Home /

Expert Answers /

Operations Management /

drew-39-s-comparny-ace-high-sells-customized-sets-of-poker-chips-he-is-developing-a-plan-for-next-y-pa368

(Solved): Drew's comparny, Ace High, sells customized sets of poker chips. He is developing a plan for next y ...

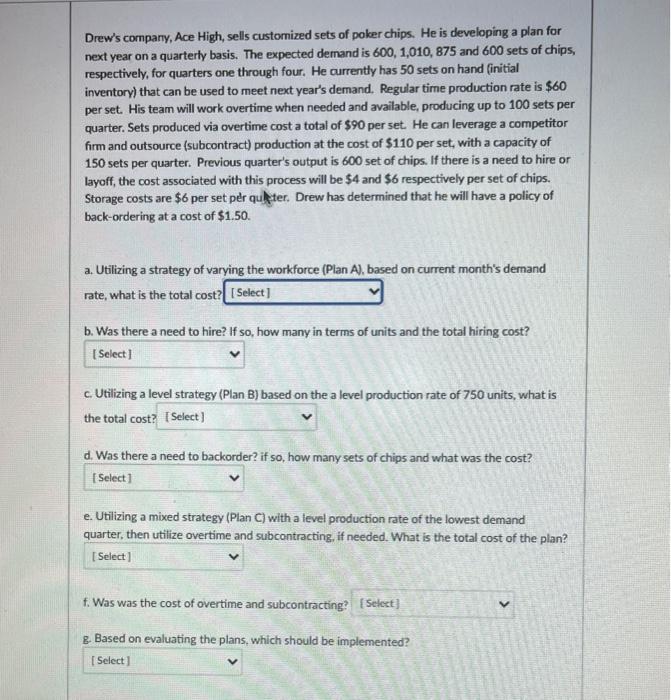

Drew's comparny, Ace High, sells customized sets of poker chips. He is developing a plan for next year on a quarterly basis. The expected demand is \( 600,1,010,875 \) and 600 sets of chips, respectively, for quarters one through four. He currently has 50 sets on hand (initial inventory) that can be used to meet next year's demand. Regular time production rate is \( \$ 60 \) per set. His team will work overtime when needed and available, producing up to 100 sets per quarter. Sets produced via overtime cost a total of \( \$ 90 \) per set. He can leverage a competitor firm and outsource (subcontract) production at the cost of \( \$ 110 \) per set, with a capacity of 150 sets per quarter. Previous quarter's output is 600 set of chips. If there is a need to hire or layoff, the cost associated with this process will be \( \$ 4 \) and \( \$ 6 \) respectively per set of chips. Storage costs are \( \$ 6 \) per set per qu/fer. Drew has determined that he will have a policy of back-ordering at a cost of \( \$ 1.50 \). a. Utilizing a strategy of varying the workforce (Plan A), based on current month's demand rate, what is the total cost? b. Was there a need to hire? If so, how many in terms of units and the total hiring cost? c. Utilizing a level strategy (Plan B) based on the a level production rate of 750 units, what is the total cost? d. Was there a need to backorder? if so, how many sets of chips and what was the cost? e. Utilizing a mixed strategy (Plan C) with a level production rate of the lowest demand quarter, then utilize overtime and subcontracting, if needed. What is the total cost of the plan?

Expert Answer

Drew's company, Ace High, sells customized sets of poker chips. He is developing a plan for next year on a quarterly basis. The expected demand is 600