Home /

Expert Answers /

Accounting /

anwer-owns-a-rental-home-and-is-involved-in-maintaining-it-and-approving-renters-during-the-year-pa172

(Solved): Anwer owns a rental home and is involved in maintaining it and approving renters. During the year, ...

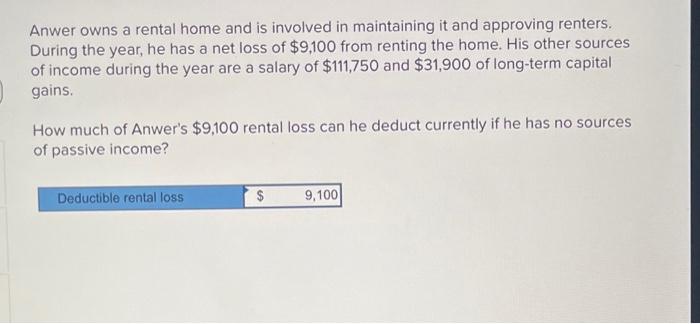

Anwer owns a rental home and is involved in maintaining it and approving renters. During the year, he has a net loss of \( \$ 9,100 \) from renting the home. His other sources of income during the year are a salary of \( \$ 111,750 \) and \( \$ 31,900 \) of long-term capital gains. How much of Anwer's \( \$ 9,100 \) rental loss can he deduct currently if he has no sources of passive income?

Expert Answer

The rental real estate loss allowance is federal tax deduction available to taxpayer who own and rent property in U.S. Up to $25,000 may be ded