Home /

Expert Answers /

Accounting /

for-each-of-the-following-separate-situations-determine-how-much-revenue-is-recognized-in-december-pa622

(Solved): For each of the following separate situations, determine how much revenue is recognized in December ...

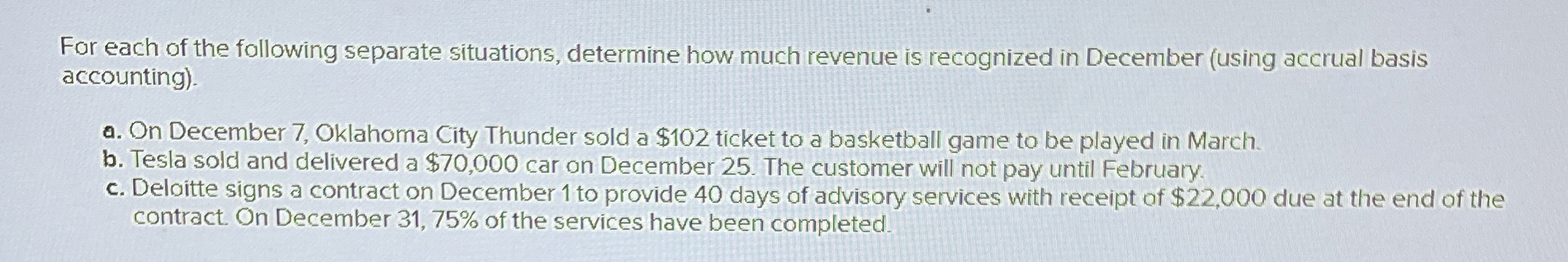

For each of the following separate situations, determine how much revenue is recognized in December (using accrual basis accounting). a. On December 7, Oklahoma City Thunder sold a

$102ticket to a basketball game to be played in March. b. Tesla sold and delivered a

$70,000car on December 25 . The customer will not pay until February. c. Deloitte signs a contract on December 1 to provide 40 days of advisory services with receipt of

$22,000due at the end of the contract. On December 31,75% of the services have been completed.