Home /

Expert Answers /

Accounting /

after-the-success-of-the-company-39-s-first-two-months-santana-rey-continues-to-operate-business-sol-pa167

(Solved): After the success of the company's first two months, Santana Rey continues to operate Business Sol ...

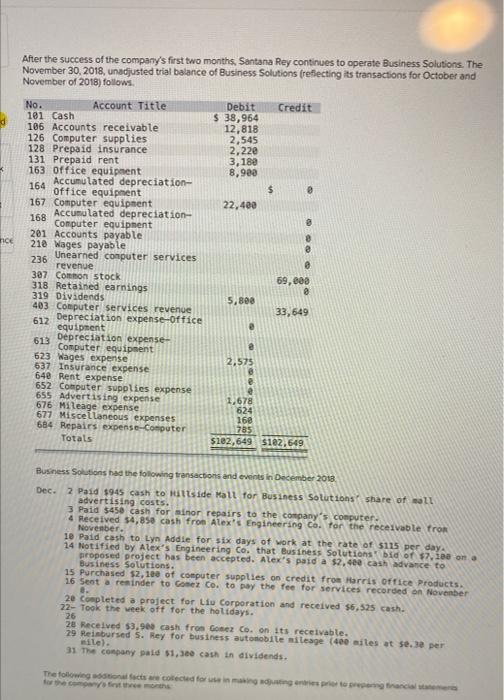

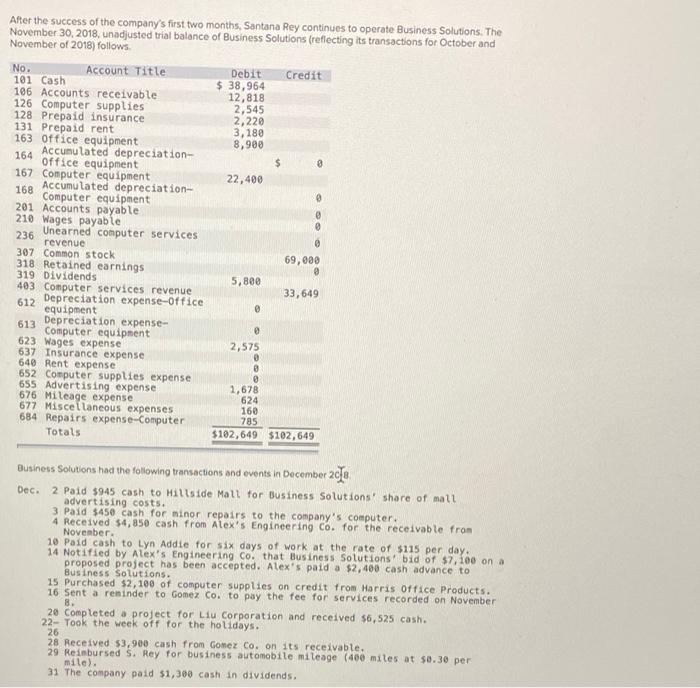

After the success of the company's first two months, Santana Rey continues to operate Business Solutions. The November 30, 2018, unadjusted trial balance of Business Solutions (refiecting its transactions for October and November of 2018) follows. Busness Solitions had the following tansactons and evints in December 20 va. Dec. 2 Paid \( \$ 945 \) cash to Hitside kall for Business Solutions? share of wall advertising costs. 3 Paid \( \$ 450 \) cash for ainor repairs to the canpany "s conputer. 4 Meceived \$4, 8se cash fron Alex's Engineering Co. Pon the recelvable fron Novenber. 18 Paid cash to Lyn Addie for six days of work at the rate of 5115 per day. 14 Notified by alex's Engineering co. that Business Solutions bid of \( \$ 7 \), 1 ae an a proposed project has been accepted. Alex's paid a \$2, 4ee cash advance to Business solutions. 15 Purchased 12,100 of conputer supplies on credit from Harris oftice Products. 16 Sent a reninder to conez Co. to pay the fee for services recorded in Novenber 20 copleted a project for Liu corporation and received 56,525 cash. 22- Took the week off for the holtdays. 26 Received \( 53.900 \) cash fron Gowez co. on its receivable. 29 Reinbursed 5 . Mey for business autonobile mitesge (4e0 ailes at se.3a per rillel. 31 the conpany pald \( 31,3 e 0 \) cash in dividends.

