Home /

Expert Answers /

Accounting /

caden-construction-company-sells-a-used-crane-to-tau-construction-for-86-000-the-crane-which-or-pa414

(Solved): Caden Construction Company sells a used crane to Tau Construction for $86,000. The crane, which or ...

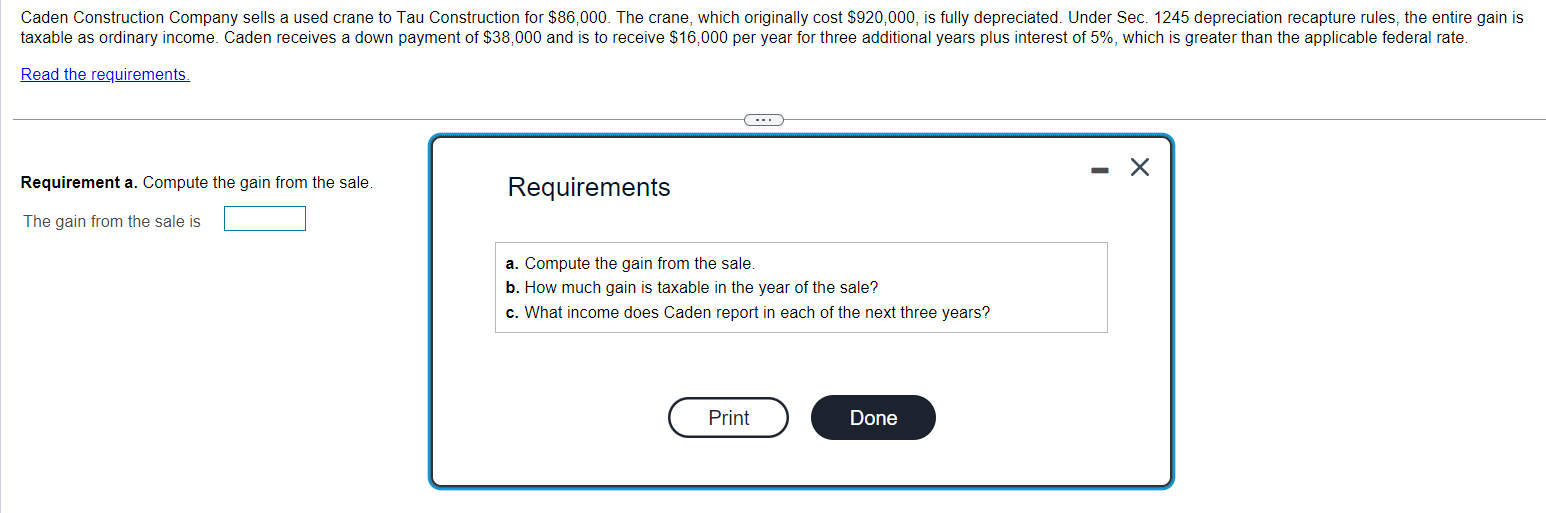

Caden Construction Company sells a used crane to Tau Construction for . The crane, which originally cost , is fully depreciated. Under Sec. 1245 depreciation recapture rules, the entire gain is taxable as ordinary income. Caden receives a down payment of and is to receive per year for three additional years plus interest of , which is greater than the applicable federal rate. Requirement a. Compute the gain from the sale. Requirements The gain from the sale is a. Compute the gain from the sale. b. How much gain is taxable in the year of the sale? c. What income does Caden report in each of the next three years?

Expert Answer

Capital gain is the profit one earns on the sale of an asset like stocks, bonds or real estateExplanation: It results in capital gain when the selling