Home /

Expert Answers /

Accounting /

calculating-deferred-income-taxes-the-sample-corporation-prepared-the-following-income-statements-pa787

(Solved): Calculating Deferred Income Taxes The Sample Corporation prepared the following income statements ...

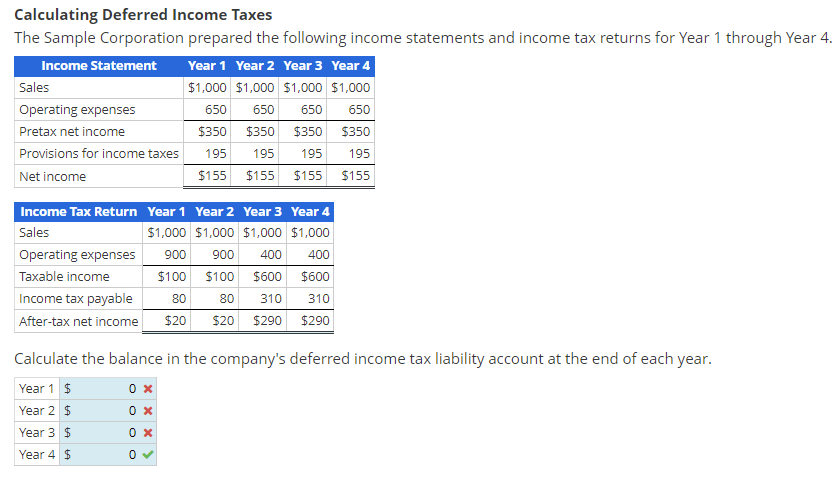

Calculating Deferred Income Taxes The Sample Corporation prepared the following income statements and income tax returns for Year 1 through Year 4. Income Statement Sales Operating expenses Pretax net income Provisions for income taxes Net income Year 1 Year 2 Year 3 Year 4 $1,000 $1,000 $1,000 $1,000 650 650 650 650 $350 $350 $350 $350 195 195 195 195 $155 $155 $155 $155 Income Tax Return Year 1 Sales $1,000 Year 2 Year 4 $1,000 $1,000 Operating expenses 900 900 400 400 Taxable income $100 $100 $600 $600 310 Income tax payable 80 80 310 After-tax net income $20 $20 $290 $290 Year 3 $1,000 $ Calculate the balance in the company's deferred income tax liability account at the end of each year. Year 1 0 x Year 2 $ 0 x Year 3 $ 0 x Year 4 $ 0?

Expert Answer

Answer Deferred Tax Assets- Assets that result from overpaying or