Home /

Expert Answers /

Accounting /

determine-the-amount-of-tax-liability-in-each-of-the-following-instances-use-the-appropriate-tax-t-pa829

(Solved): Determine the amount of tax liability in each of the following instances: Use the appropriate Tax T ...

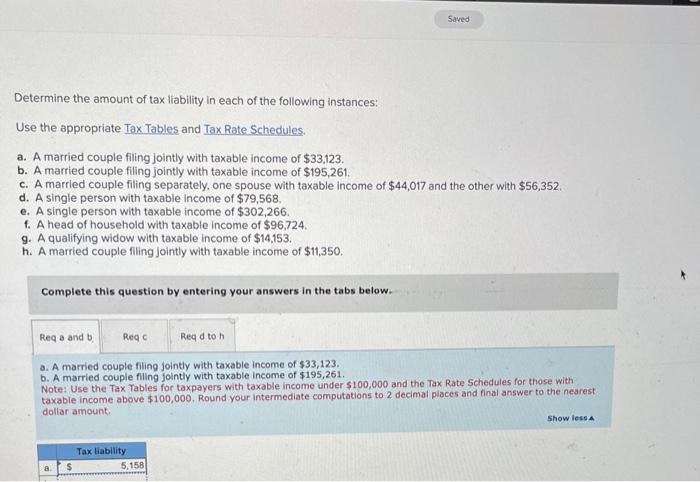

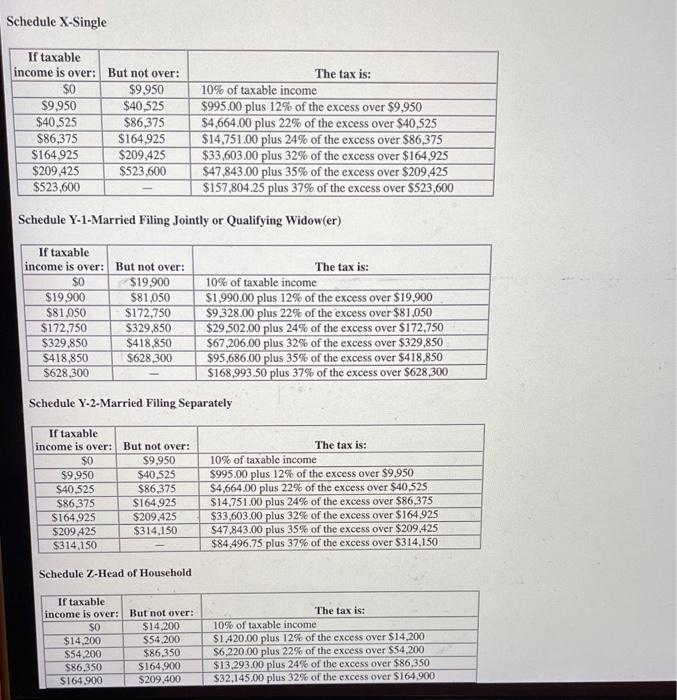

Determine the amount of tax liability in each of the following instances: Use the appropriate Tax Tables and Tax Rate Schedules. a. A married couple filing jointly with taxable income of \( \$ 33,123 . \) b. A married couple filing jointly with taxable income of \( \$ 195,261 \). c. A married couple filing separately, one spouse with taxable income of \( \$ 44,017 \) and the other with \( \$ 56,352 \). d. A single person with taxable income of \( \$ 79,568 . \) e. A single person with taxable income of \( \$ 302,266 \). f. A head of household with taxable income of \( \$ 96,724 . \) 9. A qualifying widow with taxable income of \( \$ 14,153 \). h. A married couple fling jointly with taxable income of \( \$ 11,350 . \) Complete this question by entering your answers in the tabs below. a. A married couple filing jointly with taxable income of \( \$ 33,123 \), b. A married couple filing jointly with taxable income of \( \$ 195,261 \). Note: Use the Tax Tables for taxpayers with taxable income under \( \$ 100,000 \) and the Tax Rate Schedules for those with taxable income above \( \$ 100,000 \). Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount. Show lessa

Schedule X-Single Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) Schedule Y-2-Married Filing Separately Schedule Z-Head of Household

Expert Answer

As tax rate schedule used for