Home /

Expert Answers /

Finance /

compute-and-analyze-measures-for-dupont-disaggregation-analysis-the-2018-balance-sheets-and-income-pa794

(Solved): Compute and Analyze Measures for DuPont Disaggregation Analysis The 2018 balance sheets and income ...

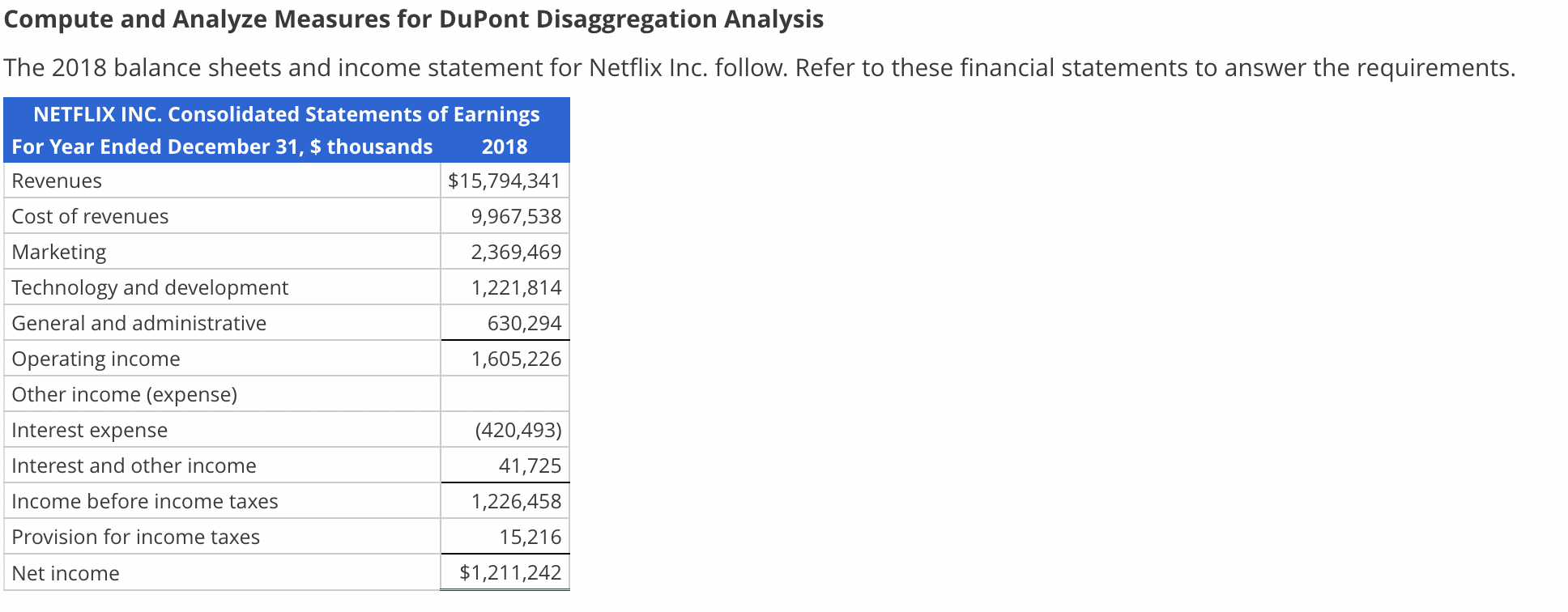

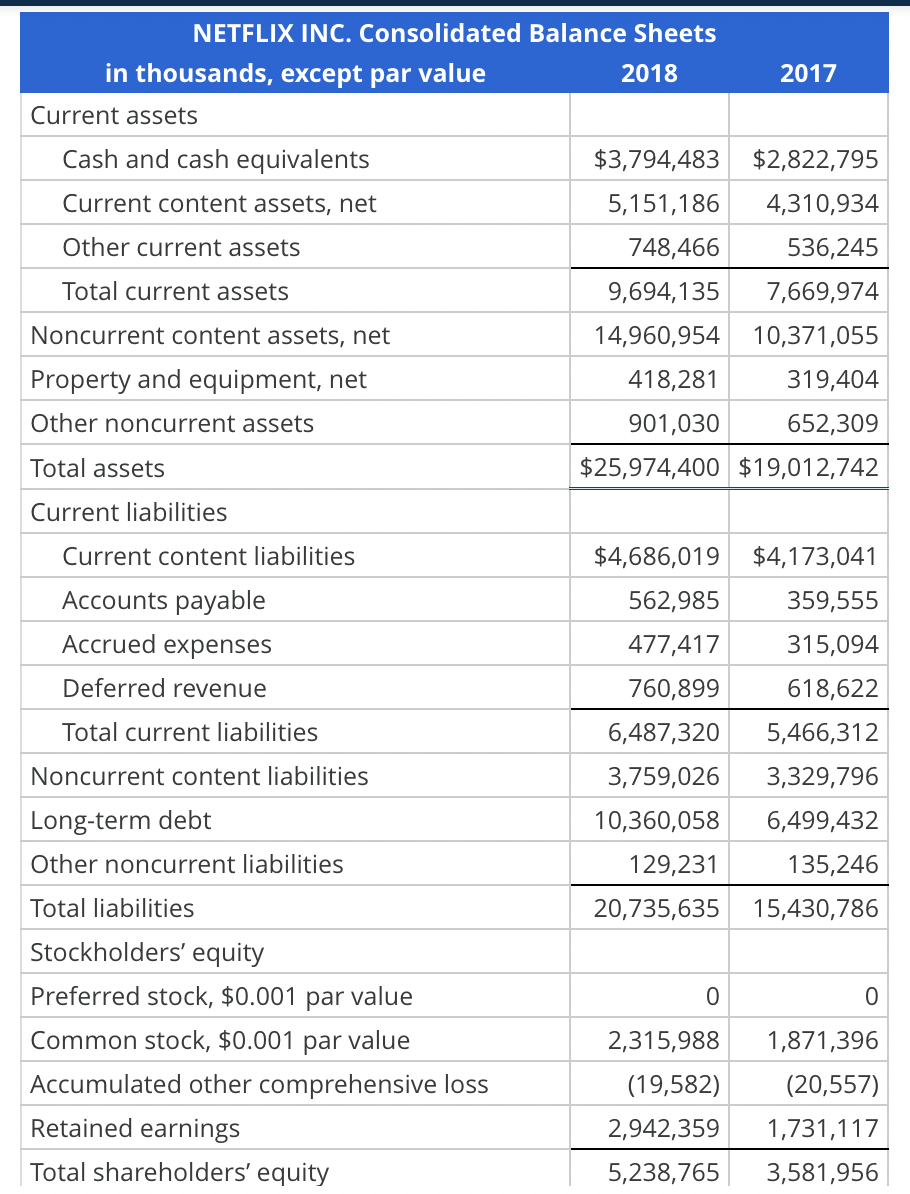

Compute and Analyze Measures for DuPont Disaggregation Analysis The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements.

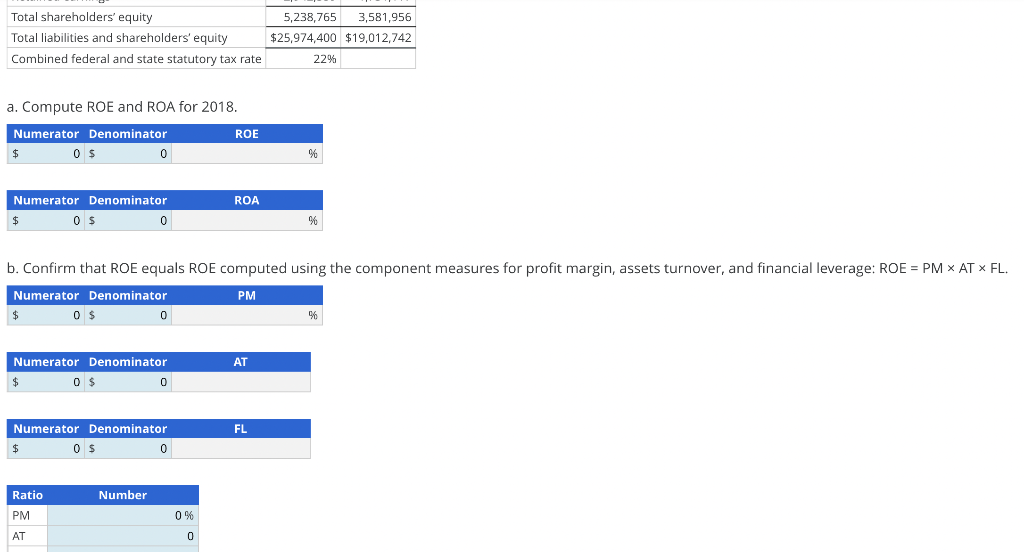

