Home /

Expert Answers /

Accounting /

colleen-company-has-gathered-the-following-data-pertaining-to-activities-it-performed-for-two-of-its-pa289

(Solved): Colleen Company has gathered the following data pertaining to activities it performed for two of its ...

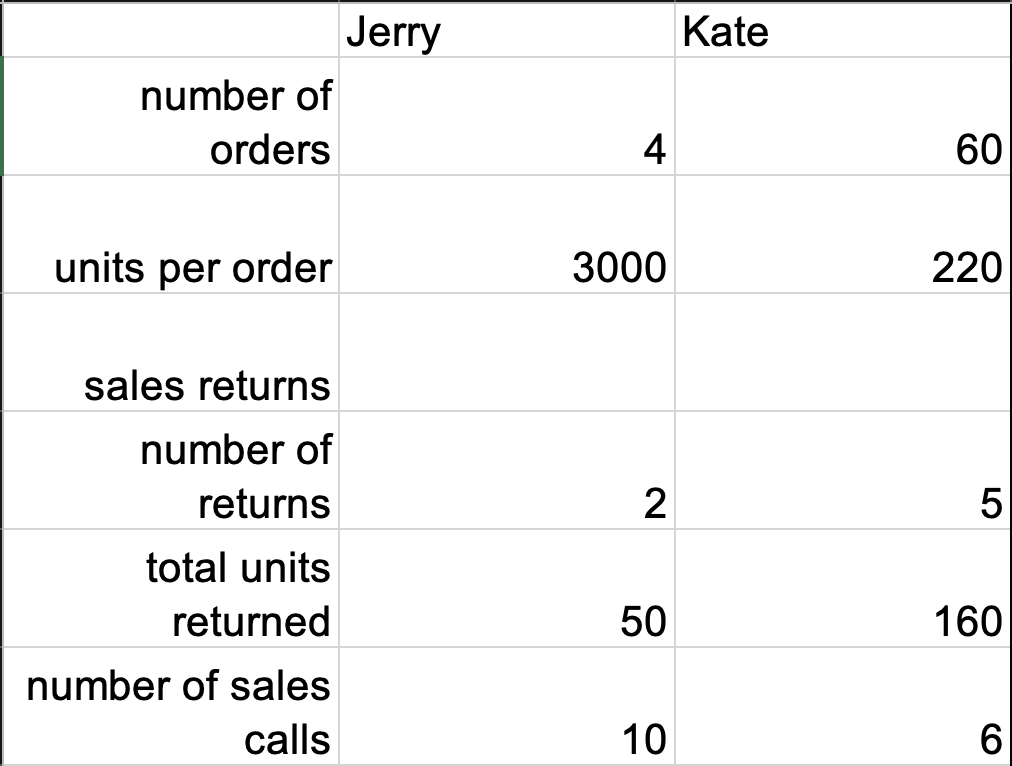

Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers.

