(Solved): Complete the transaction analysis template for the first quarter of Year 4. If you need to come up w ...

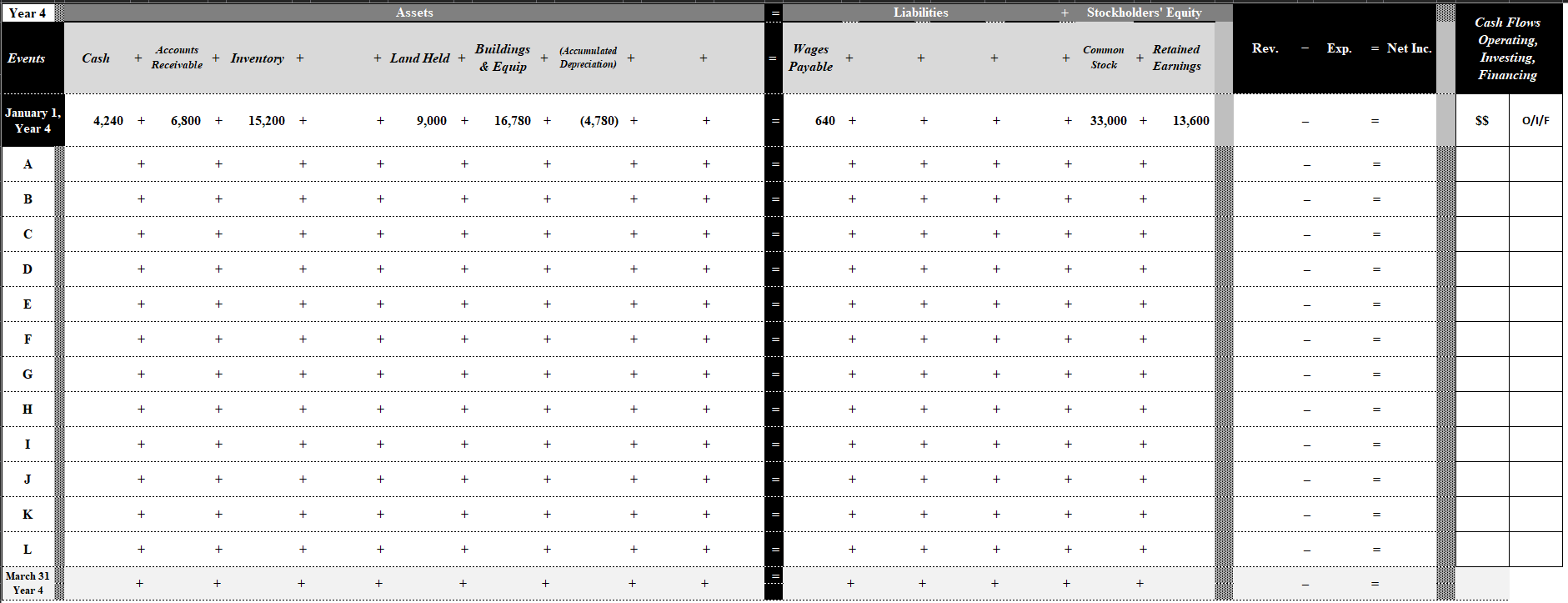

Complete the transaction analysis template for the first quarter of Year 4. If you need to come up with a new account, do your best to use a reasonable account title. Extra columns have been added to the transaction template for this purpose. Be advised that you might not use all the columns provided.

See transactions below:

A. $500 cash was paid for a new trademark for the company. It was determined that this amount should be capitalized rather than expensed. Since the trademark has an indefinite useful life, no amortization will be recorded.

B. Wages and salaries totaling $3,200 were paid in cash during the first quarter of Year 4. A portion of this amount paid off the wages that were payable at the end of the previous year. The remaining amount was for wages paid in the first quarter of Year 4.

C. All accounts receivable outstanding on December 31, Year 3 were collected in the first quarter of year 4.

D. Denver Company’s advertising agency billed the firm $1,000 for a campaign that ran during the first quarter of Year 4. Denver Company had not paid the bill as of March 31, Year 4

E. Sales totaling $18,000 were made to customers during the first quarter of Year 4. Of these sales, 60% were collected during the first quarter and the balance is expected to be collected during the next quarter.

F. The inventory related to the sales in part E above cost the company $13,000 when they were purchased.

G. Dividends were declared and paid to stockholders in the amount of $1,500.

H. Inventory costing $10,600 was purchased during the first quarter of Year 4, of which 10% was paid in cash before the end of the first quarter. The remaining 90% was still payable to the vendors at the end of the first quarter.

I. A 3-year, $4,000 12% loan was obtained from a local bank on the last day of the quarter. The full amount of interest and principal is due at the end of the 3-year period.

J. New shares of stock were issued by Denver Company during the first quarter for $2,000 in cash

K. A new 3-year lease agreement was signed and executed on January 1, Year 4 for the first 6 months of Year 4. The lease required that a $900 monthly rental be paid in advance for the first 2 quarters of the year (total paid is $5,400 = $900 x 6 months)

L. The land that had been held for plant expansion was sold for $9,000.

- There is no need to adjust the books for depreciation or item I above