Home /

Expert Answers /

Accounting /

green-brands-incorporated-gbi-presents-its-statement-of-cash-flows-using-the-indirect-method-the-pa339

(Solved): Green Brands, Incorporated (GBI) presents its statement of cash flows using the indirect method. The ...

Green Brands, Incorporated (GBI) presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from GBI’s Year 2 and Year 1 year-end balance sheets. Assume all sales and purchases of inventory are made on account.

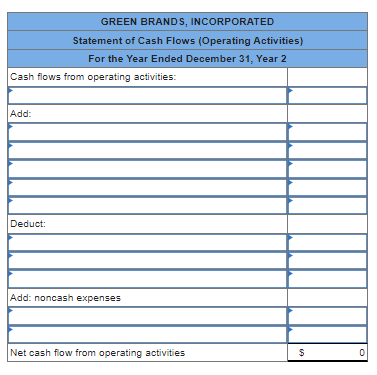

Required Information [The following information applies to the questions displayed below.] Green Brands, Incorporated (GBI) presents its statement of cash flows using the Indirect method. The following accounts and corresponding balances were drawn from GBI's Year 2 and Year 1 year-end balance sheets. Assume all sales and purchases of Inventory are made on account. Account Title Year 2 Year 1 Accounts receivable $ 26,800 $ 23,800 56,900 Inventory 51,500 Prepaid insurance 15,100 27,000 Accounts payable 23,000 16,000 Salaries payable 4,950 4,000 Unearned service revenue 800 3,000 The Year 2 Income statement is shown next. Income Statement Sales $ 618,000 (380,000) Cost of goods sold Gross margin 238,000 Service revenue 4,600 Insurance expense (39,000) Salaries expense (144,000) Depreciation expense (5,900) Operating income 53,700 3,800 Gain on sale of equipment Net income $ 57,500 b. Prepare the operating activities section of the statement of cash flows using the Indirect method. (Cash outflows should be Indicated with a minus sign.)

GREEN BRANDS, INCORPORATED Statement of Cash Flows (Operating Activities) For the Year Ended December 31, Year 2 Cash flows from operating activities: Add: Deduct: Add: noncash expenses Net cash flow from operating activities $ 0

![Required Information

[The following information applies to the questions displayed below.]

Green Brands, Incorporated (GBI) p](https://media.cheggcdn.com/media/2d4/2d47a83a-ddd7-452d-833f-efefd712d489/phpH3bYCa)