Home /

Expert Answers /

Accounting /

following-is-a-partially-completed-balance-sheet-for-hoeman-incorporated-at-december-31-2023-toge-pa945

(Solved): Following is a partially completed balance sheet for Hoeman Incorporated at December 31,2023 , toge ...

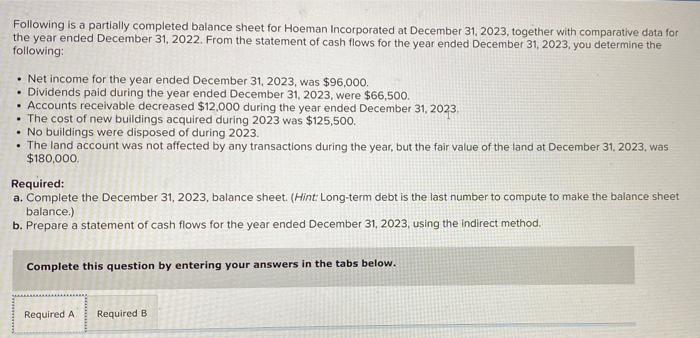

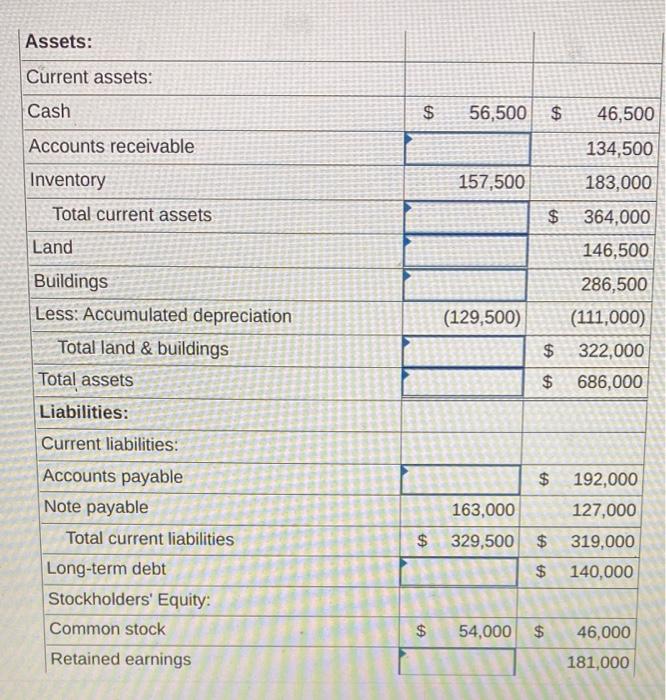

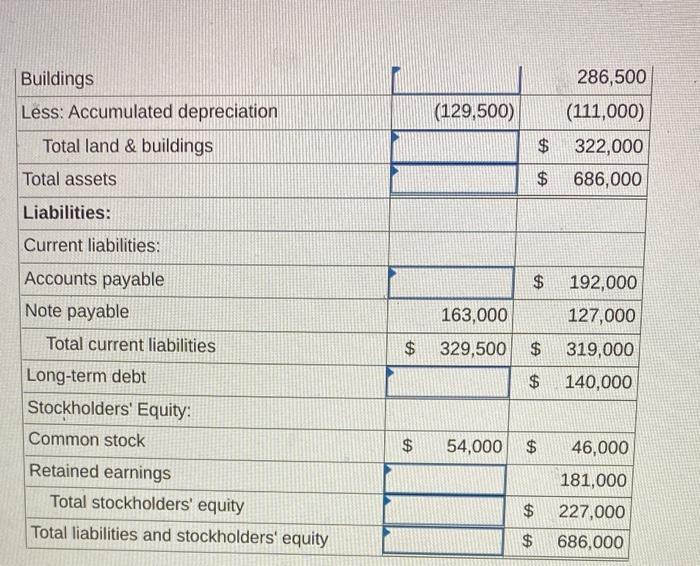

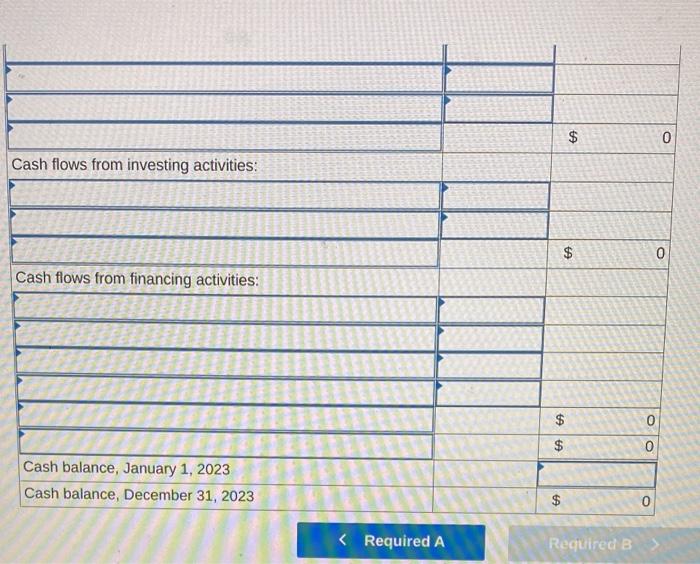

Following is a partially completed balance sheet for Hoeman Incorporated at December 31,2023 , together with comparative data for the year ended December 31,2022 . From the statement of cash flows for the year ended December 31,2023 , you determine the following: - Net income for the year ended December 31,2023 , was \( \$ 96,000 \). - Dividends paid during the year ended December 31,2023 , were \( \$ 66,500 \). - Accounts receivable decreased \( \$ 12,000 \) during the year ended December \( 31,2023 \). - The cost of new buildings