Home /

Expert Answers /

Finance /

analyzing-an-inventory-footnote-disclosure-the-inventory-footnote-from-deere-company-39-s-2015-10-pa189

(Solved): Analyzing an Inventory Footnote Disclosure The inventory footnote from Deere \& Company's 2015 10 ...

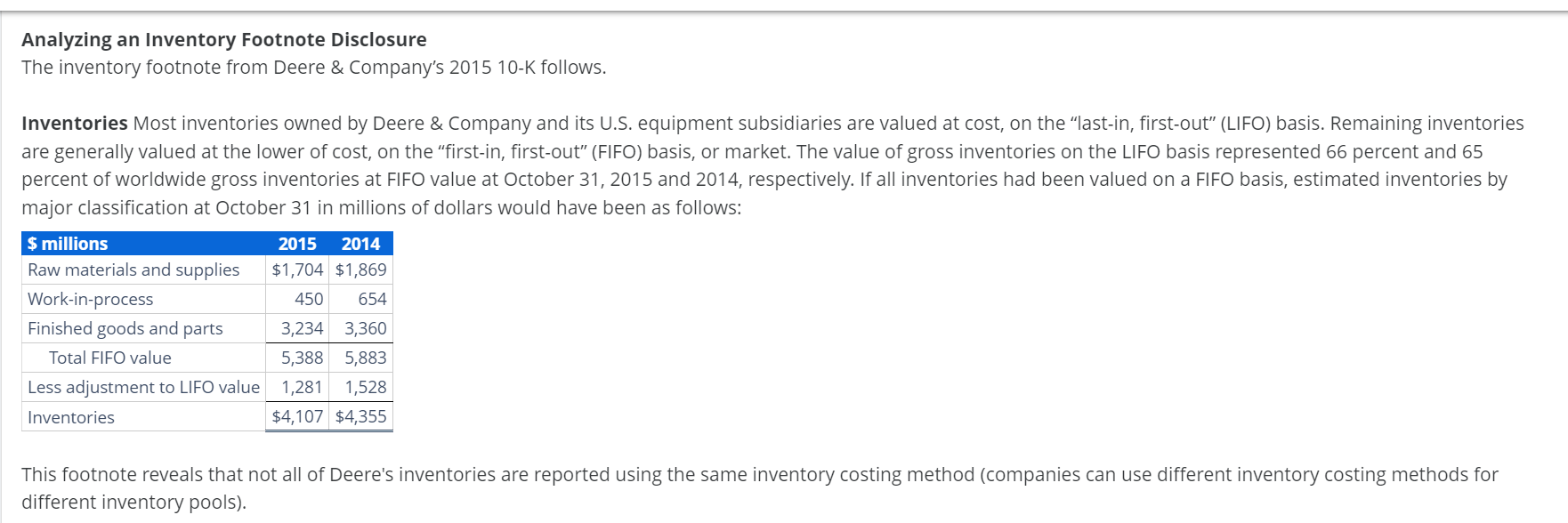

Analyzing an Inventory Footnote Disclosure The inventory footnote from Deere \& Company's 2015 10-K follows. Inventories Most inventories owned by Deere \& Company and its U.S. equipment subsidiaries are valued at cost, on the "last-in, first-out" (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the "first-in, first-out" (FIFO) basis, or market. The value of gross inventories on the LIFO basis represented 66 percent and 65 percent of worldwide gross inventories at FIFO value at October 31, 2015 and 2014, respectively. If all inventories had been valued on a FIFO basis, estimated inventories by major classification at October 31 in millions of dollars would have been as follows: This footnote reveals that not all of Deere's inventories are reported using the same inventory costing method (companies can use different inventory costing methods for different inventory pools).

