Home /

Expert Answers /

Accounting /

crane-co-at-the-end-of-2020-its-first-year-of-operations-prepared-a-reconciliation-between-preta-pa494

(Solved): Crane Co. at the end of 2020, its first year of operations, prepared a reconciliation between preta ...

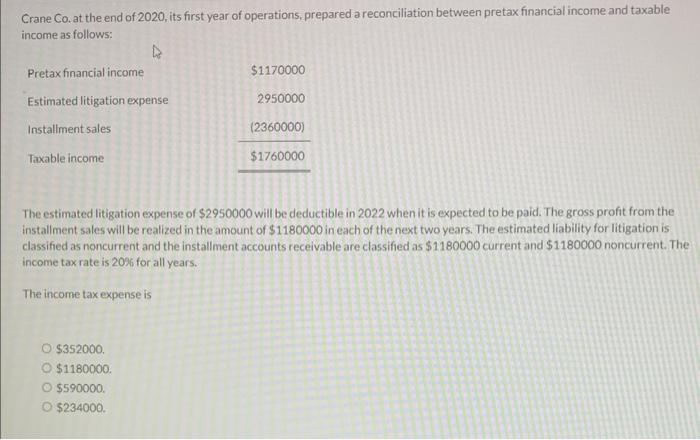

Crane Co. at the end of 2020, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income Estimated litigation expense Installment sales Taxable income O $352000. O $1180000. $1170000 ?$590000. O $234000. 2950000 The estimated litigation expense of $2950000 will be deductible in 2022 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $1180000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $1180000 current and $1180000 noncurrent. The income tax rate is 20% for all years. The income tax expense is (2360000) $1760000

Expert Answer

Answer - option (a) $352000 Taxable In