Home /

Expert Answers /

Accounting /

depreciation-for-partial-periods-norman-delivery-company-purchased-a-new-delivery-truck-for-41-400-pa310

(Solved): Depreciation for Partial Periods Norman Delivery Company purchased a new delivery truck for $41,400 ...

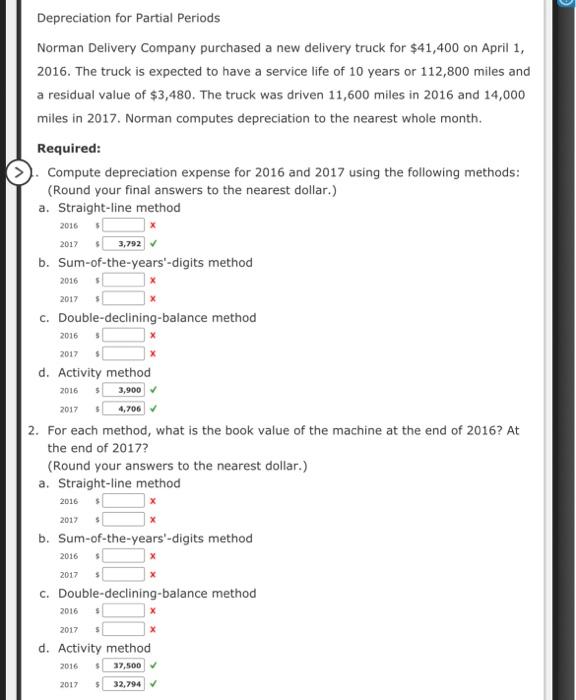

Depreciation for Partial Periods Norman Delivery Company purchased a new delivery truck for on April 1 , 2016. The truck is expected to have a service life of 10 years or 112,800 miles and a residual value of . The truck was driven 11,600 miles in 2016 and 14,000 miles in 2017. Norman computes depreciation to the nearest whole month. Required: Compute depreciation expense for 2016 and 2017 using the following methods: (Round your final answers to the nearest dollar.) a. Straight-line method \begin{tabular}{ccc} 2016 & \\ 2017 & \end{tabular} b. Sum-of-the-years'-digits method \begin{tabular}{rrr} 2016 & 5 & \\ 2017 & 5 & \end{tabular} c. Double-declining-balance method \begin{tabular}{lll} 2016 s & \\ 2017 s & \end{tabular} d. Activity method \begin{tabular}{lll} 2016 & 5 & \\ 2017 & 5 & \end{tabular} 2. For each method, what is the book value of the machine at the end of 2016 ? At the end of 2017? (Round your answers to the nearest dollar.) a. Straight-line method b. Sum-of-the-years'-digits method c. Double-declining-balance method \begin{tabular}{lll} 2016 & 5 & \\ 2017 & 5 & \end{tabular} d. Activity method \begin{tabular}{ccc} 2016 & 5 & \\ 2017 & 5 & \end{tabular}