Home /

Expert Answers /

Accounting /

chart-of-accounts-cash-111-prepaid-insurance-117-chemical-supplies-119-equipment-144-a-pa613

(Solved): Chart of Accounts: Cash (111), Prepaid Insurance (117), Chemical Supplies (119), Equipment (144), A ...

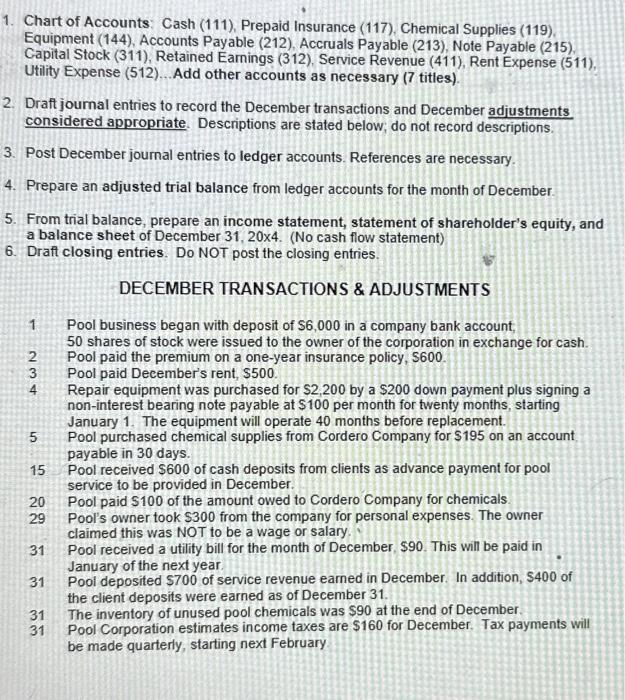

Chart of Accounts: Cash (111), Prepaid Insurance (117), Chemical Supplies (119), Equipment (144), Accounts Payable (212), Accruals Payable (213), Note Payable (215), Capital Stock (311), Retained Earnings (312), Service Revenue (411), Rent Expense (511), Utility Expense (512)...Add other accounts as necessary (7 titles). 2. Draft journal entries to record the December transactions and December adjustments considered appropriate. Descriptions are stated below; do not record descriptions. 3. Post December journal entries to ledger accounts. References are necessary. 4. Prepare an adjusted trial balance from ledger accounts for the month of December. 5. From trial balance, prepare an income statement, statement of shareholder's equity, and a balance sheet of December . (No cash flow statement) 6. Draft closing entries. Do NOT post the closing entries. DECEMBER TRANSACTIONS \& ADJUSTMENTS 1 Pool business began with deposit of in a company bank account, 50 shares of stock were issued to the owner of the corporation in exchange for cash. 2 Pool paid the premium on a one-year insurance policy, . 3 Pool paid December's rent, . 4 Repair equipment was purchased for by a down payment plus signing a non-interest bearing note payable at per month for twenty months, starting January 1 . The equipment will operate 40 months before replacement. 5 Pool purchased chemical supplies from Cordero Company for on an account payable in 30 days. 15 Pool received of cash deposits from clients as advance payment for pool service to be provided in December. 20 Pool paid of the amount owed to Cordero Company for chemicals. 29 Pool's owner took from the company for personal expenses. The owner claimed this was NOT to be a wage or salary. 31 Pool received a utility bill for the month of December, . This will be paid in January of the next year. 31 Pool deposited of service revenue earned in December. In addition, of the client deposits were earned as of December 31. 31 The inventory of unused pool chemicals was at the end of December. 31 Pool Corporation estimates income taxes are for December. Tax payments will be made quarterly, starting next February.

Expert Answer

Requirement 1: Journal entriesRecording the transactions in chronological order in the journal is th...