Home /

Expert Answers /

Accounting /

bed-ak-check-my-w-the-adjusted-trial-balance-for-happ-company-follows-adjusted-trial-balance-dec-pa537

(Solved): + bed ak Check my w The adjusted trial balance for Happ Company follows. Adjusted Trial Balance Dec ...

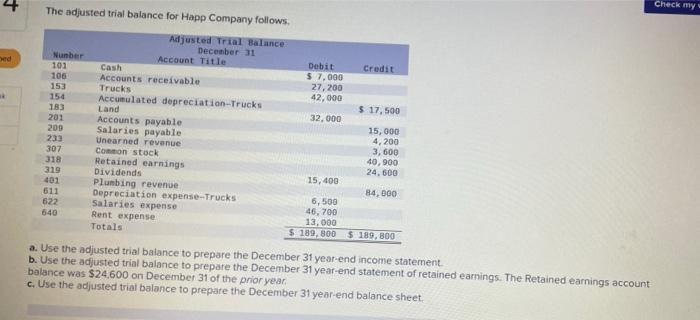

+ bed ak Check my w The adjusted trial balance for Happ Company follows. Adjusted Trial Balance December 31 Number Account Title Debit Credit 101 Cash $ 7,000 106 Accounts receivable 27,200 153 Trucks 42,000 154 Accumulated depreciation-Trucks $ 17,500 183 Land 32,000 201 209 Accounts payable Salaries payable Unearned revenue 15,000 4, 200 233 3,600 307 Common stock 40,900 318 Retained earnings Dividends 24,600 319 15,400 401 Plumbing revenue 84,000 611 Depreciation expense-Trucks 6,500 622 Salaries expense 640 Rent expense 46,700 13,000 Totals $ 189,800 $ 189,800 a. Use the adjusted trial balance to prepare the December 31 year-end income statement. b. Use the adjusted trial balance to prepare the December 31 year-end statement of retained earnings. The Retained earnings account balance was $24,600 on December 31 of the prior year. c. Use the adjusted trial balance to prepare the December 31 year-end balance sheet.

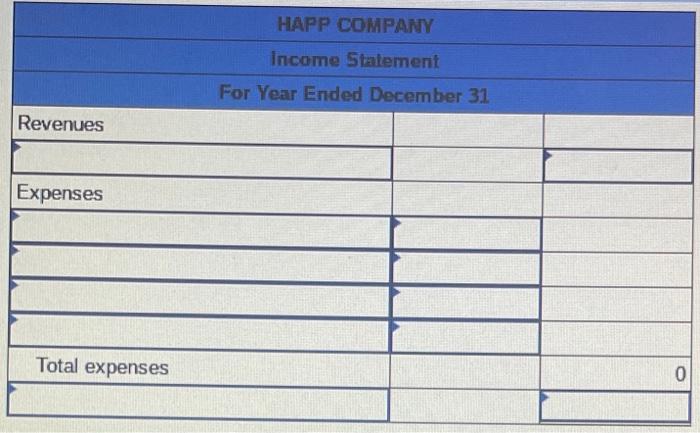

Revenues Expenses Total expenses HAPP COMPANY Income Statement For Year Ended December 31 0

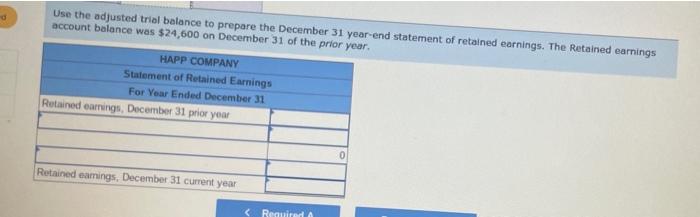

d Use the adjusted trial balance to prepare the December 31 year-end statement of retained earnings. The Retained earnings account balance was $24,600 on December 31 of the prior year. HAPP COMPANY Statement of Retained Earnings For Year Ended December 31 Retained earnings, December 31 prior year 0 Retained earnings, December 31 current year < Required A

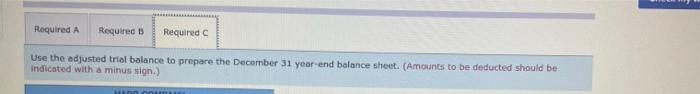

Required A Required B Required C Use the adjusted trial balance to prepare the December 31 year-end balance sheet. (Amounts to be deducted should be indicated with a minus sign.) HADD COND

December 31 $ $ $ 0 0 0 0