(Solved): Case 3 Joan Longhurst, along with three of her best tre started her own ranching operation in Hawaii ...

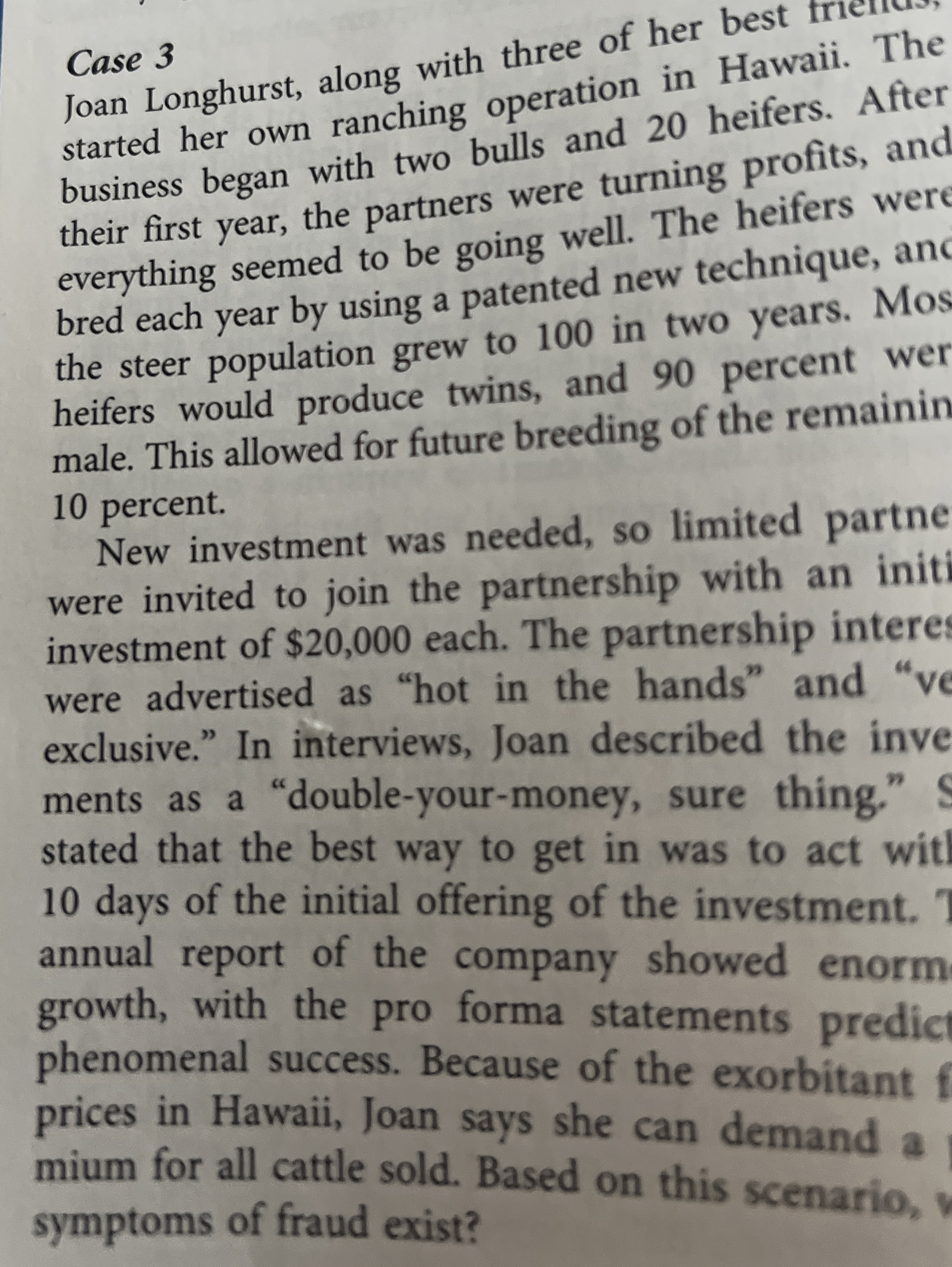

Case 3 Joan Longhurst, along with three of her best tre started her own ranching operation in Hawaii. The business began with two bulls and 20 heifers. After their first year, the partners were turning profits, and everything seemed to be going well. The heifers wer bred each year by using a patented new technique, an the steer population grew to 100 in two years. Mos heifers would produce twins, and 90 percent wer male. This allowed for future breeding of the remainin 10 percent. New investment was needed, so limited partne were invited to join the partnership with an init investment of

$20,000each. The partnership intere were advertised as "hot in the hands" and "ve exclusive." In interviews, Joan described the inve ments as a "double-your-money, sure thing." stated that the best way to get in was to act witl. 10 days of the initial offering of the investment. annual report of the company showed enorm growth, with the pro forma statements predic phenomenal success. Because of the exorbitant prices in Hawaii, Joan says she can demand a mium for all cattle sold. Based on this scenario, symptoms of fraud exist?