Home /

Expert Answers /

Accounting /

can-help-me-fill-out-this-chart-please-during-the-month-of-june-ace-incorporated-purchased-goods-f-pa381

(Solved): can help me fill out this chart please? During the month of June, Ace Incorporated purchased goods f ...

can help me fill out this chart please?

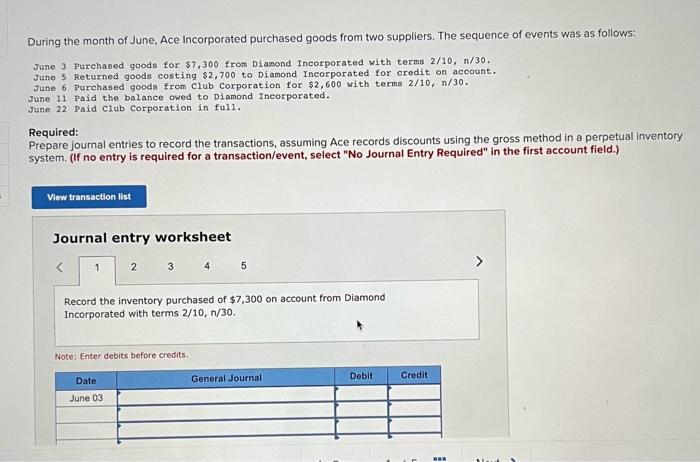

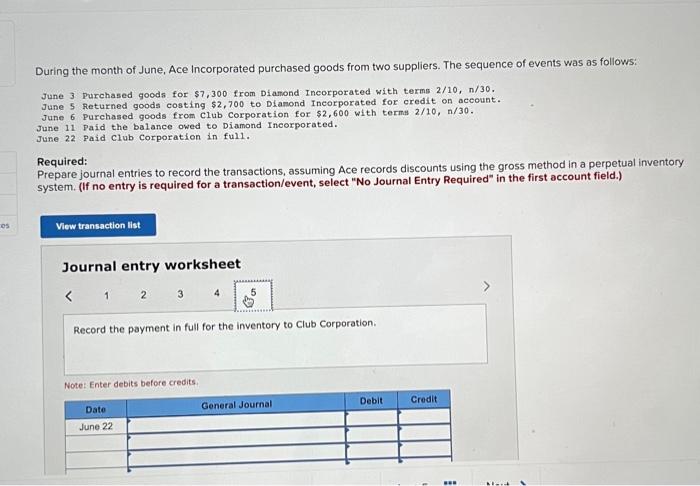

During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for \( \$ 7,300 \) from Diamond Incorporated with terms \( 2 / 10, n / 30 \). June 5 Returned goods costing \( \$ 2,700 \) to Diamond Incorporated for credit on account. June 6 purchased goods from club Corporation for \( \$ 2,600 \) with terms \( 2 / 10, \mathrm{n} / 30 \). June 11 Paid the balance owed to Diamond Incorporated. June 22 paid club corporation in full. Required: Prepare joumal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the inventory purchased of \( \$ 7,300 \) on account from Diamond Incorporated with terms \( 2 / 10, n / 30 \). Note: Enter debits before credits.

