Home /

Expert Answers /

Economics /

for-each-of-the-interest-rates-in-the-following-table-compute-the-opportunity-cost-of-holding-the-pa412

(Solved): For each of the interest rates in the following table, compute the opportunity cost of holding the $ ...

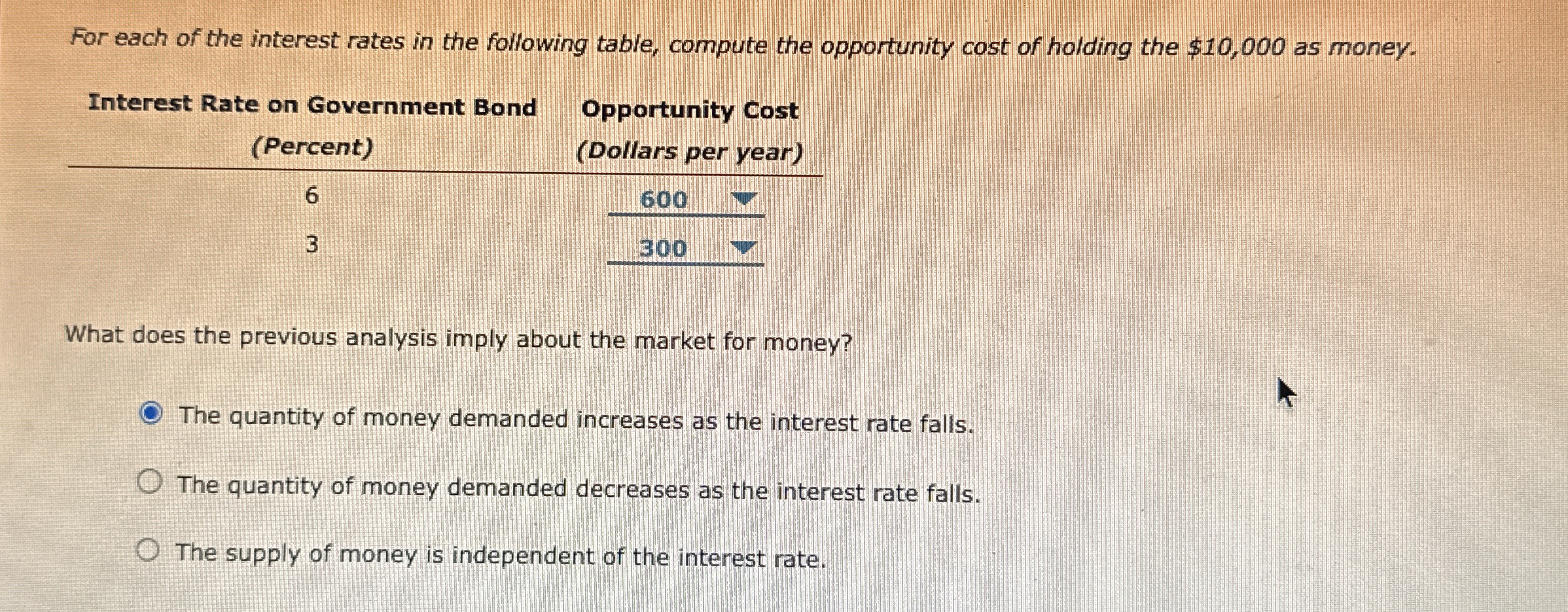

For each of the interest rates in the following table, compute the opportunity cost of holding the

$10,000as money. Interest Rate on Government Bond Opportunity Cost (Percent) (Dollars per year) 6

(600-7)/(300-7)What does the previous analysis imply about the market for money? The quantity of money demanded increases as the interest rate falls. The quantity of money demanded decreases as the interest rate falls. The supply of money is independent of the interest rate.