Home /

Expert Answers /

Accounting /

for-all-payroll-calculations-use-the-following-tax-rates-and-round-amounts-to-the-nearest-cent-em-pa854

(Solved): For all payroll calculations, use the following tax rates and round amounts to the nearest cent. Em ...

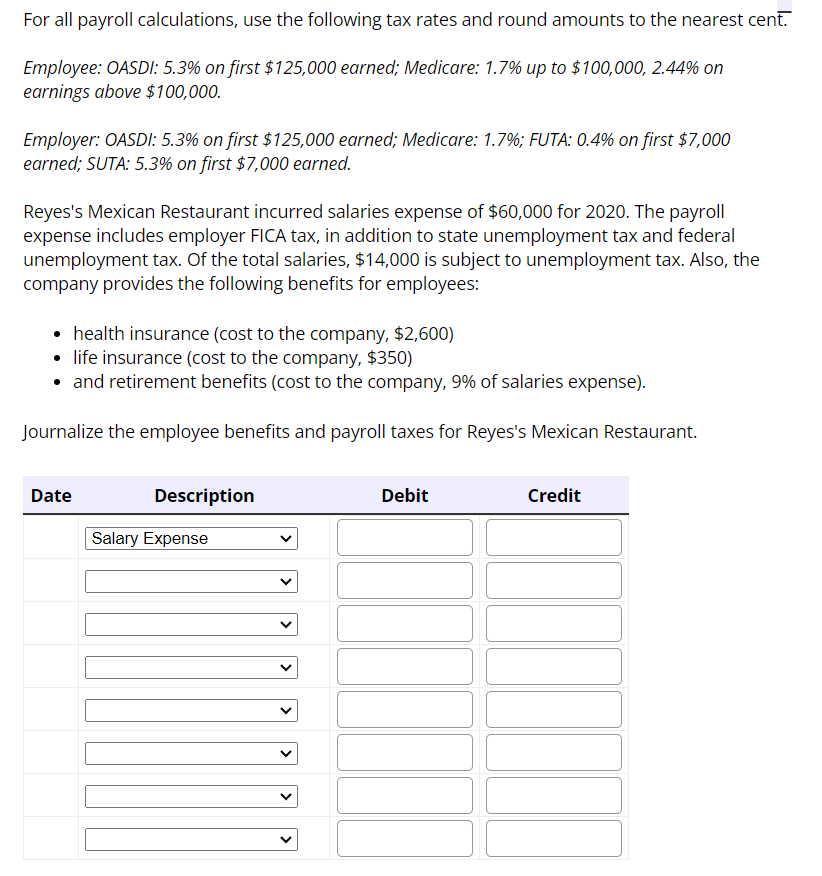

For all payroll calculations, use the following tax rates and round amounts to the nearest cent. Employee: OASDI: on first earned; Medicare: up to on earnings above . Employer: OASDI: on first earned; Medicare: ; FUTA: on first earned; SUTA: on first earned. Reyes's Mexican Restaurant incurred salaries expense of for 2020 . The payroll expense includes employer FICA tax, in addition to state unemployment tax and federal unemployment tax. Of the total salaries, is subject to unemployment tax. Also, the company provides the following benefits for employees: - health insurance (cost to the company, ) - life insurance (cost to the company, \$350) - and retirement benefits (cost to the company, of salaries expense). Journalize the employee benefits and payroll taxes for Reyes's Mexican Restaurant.