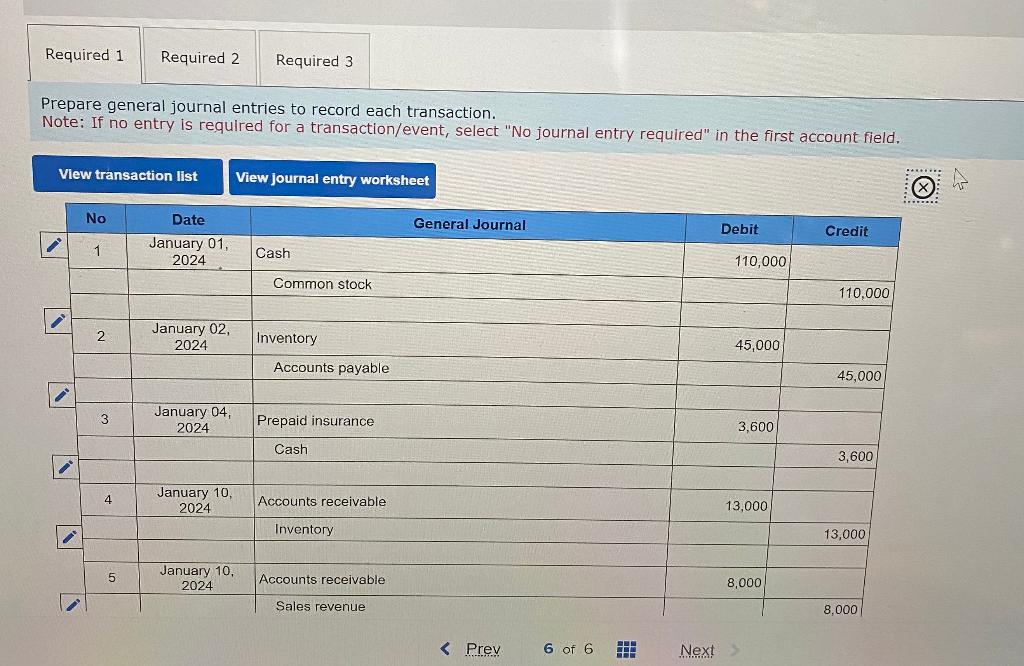

repare general journal entries to record each transaction. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field

