Home /

Expert Answers /

Economics /

chapter-5-real-business-cycle-theory-6-real-business-cycle-model-rbc-derive-step-by-step-stea-pa164

(Solved): Chapter 5 REAL-BUSINESS-CYCLE THEORY 6. Real Business Cycle Model (RBC). Derive step-by-step: stea ...

Chapter 5 REAL-BUSINESS-CYCLE THEORY

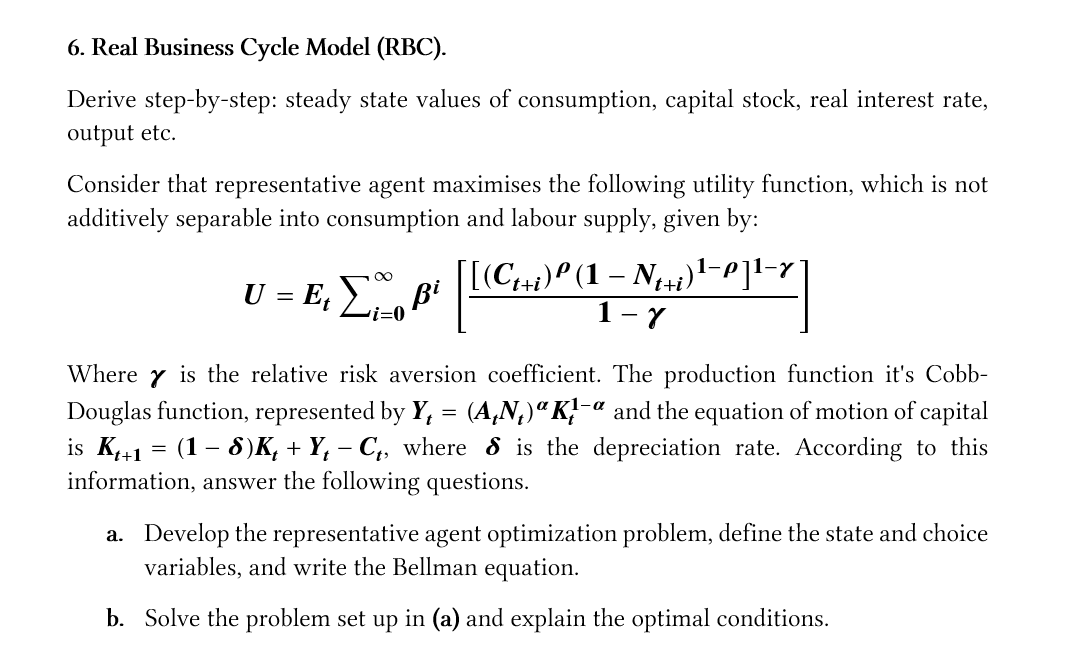

6. Real Business Cycle Model (RBC). Derive step-by-step: steady state values of consumption, capital stock, real interest rate, output etc. Consider that representative agent maximises the following utility function, which is not additively separable into consumption and labour supply, given by: \[ U=E_{t} \sum_{i=0}^{\infty} \beta^{i}\left[\frac{\left[\left(C_{t+i}\right)^{\rho}\left(\mathbf{1}-N_{t+i}\right)^{1-\rho}\right]^{1-\gamma}}{1-\gamma}\right] \] Where \( \boldsymbol{\gamma} \) is the relative risk aversion coefficient. The production function it's Cobbis \( \boldsymbol{K}_{\boldsymbol{t}+\mathbf{1}}=(\mathbf{1}-\boldsymbol{\delta}) \boldsymbol{K}_{\boldsymbol{t}}+\boldsymbol{Y}_{\boldsymbol{t}}-\boldsymbol{C}_{\boldsymbol{t}} \), where \( \boldsymbol{\delta} \) is the depreciation rate. According to this information, answer the following questions. a. Develop the representative agent optimization problem, define the state and choice variables, and write the Bellman equation. b. Solve the problem set up in (a) and explain the optimal conditions.

Expert Answer

Each household is endowed with one unit of tim