Home /

Expert Answers /

Accounting /

duela-dent-is-single-and-had-180-800-in-taxable-income-using-the-rates-from-calculate-he-pa147

(Solved): Duela Dent is single and had \( \$ 180,800 \) in taxable income. Using the rates from calculate he ...

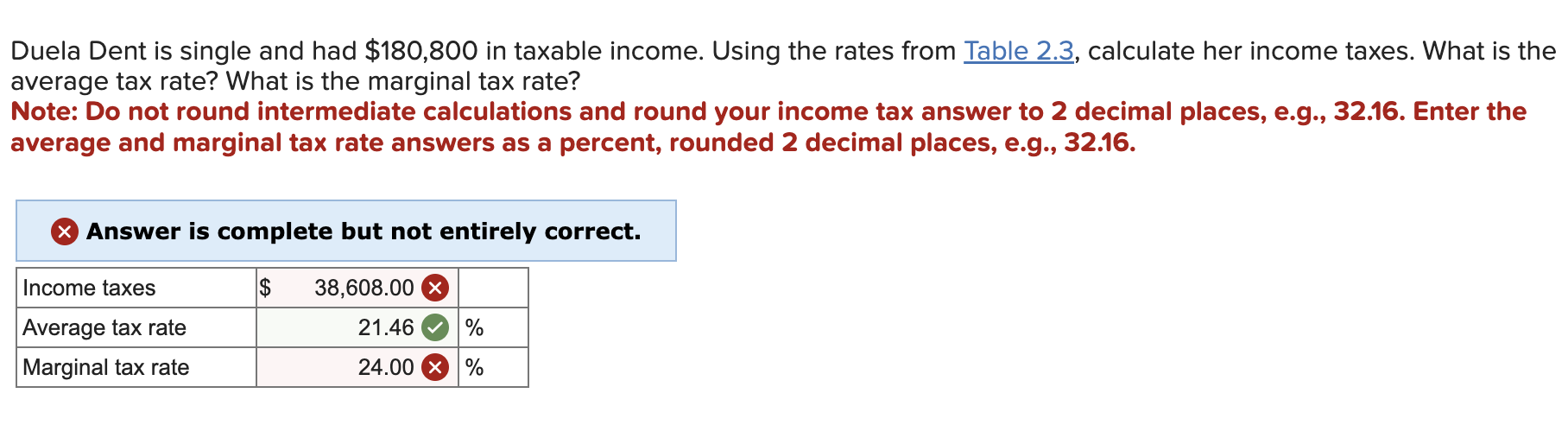

Duela Dent is single and had \( \$ 180,800 \) in taxable income. Using the rates from calculate her income taxes. What is the average tax rate? What is the marginal tax rate? Note: Do not round intermediate calculations and round your income tax answer to 2 decimal places, e.g., 32.16. Enter the average and marginal tax rate answers as a percent, rounded 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct.

Expert Answer

Taxable Income Tax rate 9,525 10% 95