Home /

Expert Answers /

Accounting /

disposal-of-fixed-asset-equipment-acquired-on-january-6-at-a-cost-of-193-200-has-an-estim-pa772

(Solved): Disposal of Fixed Asset Equipment acquired on January 6 at a cost of \( \$ 193,200 \), has an estim ...

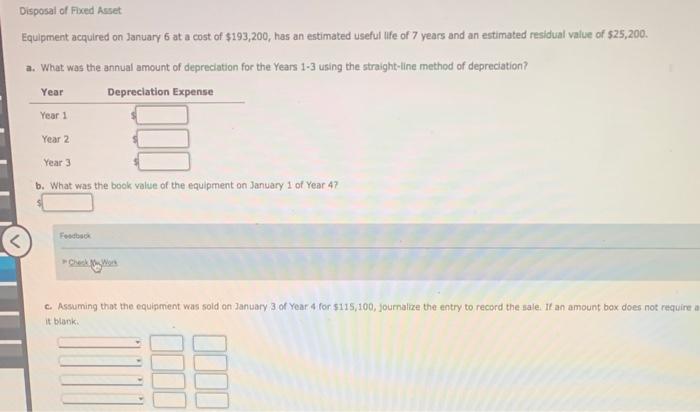

Disposal of Fixed Asset Equipment acquired on January 6 at a cost of \( \$ 193,200 \), has an estimated useful Iffe of 7 years and an estimated residual value of \( \$ 25,200 \). a. What was the annual amount of depreciation for the Years 1-3 using the straight-line method of depreciation? b. What was the book value of the equipment on January 1 of Year 4 ? Fostana c. Assuming thot the equipment was sold on January 3 of Year 4 for \( \$ 115,100 \), journalize the entry to record the sale. If an amount box does not require it blank:

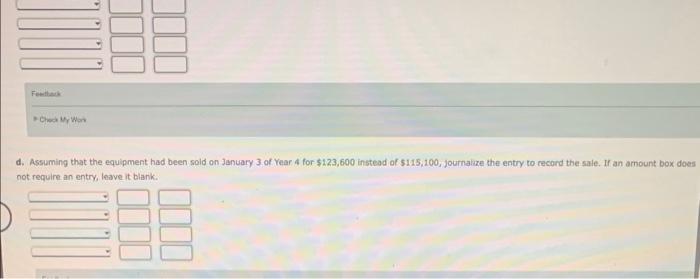

d. Assuming that the equipment had been sold on Jantary 3 of Year 4 for \( \$ 123,600 \) instead of 5115,100 , journakze the entry to record the sale. If an amount box does not require an entry, leave it blank.

Expert Answer

a. Depreciation Expense per year=(Cost?Salvage Value)/Ueful life in years=193,200?25,2007=$24,000 Depreciation Expense for Year 1= $24,000 Depreciatio