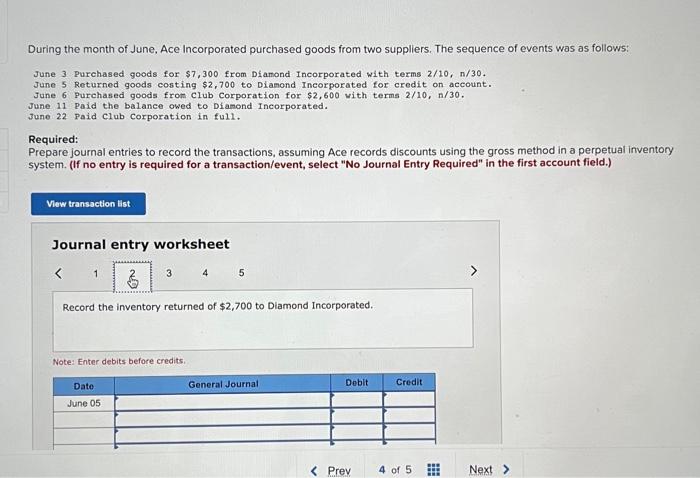

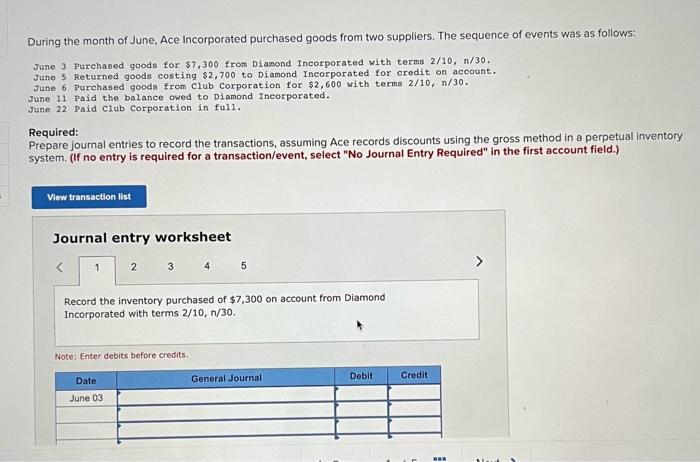

During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for \( \$ 7,300 \) from Dfamond Incorporated with terms \( 2 / 10, \mathrm{n} / 30 \). June 5 Returned goods costing \( \$ 2,700 \) to Dianond Incorporated for credit on account. June 6 Purchased goods from club Corporation for \( \$ 2,600 \) with terms \( 2 / 10, \mathrm{n} / 30 \). June 11 Paid the balance owed to Diamond Incorporated. June 22 Paid Club corporation in full. Required: Prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the inventory returned of \( \$ 2,700 \) to Diamond Incorporated. Notes Enter debits before credits.

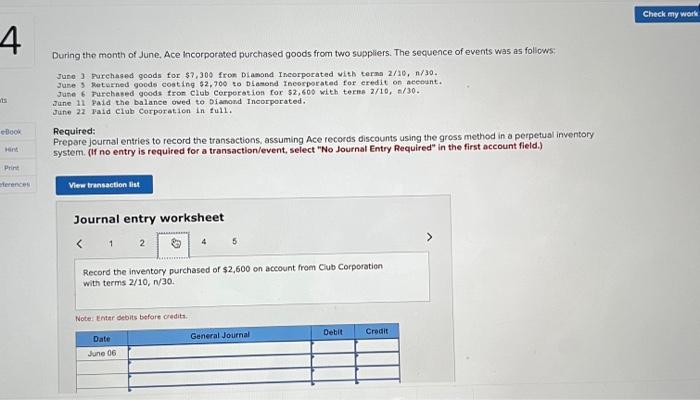

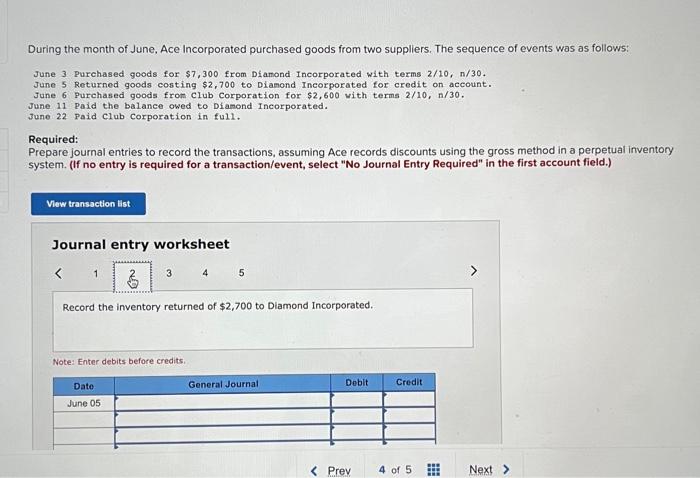

During the month of June, Ace incorporated purchased goods from two suppliers. The sequence of events was as folliows: Juce 3 Purchased goods for \( \$ 7,300 \) fron Dianond incorporated vith terna \( 2 / 20, n / 30 \). 3use 9 . foturned goods costing \( \$ 2,700 \) to Dfasond theorporated for eredit on accednt. June 6 rurehased goods tron Club Corporation for \( \$ 2,600 \) with terme \( 2 / 10, \pi / 30 \). June 11 Paid the balance oved to bianond Incorporated. June 22 Vaid club corporation in tull. Required: Prepare journal entries to record the transoctions, assuming Ace reconds discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the inventory purchased of \( \$ 2,600 \) on account from Cub Corporation with terms \( 2 / 10, n / 30 \). Note: Entar debits before credits.