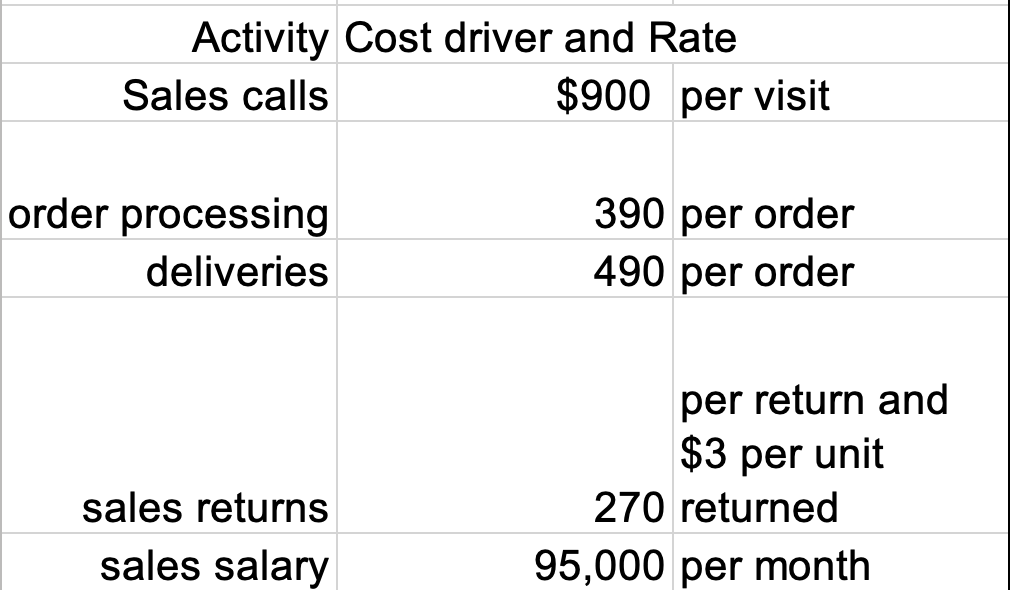

Colleen sells its products at $200 per unit. The firm’s gross margin ratio is 30%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs:

Required:

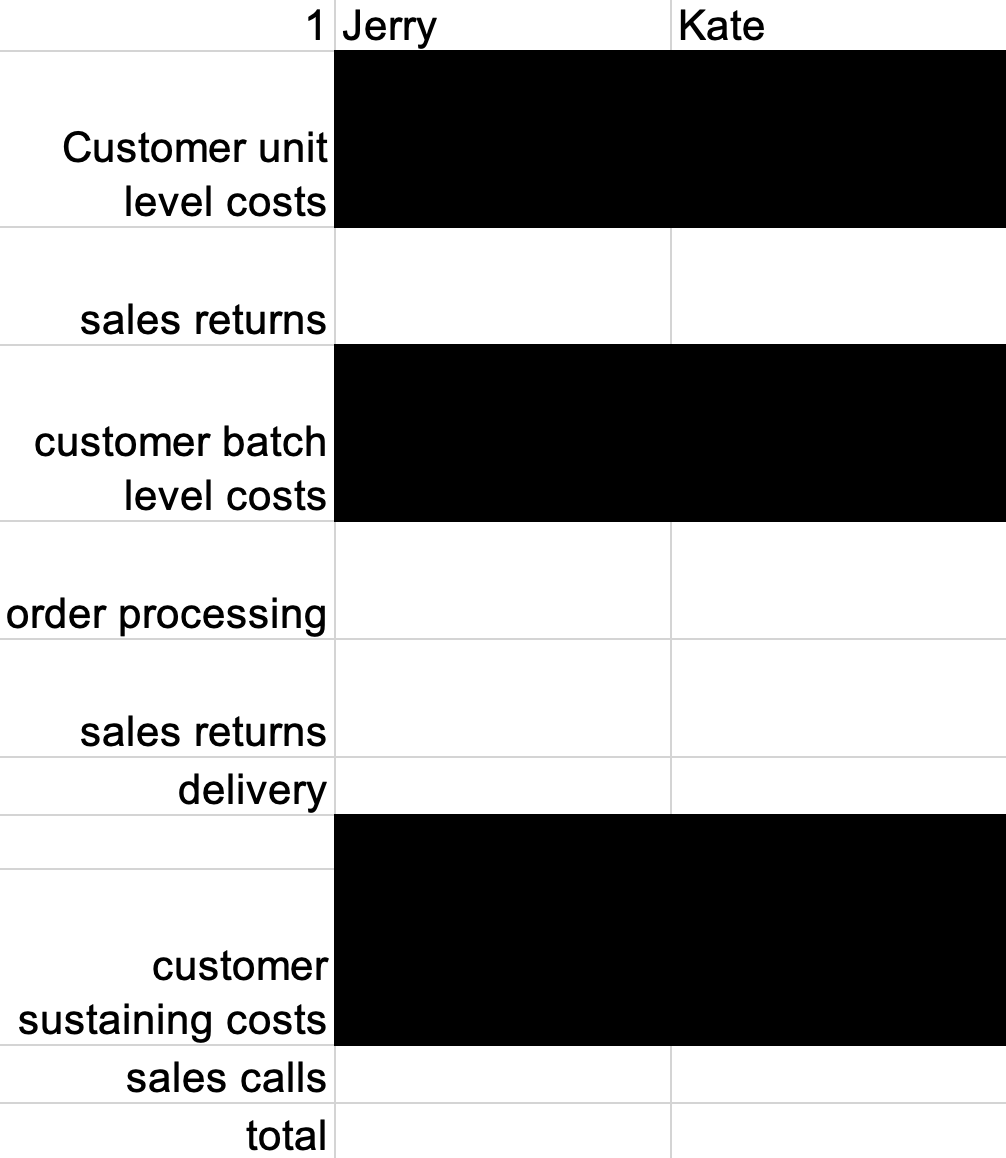

1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen Company to service Jerry, Incorporated and Kate Company.

