Home /

Expert Answers /

Accounting /

exercise-1-15-traditional-and-contribution-format-income-statement-the-alpine-house-inc-is-a-lar-pa842

(Solved): Exercise 1-15 Traditional and Contribution Format Income Statement The Alpine House, Inc., is a lar ...

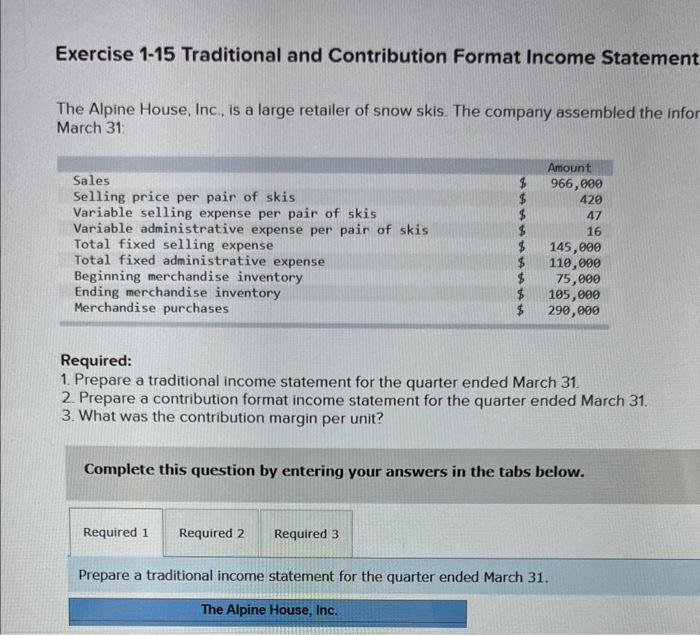

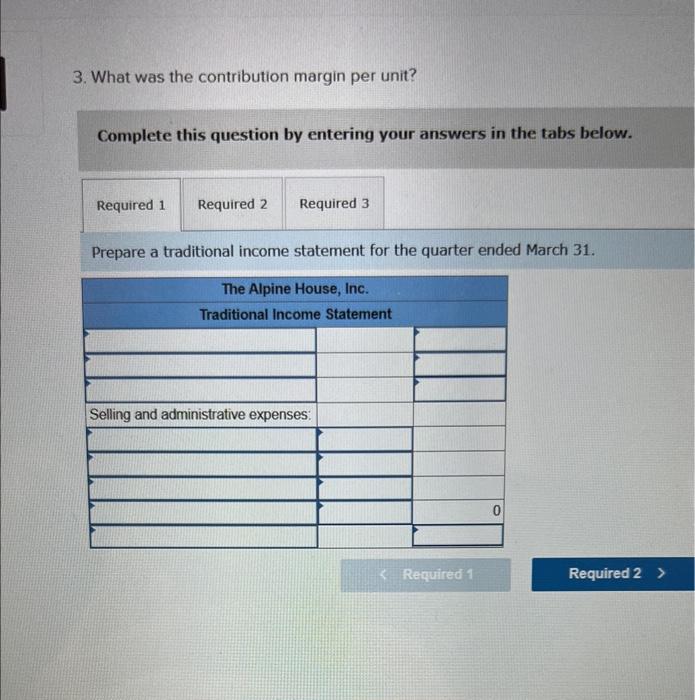

Exercise 1-15 Traditional and Contribution Format Income Statement The Alpine House, Inc., is a large retailer of snow skis. The company assembled the infor March 31: Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Prepare a traditional income statement for the quarter ended March 31.

3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Prepare a traditional income statement for the quarter ended March 31.

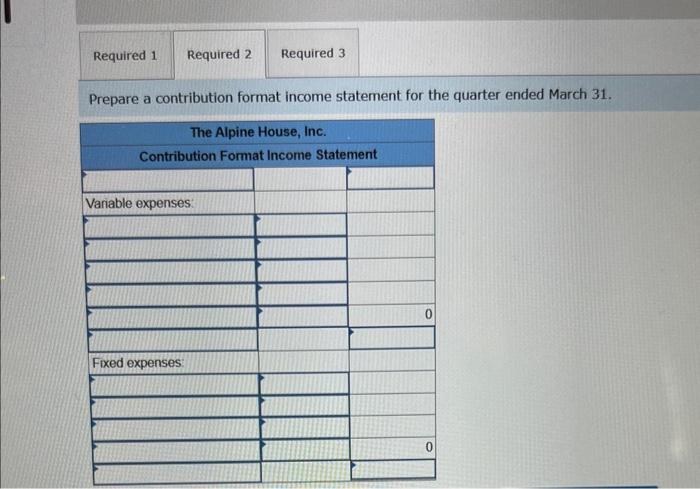

Prepare a contribution format income statement for the quarter ended March 31.

