Home /

Expert Answers /

Economics /

consider-the-goods-market-of-a-closed-economy-in-which-investment-i-is-no-longer-assumed-as-exogen-pa688

(Solved): Consider the goods market of a closed economy in which investment I is no longer assumed as exogen ...

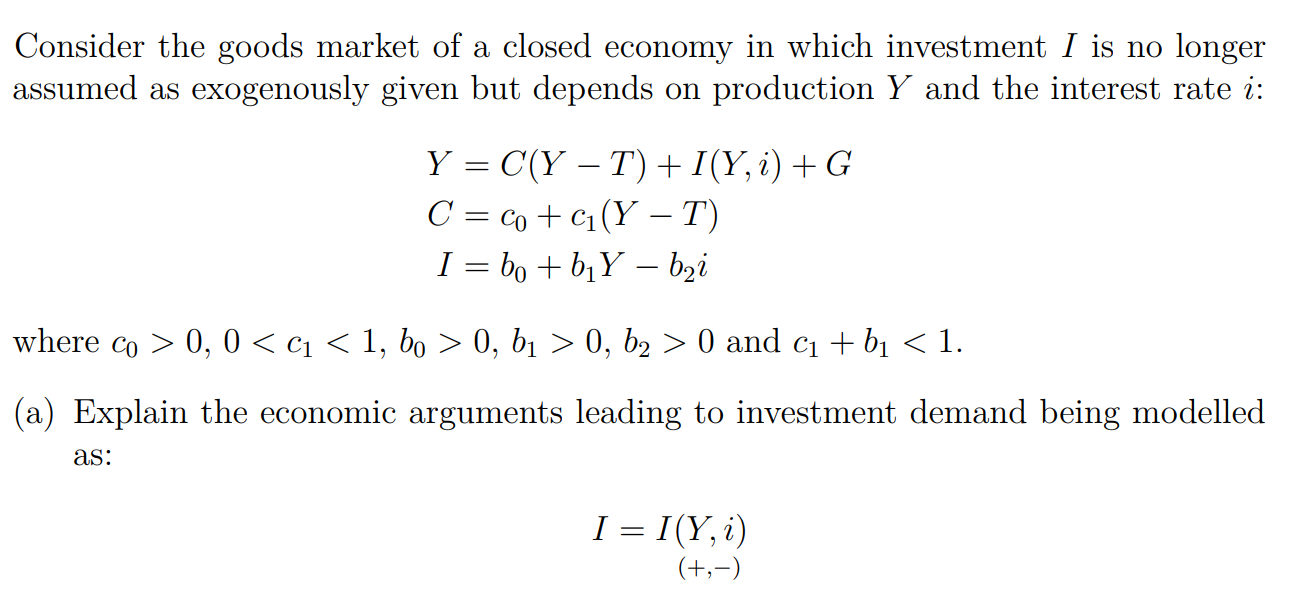

Consider the goods market of a closed economy in which investment is no longer assumed as exogenously given but depends on production and the interest rate : where and (a) Explain the economic arguments leading to investment demand being modelled as:

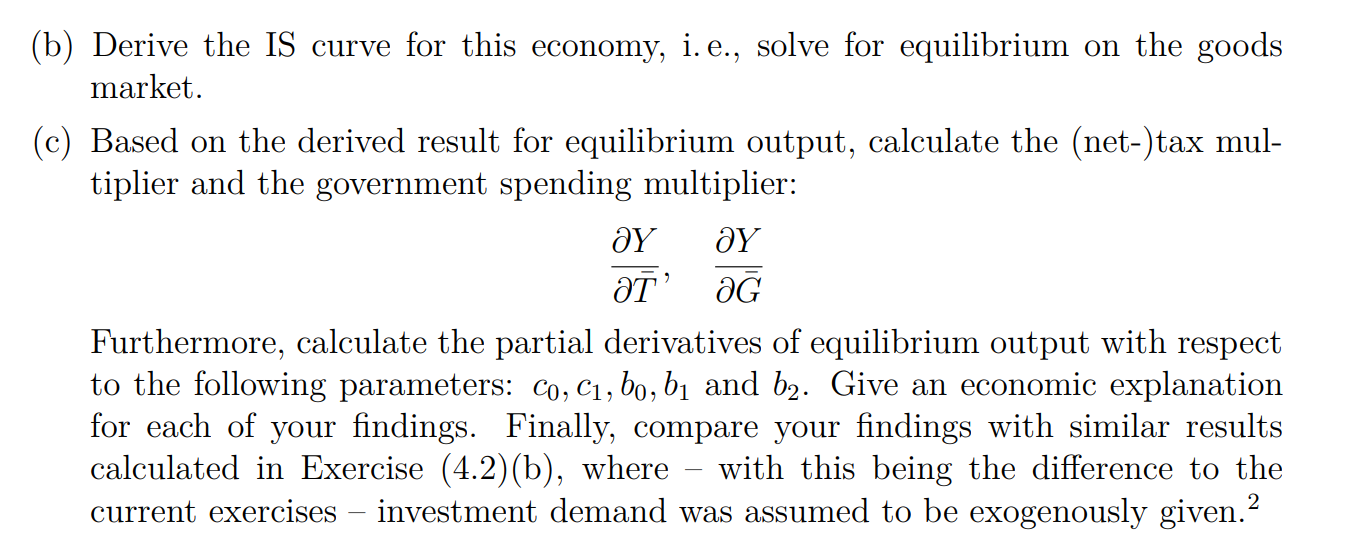

b) Derive the IS curve for this economy, i. e., solve for equilibrium on the goods market. c) Based on the derived result for equilibrium output, calculate the (net-)tax multiplier and the government spending multiplier: Furthermore, calculate the partial derivatives of equilibrium output with respect to the following parameters: and . Give an economic explanation for each of your findings. Finally, compare your findings with similar results calculated in Exercise (4.2)(b), where - with this being the difference to the current exercises - investment demand was assumed to be exogenously given.

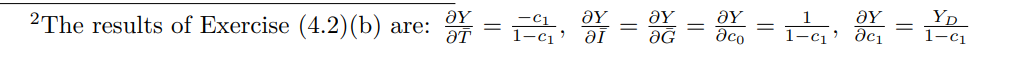

The results of Exercise are:

Expert Answer

a. The investment demand is modelled as a function of production and interest rate because both factors have a significant impact on the investment decisions of firms.Firstly, the level of production (Y) directly affects the profitability of investment. When production is high, firms are likely to have higher profits and therefore more resources to invest. Conversely, when production is low, firms are likely to have lower profits and may reduce their investment spending.Secondly, the interest rate (i) plays a crucial role in determining the cost of borrowing funds for investment. Higher interest rates increase the cost of borrowing and reduce the profitability of investment projects. Therefore, when interest rates are high, firms may reduce their investment spending.Overall, investment demand is modelled as a function of production and interest rate because both of these factors are crucial determinants of investment decisions in the economy.