Home /

Expert Answers /

Accounting /

compute-the-cost-assigned-to-ending-inventory-using-a-fifo-b-lifo-c-weighted-average-and-d-pa153

(Solved): Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d ...

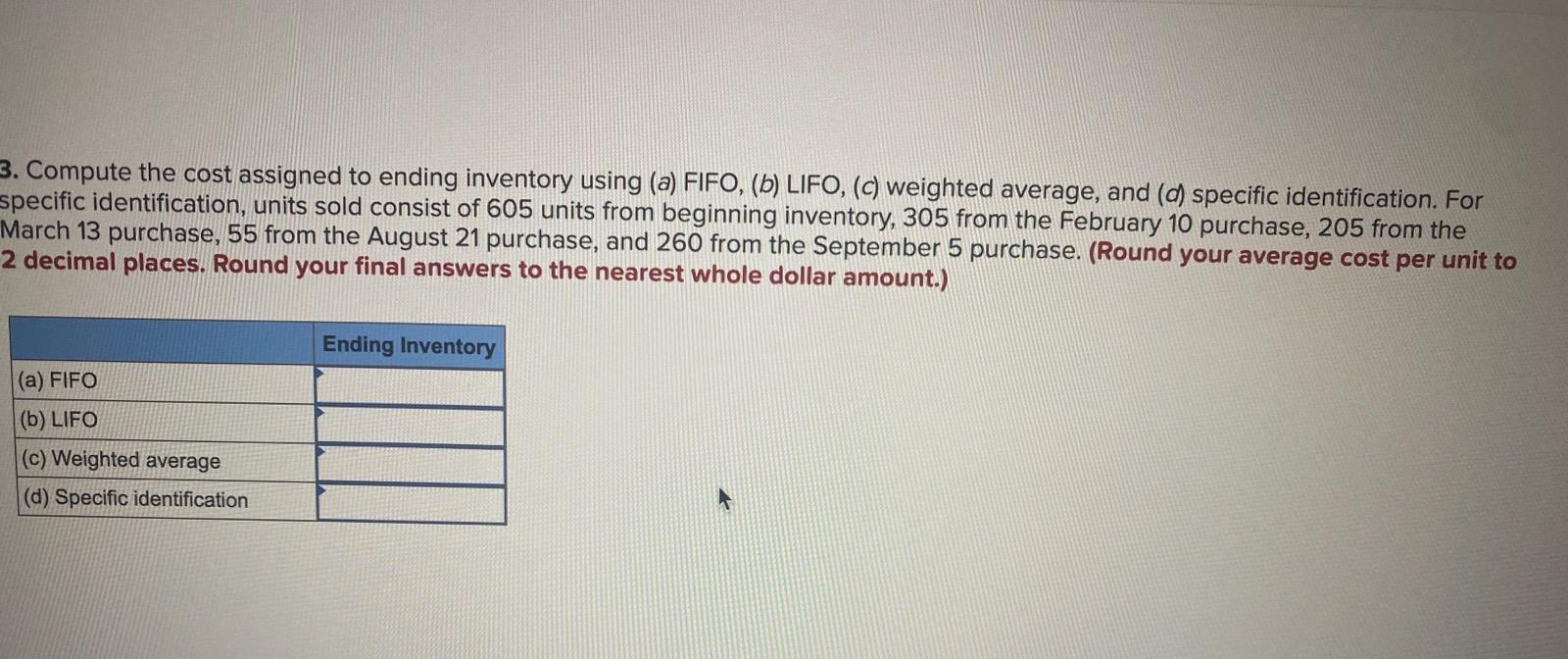

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, units sold consist of 605 units from beginning inventory, 305 from the February 10 purchase, 205 from the March 13 purchase, 55 from the August 21 purchase, and 260 from the September 5 purchase.

