(Solved): FIX THE VISUAL BASIC CODE FOR THE FOLLOWING INSTRUCTIONS: CODE ABOVE FOR COPY AND PAST ...

FIX THE VISUAL BASIC CODE FOR THE FOLLOWING INSTRUCTIONS:

CODE ABOVE FOR COPY AND PAST

Public Class frmCalculateTax

Private Sub btnExit_Click(sender As Object, e As EventArgs) Handles btnExit.Click

Me.Close()

End Sub

Private Sub btnCalculate_Click(sender As Object, e As EventArgs) Handles btnCalculate.Click

Dim taxableIncome As Decimal = CDec(txtTaxableIncome.Text)

Dim incomeTaxOwed As Decimal

Select Case taxableIncome

Case taxableIncome

End Select

Select Case incomeTaxOwed

Case Is <= 8700

incomeTaxOwed = (0 + taxableIncome * 0.1D)

Case Is <= 35350

incomeTaxOwed = (870 + (taxableIncome - 8700) * 0.15D)

Case Is <= 85650

incomeTaxOwed = (4867 + (taxableIncome - 35350) * 0.25D)

Case Is <= 178650

incomeTaxOwed = (17442 + (taxableIncome - 85650) * 0.28D)

Case Is <= 388350

incomeTaxOwed = (43482 + (taxableIncome - 178650) * 0.33D)

Case Else

incomeTaxOwed = (112683 + (taxableIncome - 388350) * 0.35D)

End Select

'If taxableIncome >= 0 AndAlso taxableIncome <= 8700 Then

'incomeTaxOwed = (0 + taxableIncome * 0.1D)

'ElseIf taxableIncome > 8700 AndAlso taxableIncome <= 35350 Then

'incomeTaxOwed = (870 + (taxableIncome - 8700) * 0.15D)

'ElseIf taxableIncome > 35350 AndAlso taxableIncome <= 85650 Then

'incomeTaxOwed = (4867 + (taxableIncome - 35350) * 0.25D)

'ElseIf taxableIncome > 85650 AndAlso taxableIncome <= 178650 Then

'incomeTaxOwed = (17442 + (taxableIncome - 85650) * 0.28D)

'ElseIf taxableIncome > 178650 AndAlso taxableIncome <= 388350 Then

'incomeTaxOwed = (43482 + (taxableIncome - 178650) * 0.33D)

'ElseIf taxableIncome > 388350 Then

'incomeTaxOwed = (112683 + (taxableIncome - 388350) * 0.35D)

'End If

txtIncomeTaxOwed.Text = incomeTaxOwed.ToString("C")

End Sub

End Class

Expert Answer

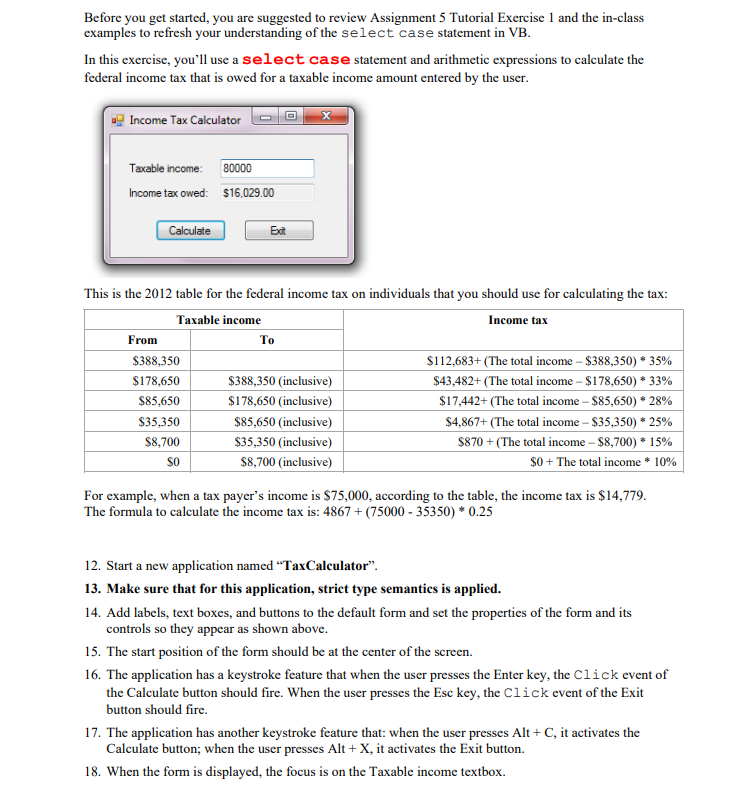

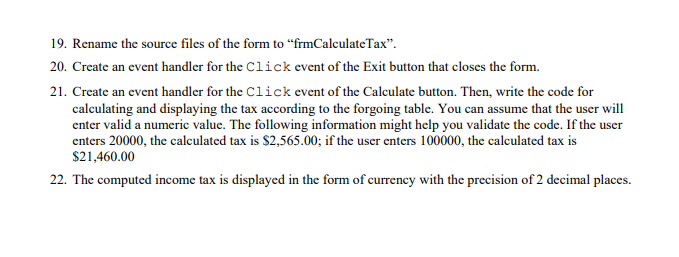

**************** SOLUTION *************** TaxCalculator.vb -------------------------------------------------------------------------------- Public Cla

![nCalculateTax.vb \( { }^{*} \quad \Varangle \times \) frmCalculateTax.vb [Design]

TaxCalculator](https://media.cheggcdn.com/media/075/07521dd3-04c8-4cdf-9a7c-1dc12d3ae9d2/phpPvGxxb)