Home /

Expert Answers /

Finance /

case-2-cost-of-capital-a-tech-produces-shoes-it-has-an-enterprise-value-of-500-debt-equal-to-pa541

(Solved): Case 2: Cost of capital. a. Tech produces shoes. It has an enterprise value of 500, debt equal to ...

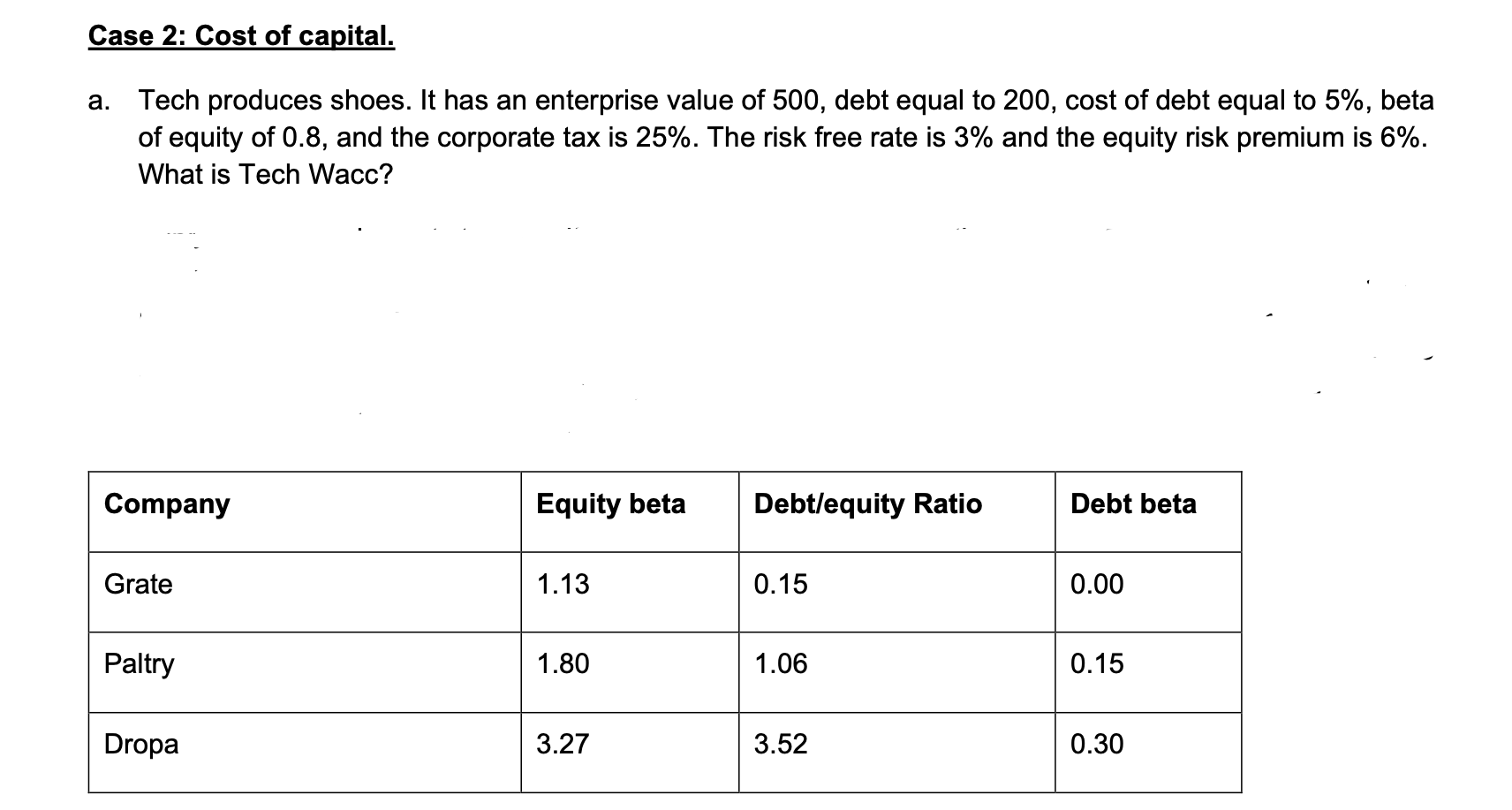

Case 2: Cost of capital. a. Tech produces shoes. It has an enterprise value of 500, debt equal to 200, cost of debt equal to 5%, beta of equity of 0.8, and the corporate tax is 25%. The risk free rate is 3% and the equity risk premium is 6%. What is Tech Wacc? Company Grate Paltry Dropa Equity beta 1.13 1.80 3.27 Debt/equity Ratio 0.15 1.06 3.52 Debt beta 0.00 0.15 0.30

Expert Answer

Solution: a) What is Tech’s WACC? Answer) 5.37% Working: We find the amount of equity here Enterprise value = Equity value + debt – cash 500 = Equity value + 300 – 0 500 = Equity value + 300 500 – 300 = Equity va