Home /

Expert Answers /

Accounting /

canova-corporation-adopted-the-dollar-value-lifo-retail-method-on-january-1-2024-on-that-date-t-pa706

(Solved): Canova Corporation adopted the dollar-value LIFO retail method on January 1, 2024. On that date, t ...

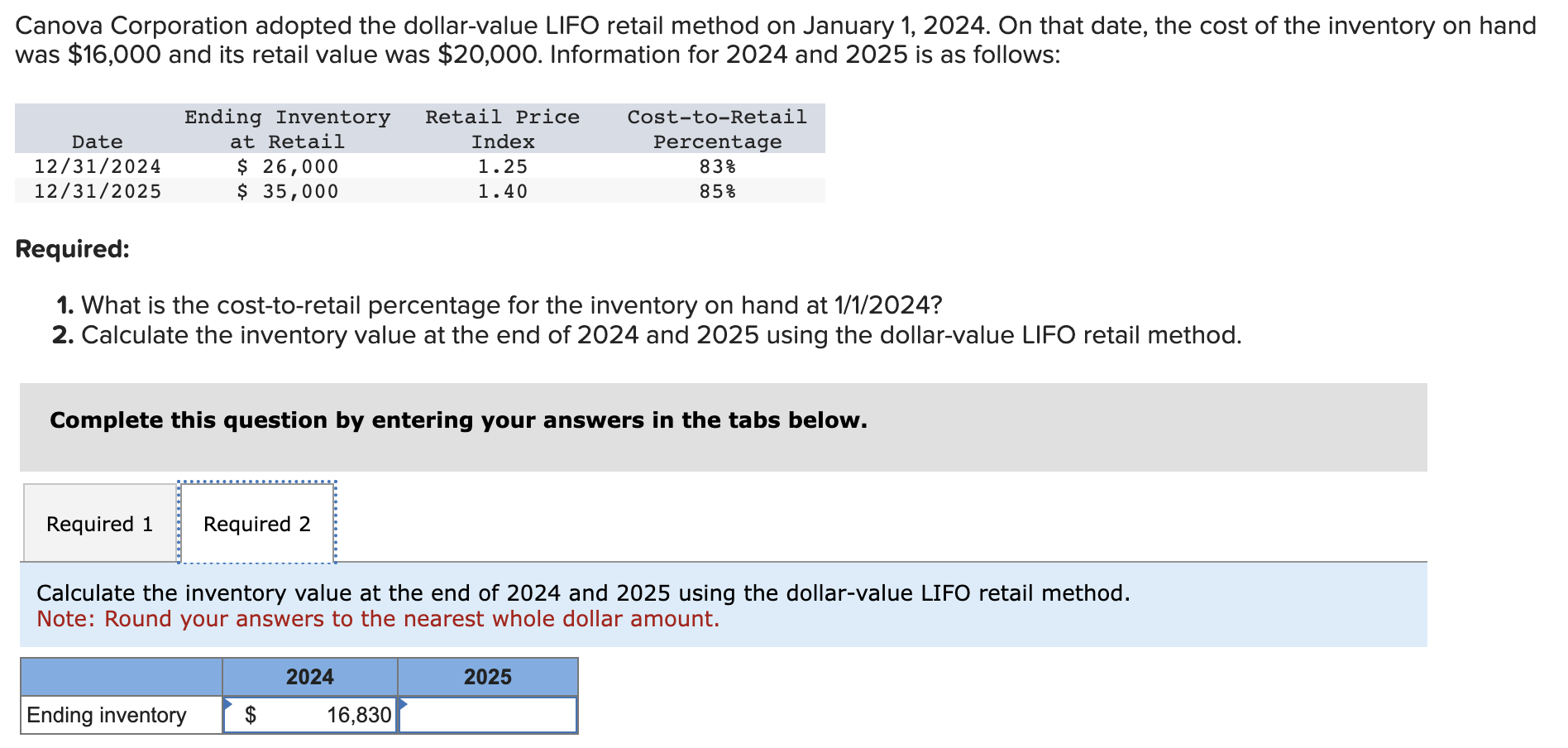

Canova Corporation adopted the dollar-value LIFO retail method on January 1, 2024. On that date, the cost of the inventory on hand was $16,000 and its retail value was $20,000. Information for 2024 and 2025 is as follows: Ending Inventory Retail Price Cost-to-Retail Date Index Percentage at Retail $ 26,000 12/31/2024 12/31/2025 1.25 1.40 83% 85% $ 35,000 Required: 1. What is the cost-to-retail percentage for the inventory on hand at 1/1/2024? 2. Calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO retail method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO retail method. Note: Round your answers to the nearest whole dollar amount. 2024 2025 Ending inventory $ 16,830

Expert Answer

1. Cost to retail percentage = $16,000/$20,000 = 80% 2 . 2024 Ending inventory at Retail =