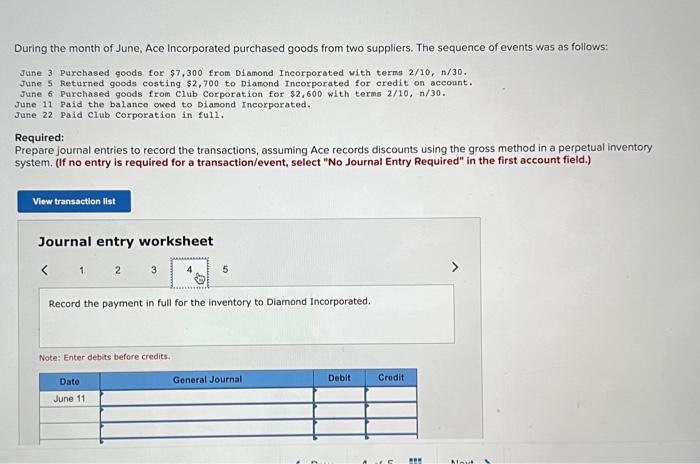

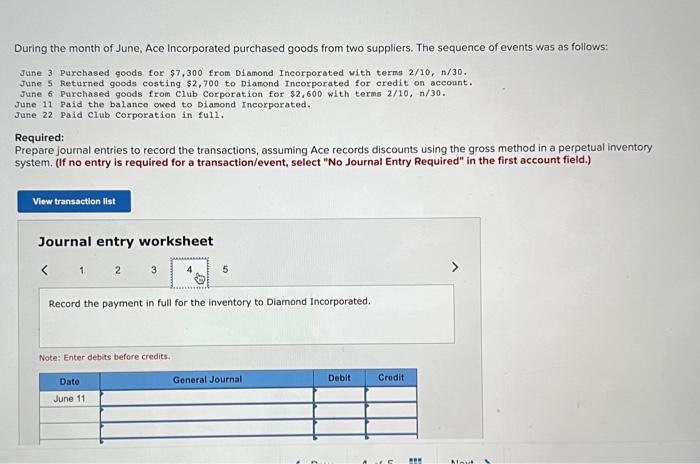

During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for \( \$ 7,300 \) from Diamond Incorporated with terms \( 2 / 10 \), \( \mathrm{n} / 30 \). June 5 Returned goods costing \( \$ 2,700 \) to Diamond Incorporated for eredit on account. June 6 Purchased goods from Club Corporation for \( \$ 2,600 \) with terms \( 2 / 10, \mathrm{n} / 30 \). June 11 paid the balance owed to Diamond Incorporated. June 22 paid club corporation in full. Required: Prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the payment in full for the inventory to Diamond Incorporated. Note: Enter debits before credits.

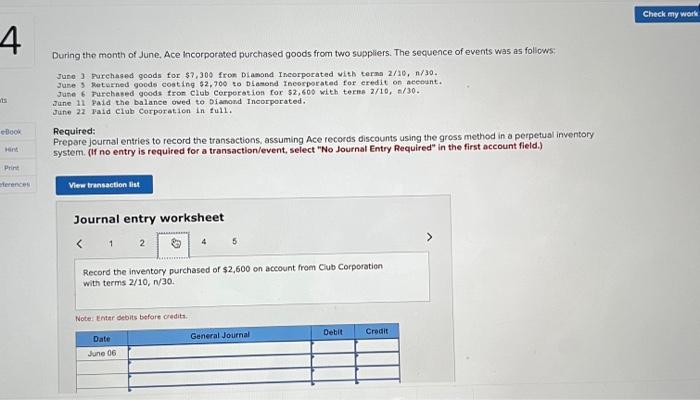

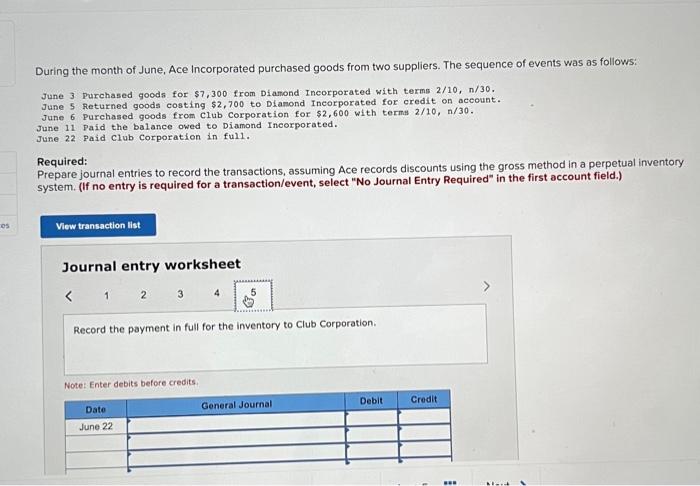

During the month of June, Ace incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for \( \$ 7,300 \) from Diamond Incorporated with terms \( 2 / 10, n / 30 \). June 5 Returned goods costing \( \$ 2,700 \) to Dianond Incorporated for credit on account. June 6 purchased goods from club Corporation for \( \$ 2,600 \) with terms \( 2 / 10, n / 30 \). June 11 Paid the balance owed to Diamond Incorporated. June 22 Paid club corporation in full. Required: Prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the payment in full for the inventory to Club Corporation. Note: Enter debits before credits.

Expert Answer

Gross method of recording discount Under the gross method of discount accounting, the discounts received on the payment for purchases from the supplie