Home /

Expert Answers /

Accounting /

bobs-bistro-produces-party-sized-hoagie-sandwiches-for-next-year-bobs-bistro-predicts-that-4-pa990

(Solved): Bobs Bistro produces party-sized hoagie sandwiches. For next year, Bobs Bistro predicts that 4 ...

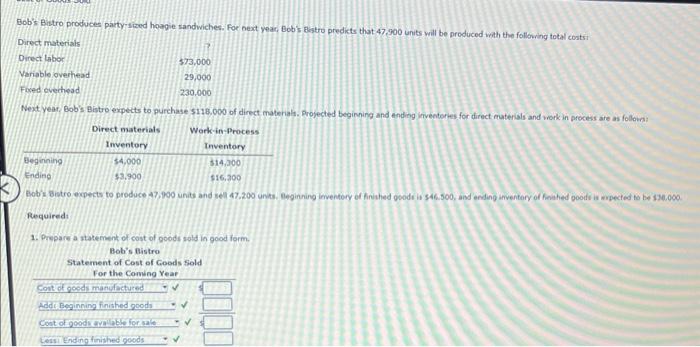

Bob’s Bistro produces party-sized hoagie sandwiches. For next year, Bob’s Bistro predicts that 47,900 units will be produced with the following total costs:

| Direct materials | ? |

| Direct labor | $73,000 |

| Variable overhead | 29,000 |

| Fixed overhead | 230,000 |

Next year, Bob’s Bistro expects to purchase $118,000 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows:

| Direct materials Inventory | Work-in-Process Inventory | |

| Beginning | $4,000 | $14,300 |

| Ending | $3,900 | $16,300 |

Bob’s Bistro expects to produce 47,900 units and sell 47,200 units. Beginning inventory of finished goods is $46,500, and ending inventory of finished goods is expected to be $38,000.

Required:

Question Content Area

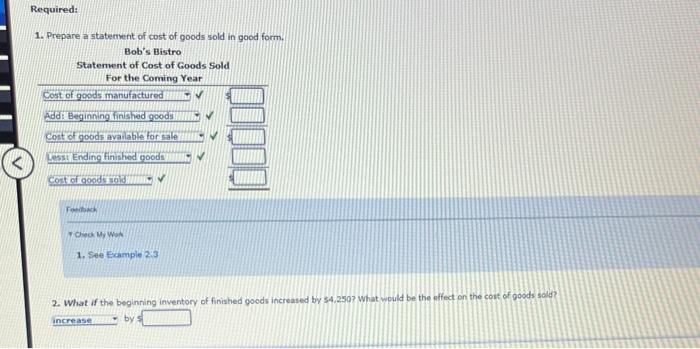

1. Prepare a statement of cost of goods sold in good form.

| $Cost of goods manufactured | |

| Add: Beginning finished goods | |

| $Cost of goods available for sale | |

| Less: Ending finished goods | |

| $Cost of goods sold |

Feedback Area

Feedback

1. See Example 2.3

Question Content Area

2. What if the beginning inventory of finished goods increased by $4,250? What would be the effect on the cost of goods sold?

Bob's Bistro produces party-sized hoagie sandwiches. Foe next year, Bob's Bistro predicts that 47,900 units will be produced wabh the following total costsi Next year. Bobs Bistro expects to purchase s138.000 of direct materiah. Projected beginning and endiag inventories for direct materals and work in process are as folown? Required 1. Prepare a statement of cost of poods sold in good form.

1. Prepare a statement of cost of goods sold in good form. resibach Forea Mr wok. 1. See Ecample \( 2.3 \) 2. What if the beginning inventory of finished goods increased by 54,250 ? What would be the effect on the cost of goods scld? by 5