Home /

Expert Answers /

Accounting /

blossom-company-sponsors-a-defined-benefit-plan-for-its-100-employees-on-january-1-2025-the-comp-pa814

(Solved): Blossom Company sponsors a defined benefit plan for its 100 employees, On January 1, 2025, the comp ...

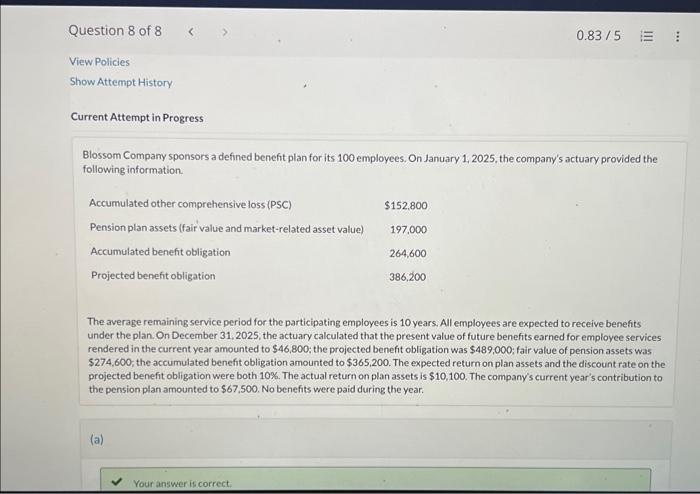

Blossom Company sponsors a defined benefit plan for its 100 employees, On January 1, 2025, the company's actuary provided the following information. The average remaining service period for the participating employees is 10 years. All employees are expected to receive benefits under the plan. On December 31.2025, the actuary calculated that the present value of future benefits earned for employee services rendered in the current year amounted to ; the projected benefit obligation was ; fair value of pension assets was ; the accumulated benefit obligation amounted to . The expected return on plan assets and the discount rate on the projected benefit obligation were both . The actual return on plan assets is . The company's current year's contribution to the pension plan amounted to . No benefits were paid during the year.

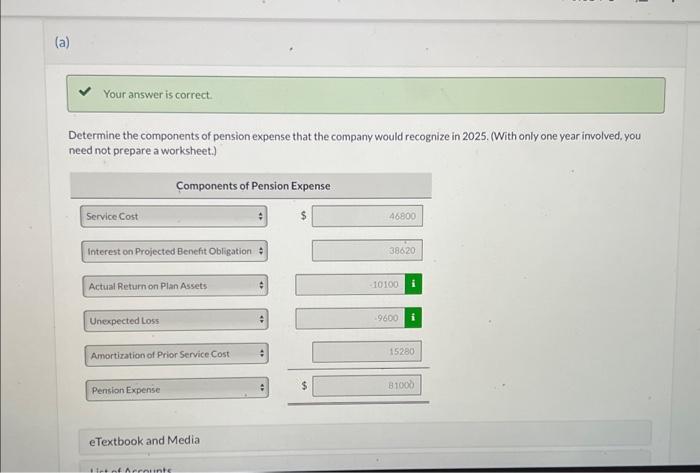

Determine the components of pension expense that the company would recognize in 2025. (With only one year involved, you need not prepare a worksheet.)

Prepare the journal entry to record the pension expense and the company's funding of the pension plan in 2025. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)