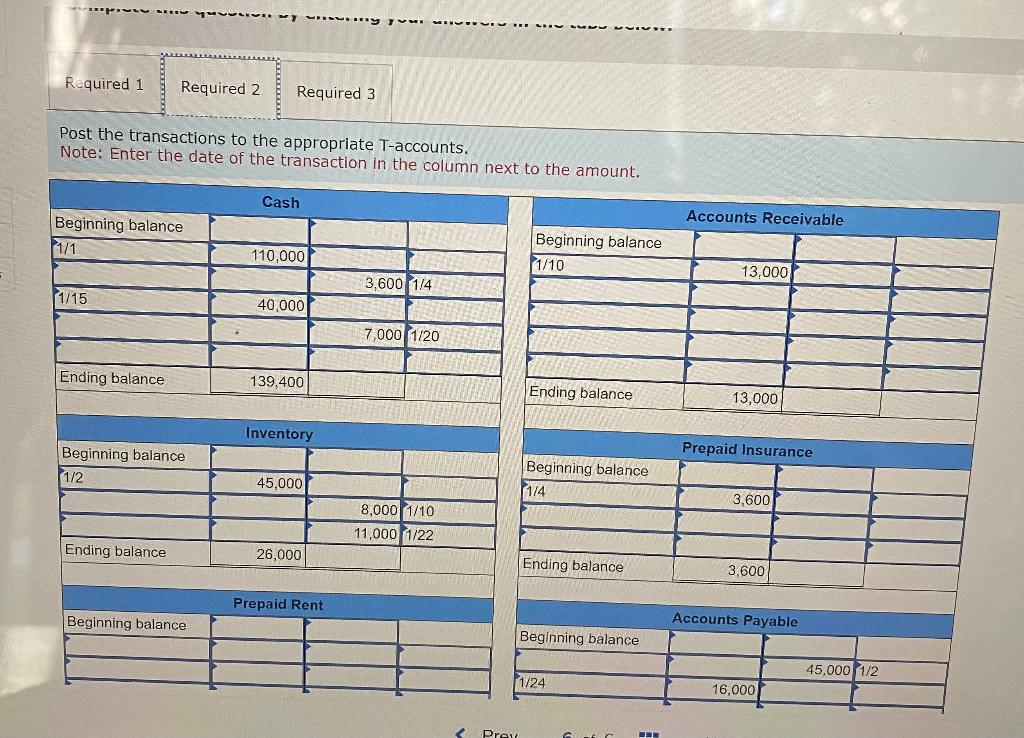

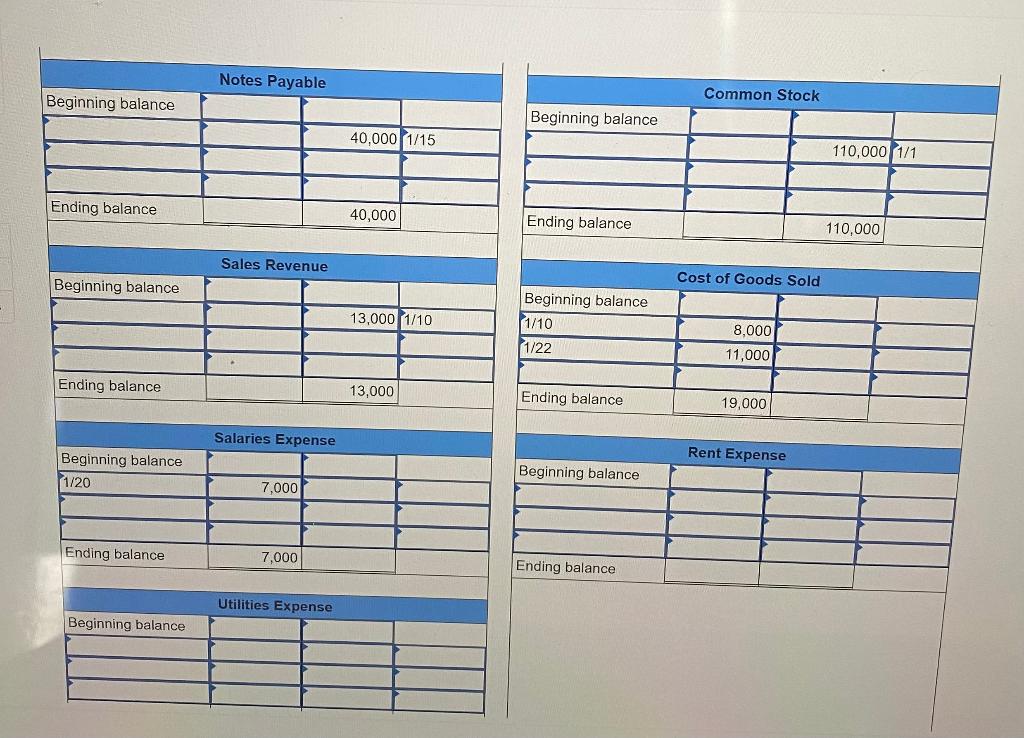

Post the transactions to the appropriate \( \mathrm{T} \)-accounts. Note: Enter the date of the transaction in the column next to the amount.

\begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Common Stock } \\ \hline Beginning balance & & & \\ \hline & & 110,000 & \( 1 / 1 \) \\ \hline & & & \\ \hline Ending balance & & & \\ \hline & & 110,000 & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline Beginning balance & \multicolumn{1}{|l|}{ Cost of Goods Sold } \\ \hline \( 1 / 10 \) & 8,000 & \\ \hline \( 1 / 22 \) & 11,000 & \\ \hline & & \\ \hline Ending balance & 19,000 & \\ \hline & & \\ \hline Beginning balance & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Ending balance & & \\ \hline & \\ \hline \end{tabular}

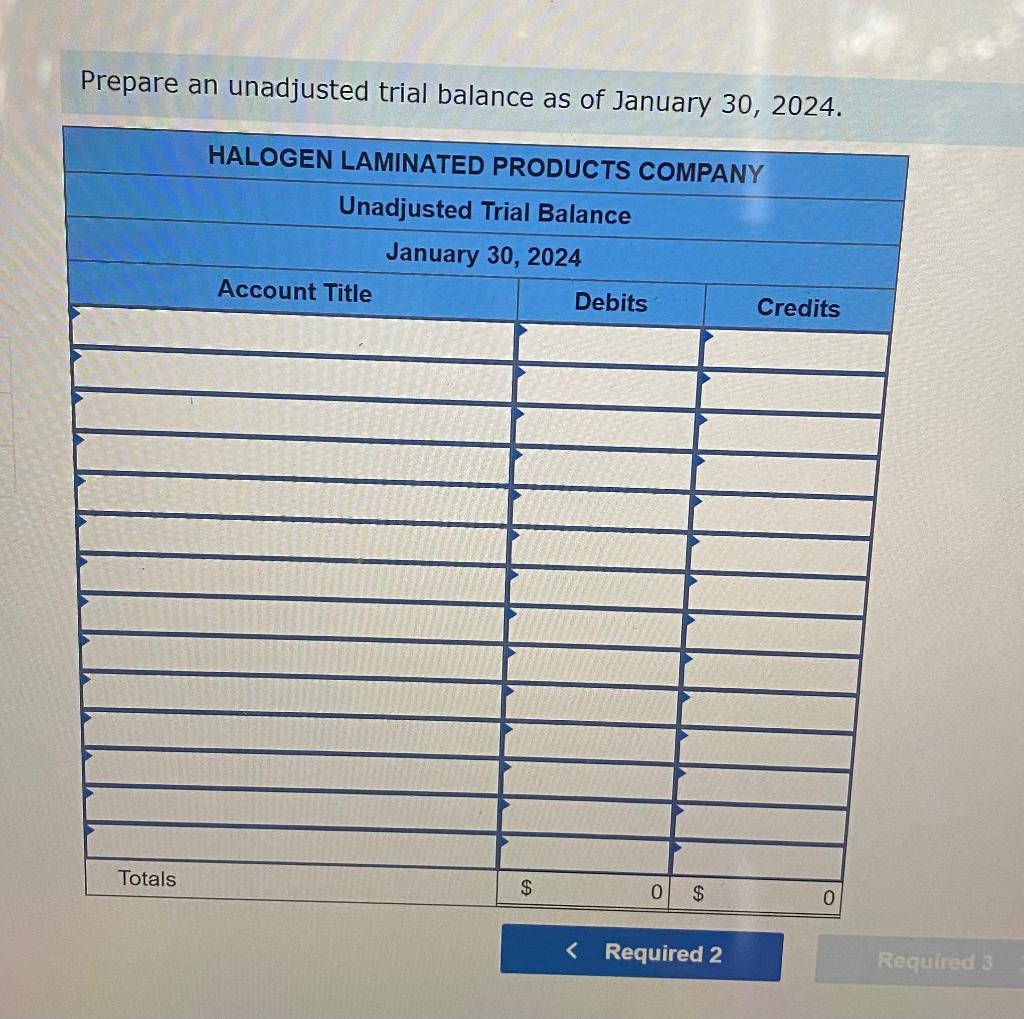

Prepare an unadjusted trial balance as of January \( 30,2024 . \)

Expert Answer

Required-1 No Date General Journal Debit Credit 1 1-Jan Cash 110,000 Common stock 110,000 2 2-Jan Inventory 45,000 Account payable 45,000 3-