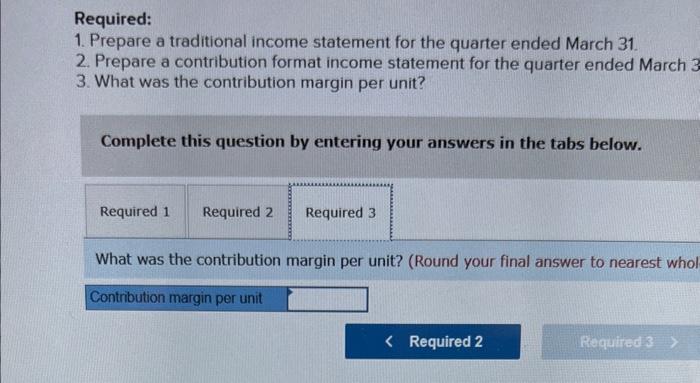

Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 3 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. What was the contribution margin per unit? (Round your final answer to nearest whol

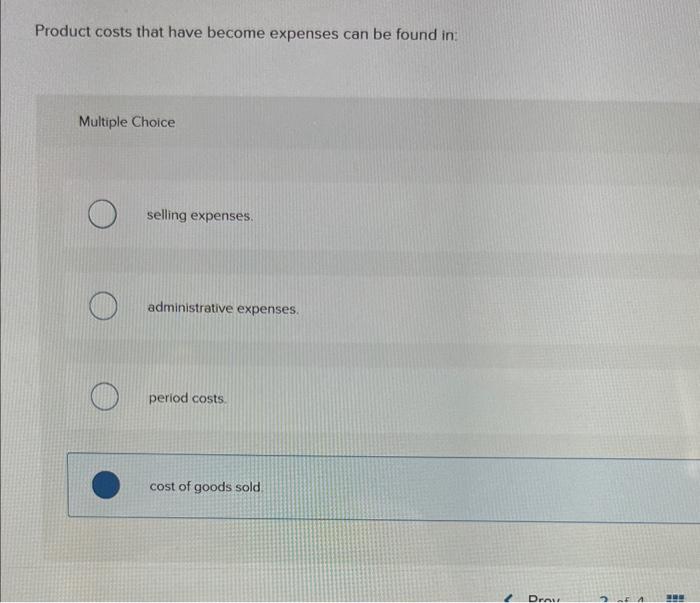

Product costs that have become expenses can be found in: Multiple Choice selling expenses. administrative expenses. period costs. cost of goods sold

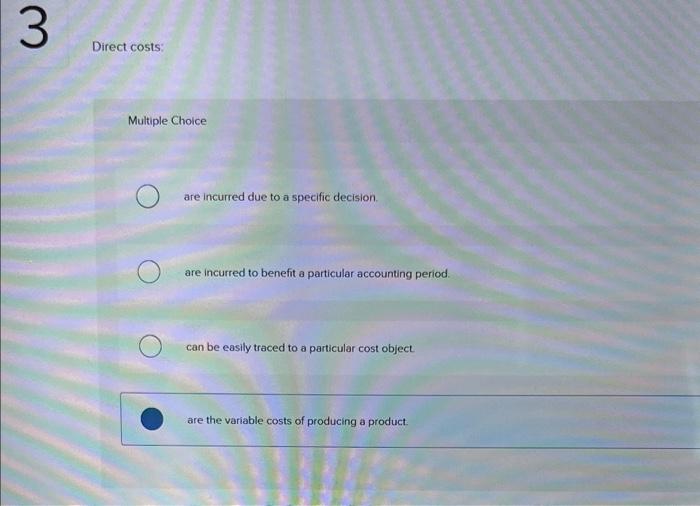

Direct costs: Multiple Choice are incurred due to a specific decision. are incurred to benefit a particular accounting period. can be easily traced to a particular cost object. are the variable costs of producing a product.

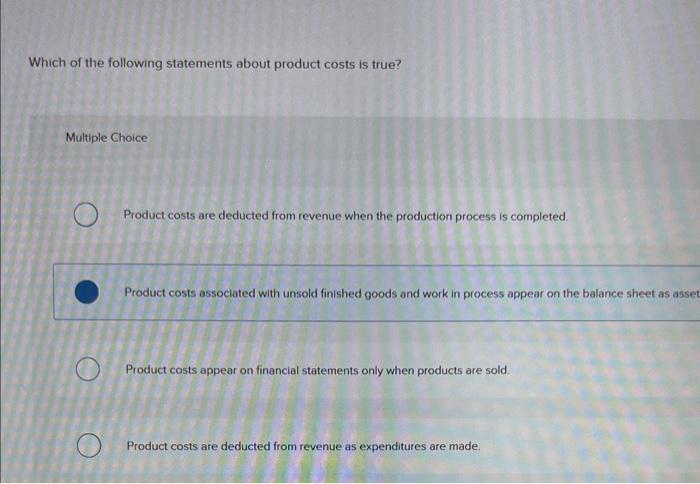

Which of the following statements about product costs is true? Multiple Choice Product costs are deducted from revenue when the production process is completed. Product costs associated with unsold finished goods and work in process appear on the balance sheet as asse Product costs appear on financial statements only when products are sold. Product costs are deducted from revenue as expenditures are made.

Expert Answer

Traditional income statementThe Alpine House, Inc.Traditional income statementSales$966,000Cost of goods sold$260,000Gross margin$706,000Selling and a