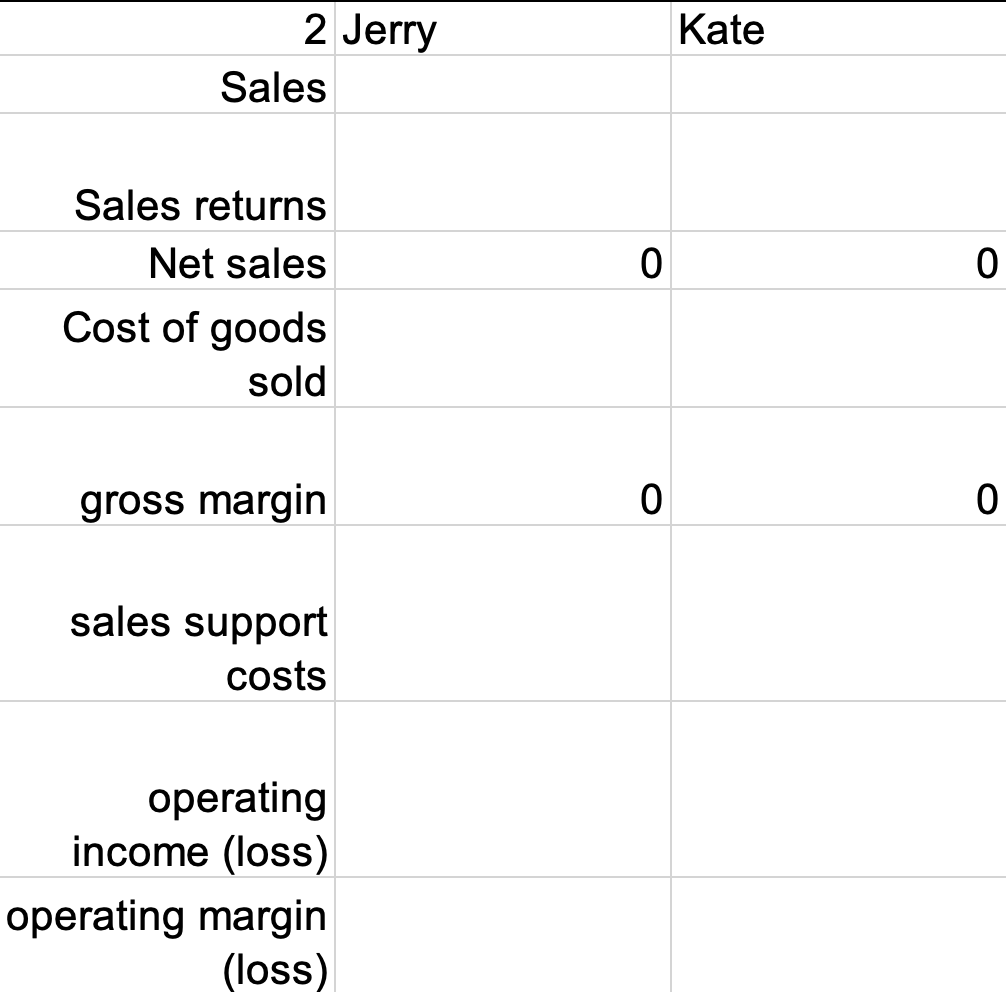

2. Compare the profitability of these two customers.

Jerry Kate number of orders 4 60 units per order 3000 220 sales returns number of returns 2 5 total units returned 50 160 number of sales calls 10 6

Activity Cost driver and Rate Sales calls per visit \begin{tabular}{r|l} order processing & 390 per order \\ \hline deliveries & 490 per order \end{tabular} per return and \$3 per unit sales returns returned sales salary per month

1 Jerry Kate Customer unit level costs sales returns customer batch level costs order processing sales returns delivery customer sustaining costs sales calls total

2 Jerry Kate Sales Sales returns Net sales 0 0 Cost of goods sold gross margin 0 0 sales support costs operating income (loss) operating margin (loss)

Expert Answer

A costing method where a company identifies a comprehensive list of its business activities and determines the cost of every activity is known as acti