Home /

Expert Answers /

Accounting /

complete-the-analysis-chart-for-each-transaction-the-nbsp-create-a-general-journal-for-the-transact-pa179

(Solved): Complete the analysis chart for each transaction the create a general journal for the transact ...

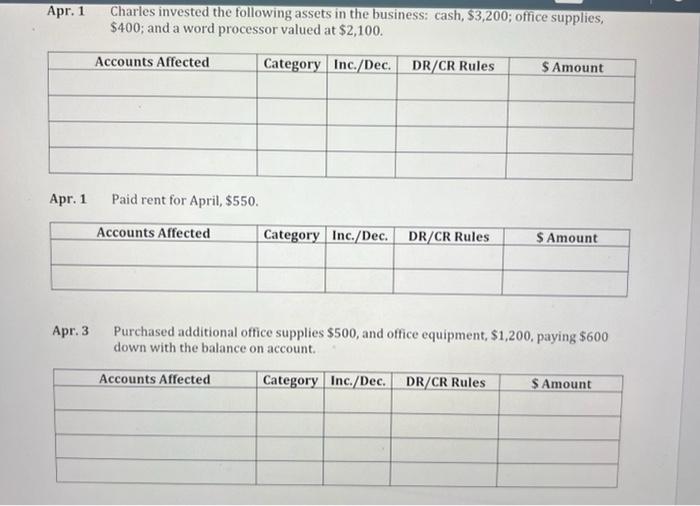

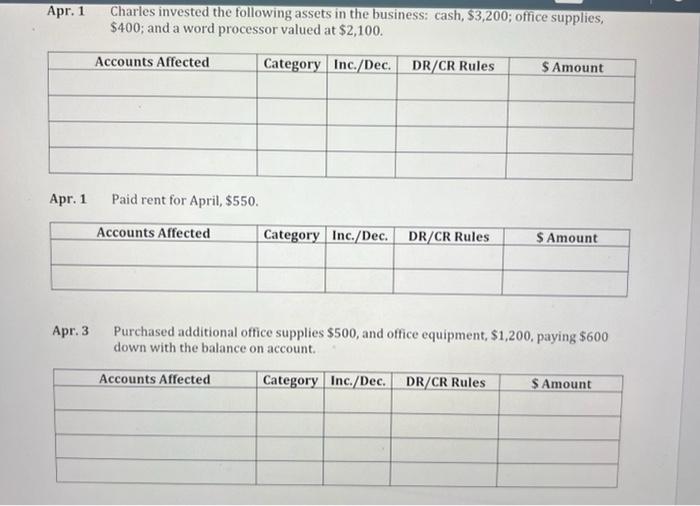

Complete the analysis chart for each transaction the create a general journal for the transactions.

Apr. 1 Charles invested the following assets in the business: cash, \$3,200; office supplies, \( \$ 400 \); and a word processor valued at \( \$ 2,100 \). Apr. 1 Paid rent for April, \( \$ 550 \). Apr. 3 Purchased additional office supplies \( \$ 500 \), and office equipment, \( \$ 1,200 \), paying \( \$ 600 \) down with the balance on account.

Apr. 7 Paid for repairs to equipment, \( \$ 230 \).

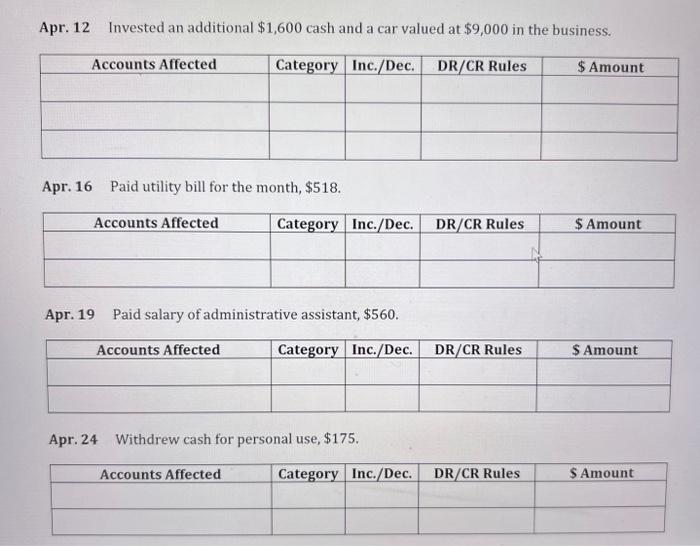

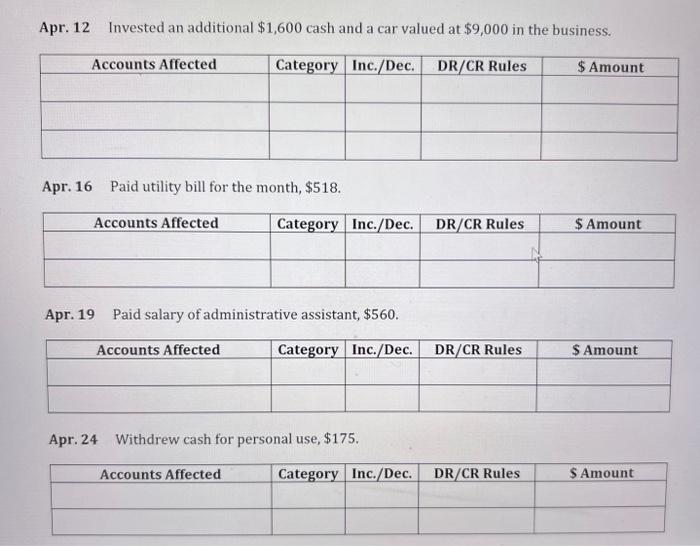

Apr. 12 Invested an additional \( \$ 1,600 \) cash and a car valued at \( \$ 9,000 \) in the business. Apr. 16 Paid utility bill for the month, \( \$ 518 . \) Apr. 19 Paid salary of administrative assistant, \( \$ 560 \). Apr. 24 Withdrew cash for personal use, \( \$ 175 \).

Apr. 30 Recorded fees earned and cash received for the month, \( \$ 2,025 \).