Home /

Expert Answers /

Finance /

anadolu-efes-is-a-producer-of-beer-and-non-alcoholic-beverages-with-a-capital-structure-of-23-pa633

(Solved): Anadolu Efes is a producer of beer and non-alcoholic beverages with a capital structure of \( 23 \ ...

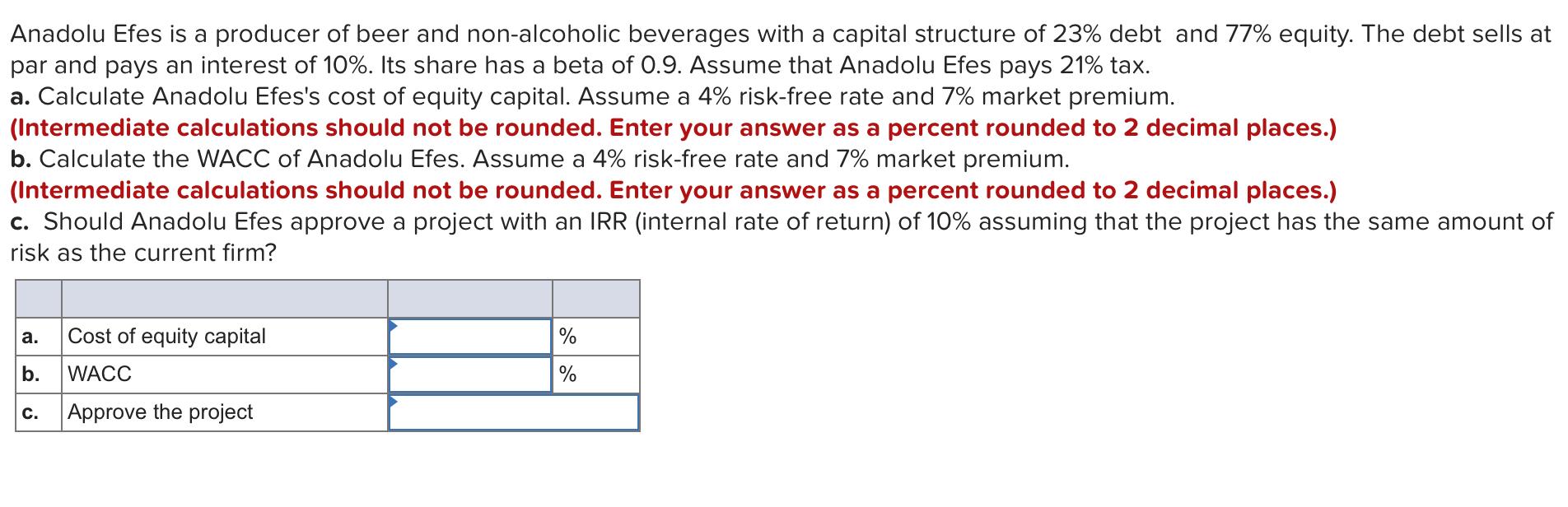

Anadolu Efes is a producer of beer and non-alcoholic beverages with a capital structure of \( 23 \% \) debt and \( 77 \% \) equity. The debt sells at par and pays an interest of \( 10 \% \). Its share has a beta of 0.9. Assume that Anadolu Efes pays \( 21 \% \) tax. a. Calculate Anadolu Efes's cost of equity capital. Assume a \( 4 \% \) risk-free rate and \( 7 \% \) market premium. (Intermediate calculations should not be rounded. Enter your answer as a percent rounded to 2 decimal places.) b. Calculate the WACC of Anadolu Efes. Assume a \( 4 \% \) risk-free rate and \( 7 \% \) market premium. (Intermediate calculations should not be rounded. Enter your answer as a percent rounded to 2 decimal places.) c. Should Anadolu Efes approve a project with an IRR (internal rate of return) of \( 10 \% \) assuming that the project has the same amount of risk as the current firm?

Expert Answer

To calculate Karsan Otomativ's book debt-to-value (D/V) ratio, you need to divide the company's long-term debt by its book value. The book value is ca