Home /

Expert Answers /

Accounting /

fresno-transportation-owns-a-fleet-of-50-semi-trucks-the-original-cost-of-the-fleet-at-the-end-of-pa548

(Solved): Fresno Transportation owns a fleet of 50 semi-trucks. The original cost of the fleet At the end of ...

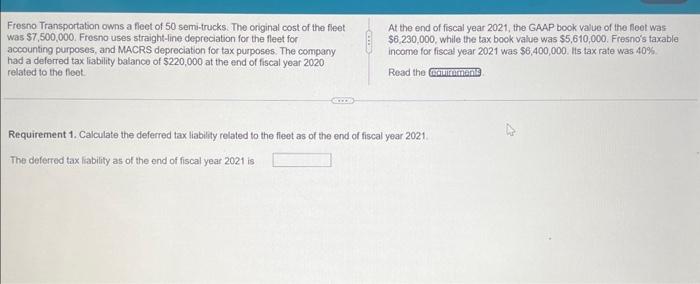

Fresno Transportation owns a fleet of 50 semi-trucks. The original cost of the fleet At the end of fiscal year 2021, the GAAP book value of the seet was was \$7, 500,000. Fresno uses straight-line depreciation for the fleet for , while the tax bock value was . Fresno's taxable accounting purposes, and MACRS depreciation for tax purposes. The company income for fiscal year 2021 was . Its tax rate was had a deferred tax liability balance of at the end of fiscal year 2020 related to the fleet. Read the Requirement 1. Calculate the deferred tax liability related to the fieet as of the end of fiscal year 2021 The deferred tax liability as of the end of fiscal year 2021 is

Requirements 1. Calculate the deferred tax liability related to the fleet as of the end of fiscal year 2021. 2. Record the tax accrual for 2021 as of the end of fiscal year 2021.