Home /

Expert Answers /

Accounting /

analyzing-an-inventory-footnote-disclosure-illinois-tool-works-reports-the-following-footnote-in-i-pa188

(Solved): Analyzing an Inventory Footnote Disclosure Illinois Tool Works reports the following footnote in i ...

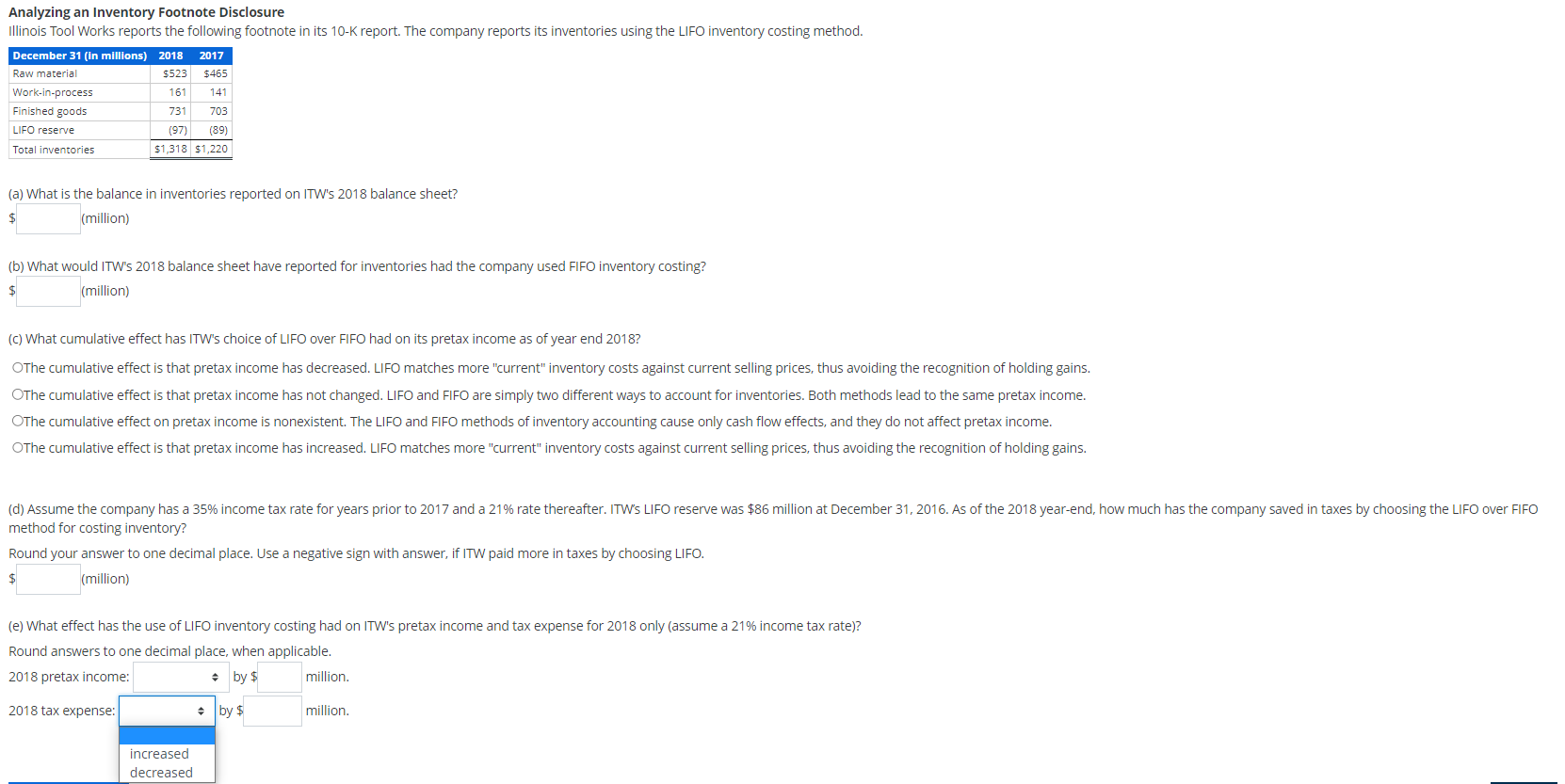

Analyzing an Inventory Footnote Disclosure Illinois Tool Works reports the following footnote in its 10-K report. The company reports its inventories using the LIFO inventory costing method. (a) What is the balance in inventories reported on ITW's 2018 balance sheet? (million) (b) What would ITW's 2018 balance sheet have reported for inventories had the company used FIFO inventory costing? (million) (c) What cumulative effect has ITW's choice of LIFO over FIFO had on its pretax income as of year end 2018? method for costing inventory? Round your answer to one decimal place. Use a negative sign with answer, if ITW paid more in taxes by choosing LIFO. (million) (e) What effect has the use of LIFO inventory costing had on ITW's pretax income and tax expense for 2018 only (assume a \( 21 \% \) income tax rate)? Round answers to one decimal place, when applicable. 2018 pretax income: \( \quad \) by \( \uparrow \) million. 2018 tax expense:

Expert Answer

Answer and Explanation :- (d)increase of opening inventory by$86 will decrease pretax income by $86 decreas