Home /

Expert Answers /

Accounting /

cathy-company-began-business-on-january-1-2021-the-company-uses-the-lifo-cost-flow-assumption-for-pa905

(Solved): Cathy Company began business on January 1, 2021. The company uses the LIFO cost flow assumption for ...

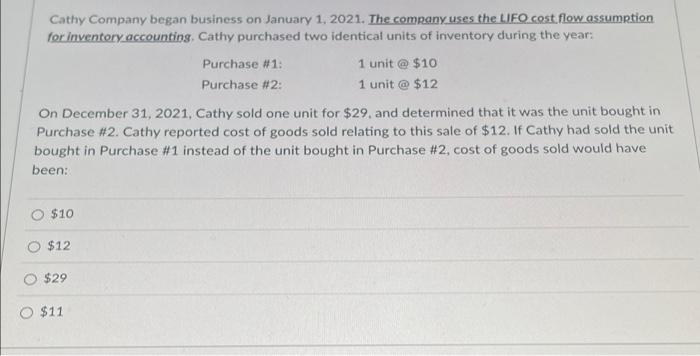

Cathy Company began business on January 1, 2021. The company uses the LIFO cost flow assumption for inventory accounting. Cathy purchased two identical units of inventory during the year: $10 On December 31, 2021, Cathy sold one unit for $29, and determined that it was the unit bought in Purchase #2. Cathy reported cost of goods sold relating to this sale of $12. If Cathy had sold the unit bought in Purchase #1 instead of the unit bought in Purchase #2, cost of goods sold would have been: $12 $29 Purchase #1: Purchase #2: O $11 1 unit @ $10 1 unit @ $12

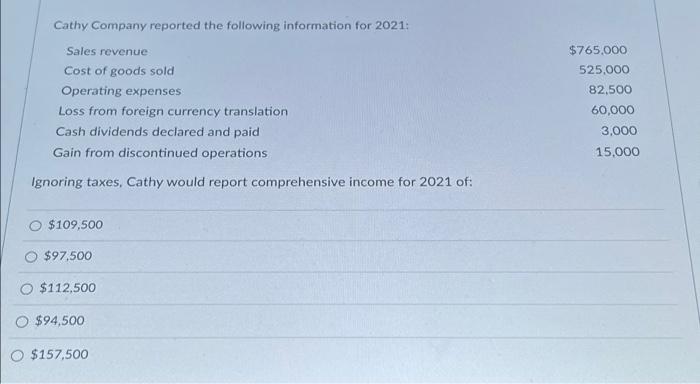

Cathy Company reported the following information for 2021: Sales revenue Cost of goods sold Operating expenses Loss from foreign currency translation Cash dividends declared and paid Gain from discontinued operations Ignoring taxes, Cathy would report comprehensive income for 2021 of: $109,500 $97,500 O $112,500 $94,500 O $157,500 $765.000 525,000 82,500 60,000 3,000 15,000

Expert Answer

1) Question on LIFO) A) Second option $ 12 is correct as explained below. B) When a business enterprise deals in identical or interchangeable goods purchased at different times and at different rates, it is not possible to trace units sold to units a