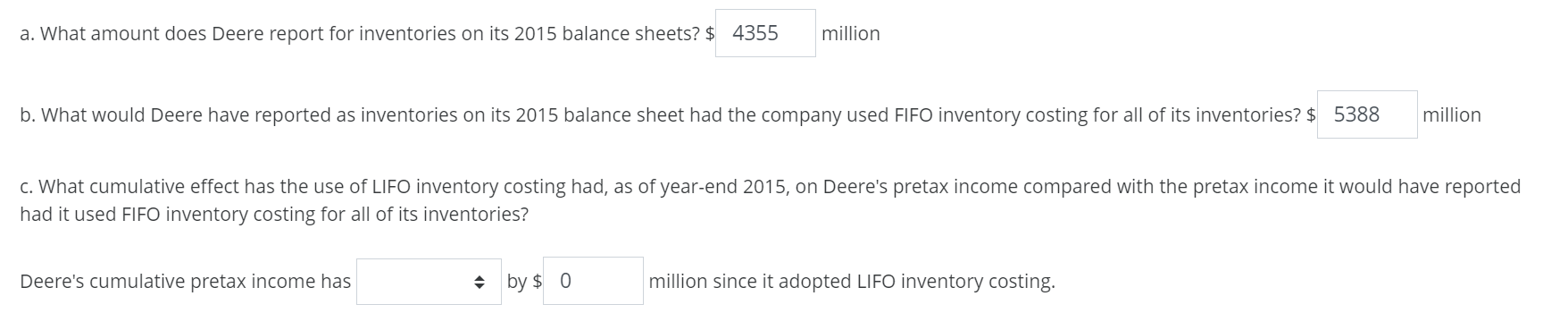

a. What amount does Deere report for inventories on its 2015 balance sheets? million b. What would Deere have reported as inventories on its 2015 balance sheet had the company used FIFO inventory costing for all of its inventories? \$ million c. What cumulative effect has the use of LIFO inventory costing had, as of year-end 2015, on Deere's pretax income compared with the pretax income it would have reported had it used FIFO inventory costing for all of its inventories? Deere's cumulative pretax income has by million since it adopted LIFO inventory costing.

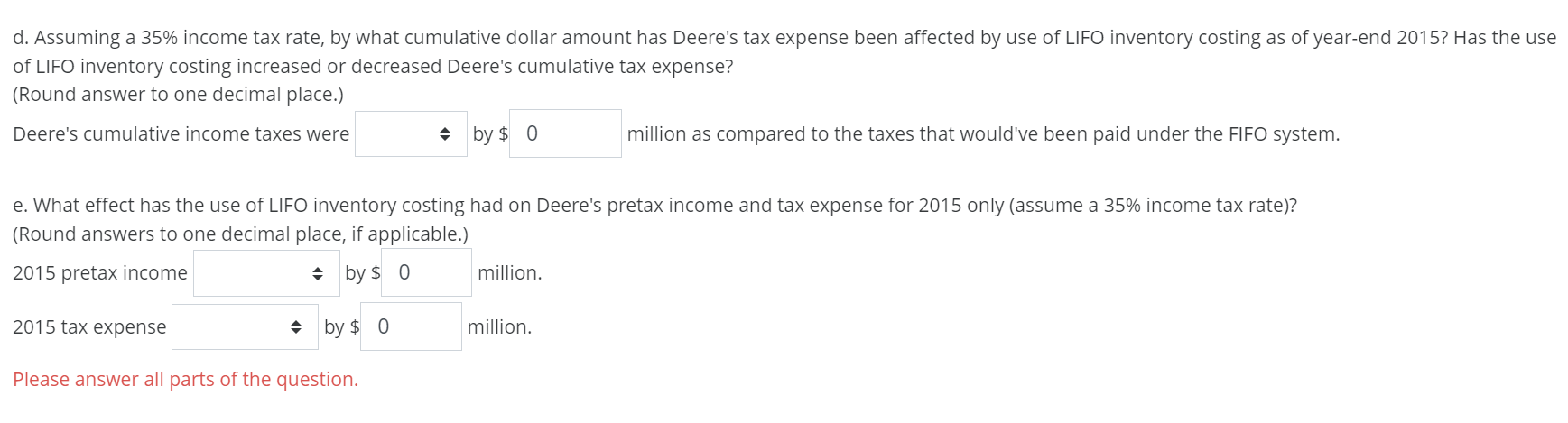

d. Assuming a income tax rate, by what cumulative dollar amount has Deere's tax expense been affected by use of LIFO inventory costing as of year-end 2015 ? Has the use of LIFO inventory costing increased or decreased Deere's cumulative tax expense? (Round answer to one decimal place.) Deere's cumulative income taxes were by million as compared to the taxes that would've been paid under the FIFO system. e. What effect has the use of LIFO inventory costing had on Deere's pretax income and tax expense for 2015 only (assume a income tax rate)? (Round answers to one decimal place, if applicable.) 2015 pretax income by million. 2015 tax expense by million. Please answer all parts of the question.