Home /

Expert Answers /

Accounting /

determine-the-amount-of-the-earned-income-credit-in-each-of-the-following-cases-nbsp-assume-that-th-pa136

(Solved): Determine the amount of the Earned Income Credit in each of the following cases. Assume that th ...

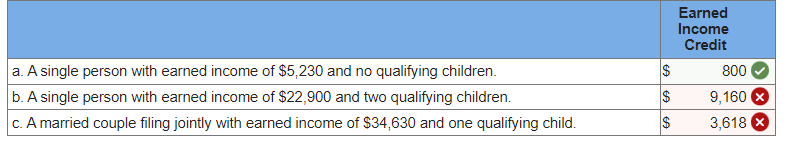

Determine the amount of the Earned Income Credit in each of the following cases. Assume that the person or persons are eligible to take the credit (as of 2021). Use Table 9-3.

Earned Income Credit a. A single person with earned income of \( \$ 5,230 \) and no qualifying children. b. A single person with earned income of \( \$ 22,900 \) and two qualifying children. c. A married couple filing jointly with earned income of \( \$ 34,630 \) and one qualifying child. \begin{tabular}{|lr|} \( \$ \$ \) & \( 800 \boldsymbol{\chi} \) \\ \( \$ \$ \) & \( 9,160 \mathbf{x} \) \\ \( \$ \) & \( 3,618 \mathbf{x} \) \\ \hline \end{tabular}

TABLE 9-3* Earned Income Credit Tax Year 2021

Expert Answer

From the given Table9-3, A person is eligible to take Earned Inc