acquired during 2023 was \( \$ 125,500 \). - No buildings were disposed of during 2023. - The land account was not affected by any transactions during the year, but the fair value of the land at December 31, 2023, was \( \$ 180,000 \). Required: a. Complete the December 31, 2023, balance sheet. (Hint: Long-term debt is the last number to compute to make the balance sheet balance.) b. Prepare a statement of cash flows for the year ended December 31,2023 , using the indirect method. Complete this question by entering your answers in the tabs below.

Assets:

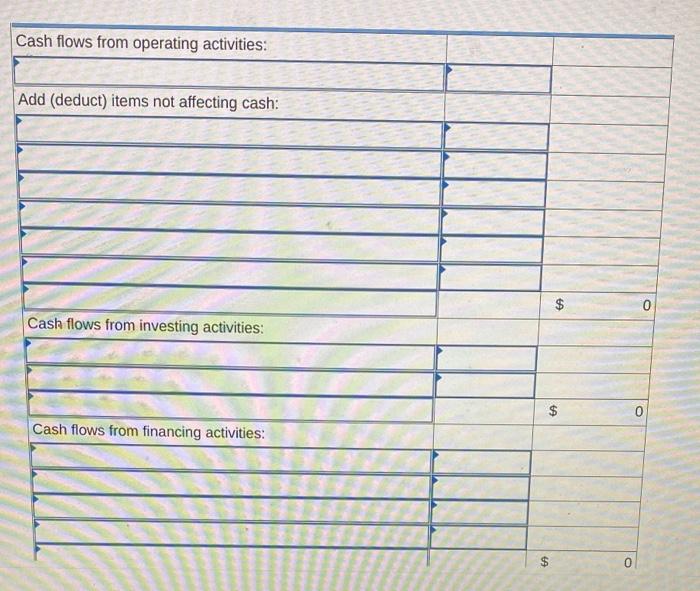

Cash flows from operating activities:

\begin{tabular}{|l|} \hline Cash flows from investing activities: \\ \hline Cash flows from financing activities: \\ \hline Cash balance, January 1,2023 \\ \hline \end{tabular}

Expert Answer

Balance Sheet for December 31, 2023 HOEMAN INCORPORATED Balance Sheet For the Month End December 31, 2023 Particulars Amount Assets