a. Compute ROE and ROA for \( 2018 . \) b. Confirm that ROE equals ROE computed using the component measures for profit margin, assets turnover, and financial leverage: ROE \( = \) PM \( \times \) AT \( \times \) FL.

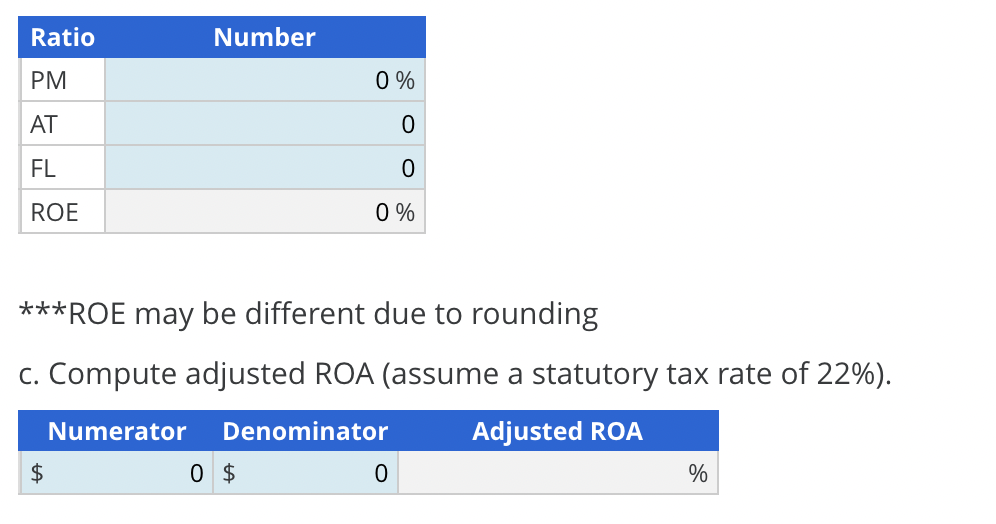

\( * * * R O E \) may be different due to rounding c. Compute adjusted ROA (assume a statutory tax rate of \( 22 \% \) ).

Expert Answer

a) Formulae: - ROE (Return on Equity) = Net Income/Total Shareholder's equity ROA (Return on Assets) = Net Income/Total Assets