(And may I add if you can list how you got each of the

number? I seem to struggle on the COGS

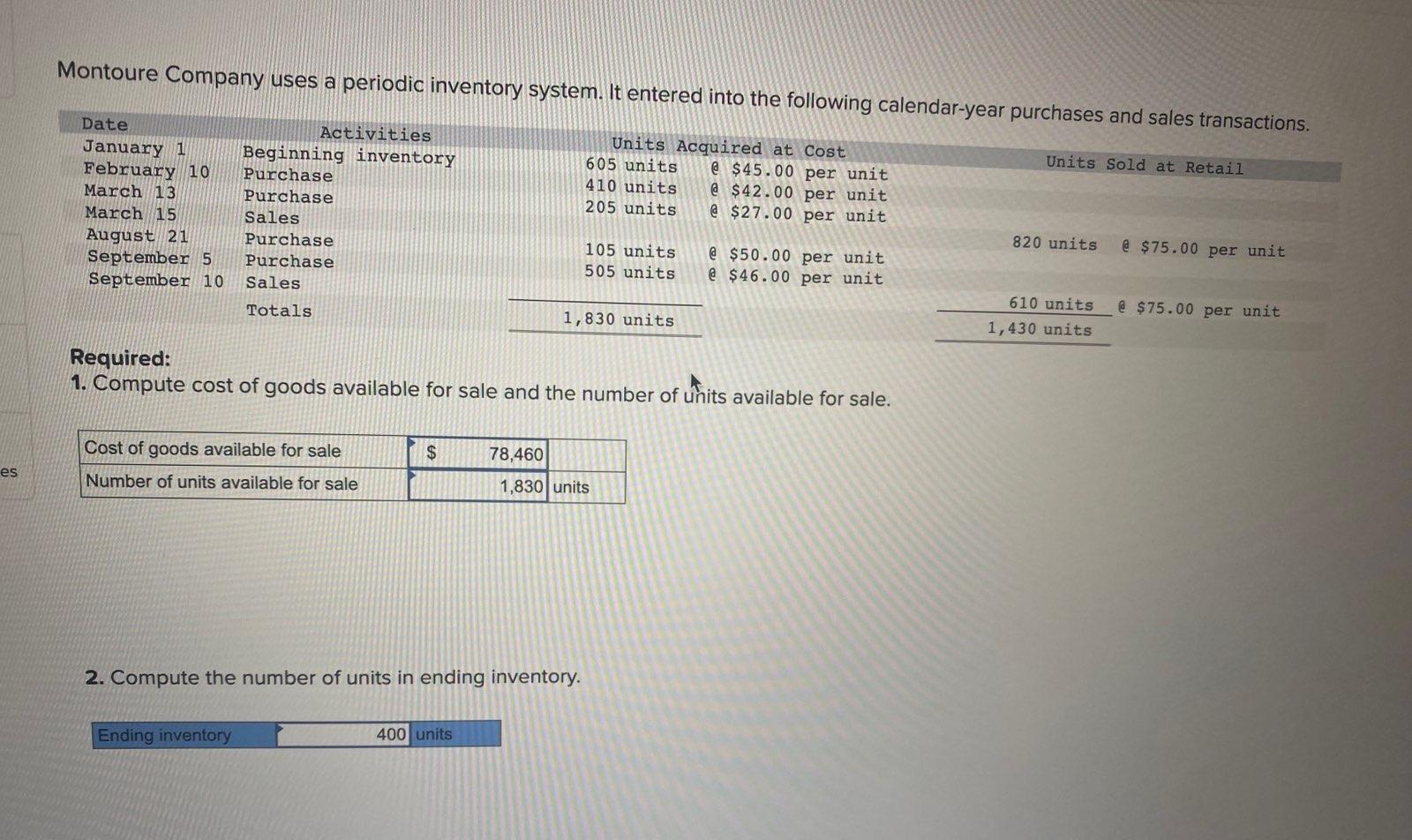

Montoure Company uses a periodic inventory system. It entered into the following calendar-year purchases and calnatw. reyuirea: 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory.

3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For pecific identification, units sold consist of 605 units from beginning inventory, 305 from the February 10 purchase, 205 from the March 13 purchase, 55 from the August 21 purchase, and 260 from the September 5 purchase. (Round your average cost per unit to 2 decimal places. Round your final answers to the nearest whole dollar amount.)

Expert Answer

Periodic FIFO : Beginning Inventory & Purchases Cost of Goods Sold Ending Inventory Date Quantity Cost per unit Total Cost Quantity Cost per unit Tota