Home /

Expert Answers /

Accounting /

es-2-complete-the-below-table-to-calculate-income-statement-data-in-common-size-percents-round-d-pa784

(Solved): es 2. Complete the below table to calculate income statement data in common-size percents. (Round d ...

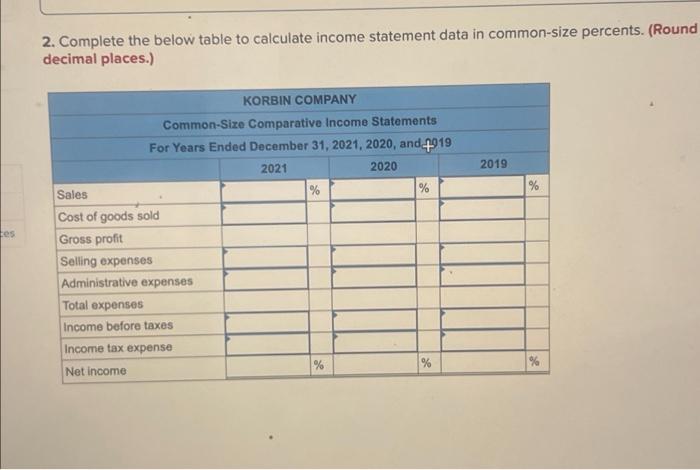

es 2. Complete the below table to calculate income statement data in common-size percents. (Round decimal places.) KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2021, 2020, and 4919 2021 2020 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income % % % % 2019 % %

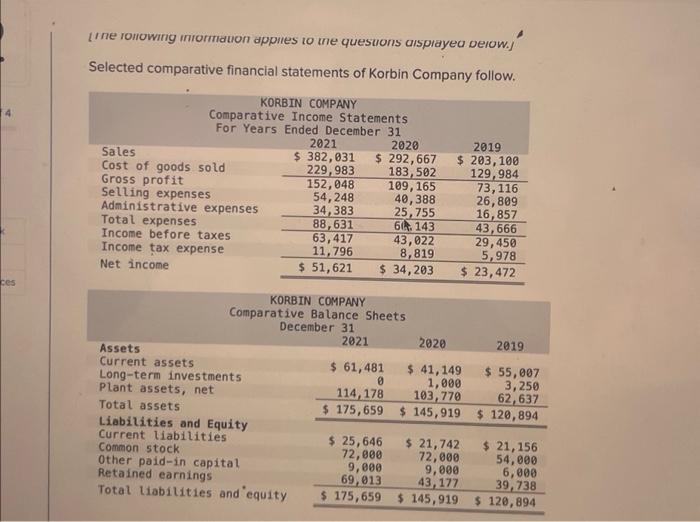

ces Line following information applies to the questions displayed below.j Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 $ 382,031 $ 292,667 229,983 183,502 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income 152,048 54,248 34,383 109, 165 40,388 25,755 88,631 60 143 63,417 43,022 11,796 8,819 $ 51,621 $ 34,203 KORBIN COMPANY Comparative Balance Sheets Assets Current assets Long-term investments, Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity December 31 2021 2019 $ 203,100 129,984 2020 $ 61,481 0 114,178 $ 41,149 1,000 103,770 $ 175,659 $ 145,919 $ 25,646 72,000 9,000 69,013 $ 175,659 $ 21,742 72,000 9,000 43,177 $ 145,919 73,116 26,809 16,857 43,666 29,450 5,978 $ 23,472 2019 $ 55,007 3,250 62,637 $120,894 $ 21,156 54,000 6,000 39,738 $ 120,894

Expert Answer

2. Income statement data in comm