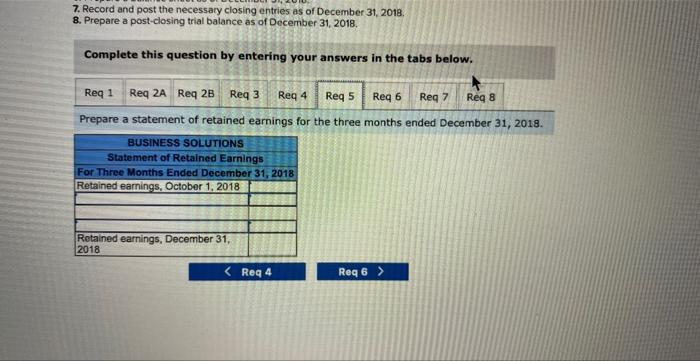

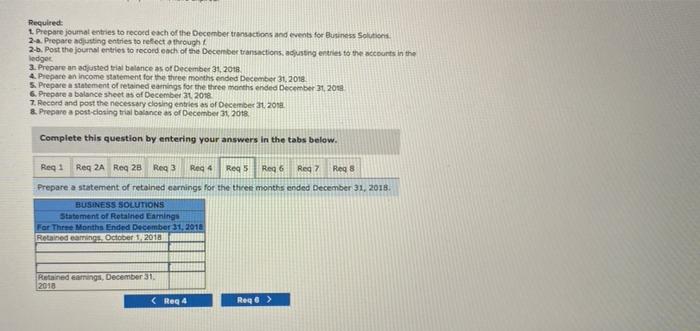

7. Record and post the necessary closing entries as of December 31,2018 . 8. Prepare a post-closing trial balance as of December 31, 2018 . Complete this question by entering your answers in the tabs below. Prepare a statement of retained earnings for the three months ended December \( 31,2018 . \)

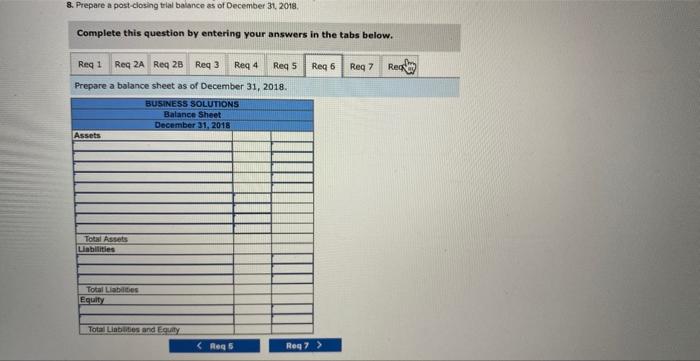

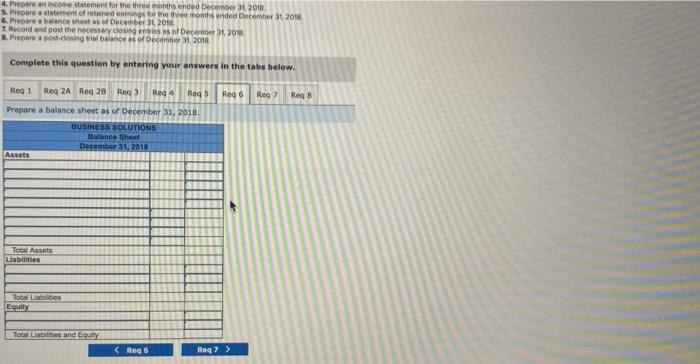

8. Prepare a post-closing trial baiancen as of December 31, 2018 . Complete this question by entering your answers in the tabs below. Prepare a balance sheet as of December \( 31,2018 . \)

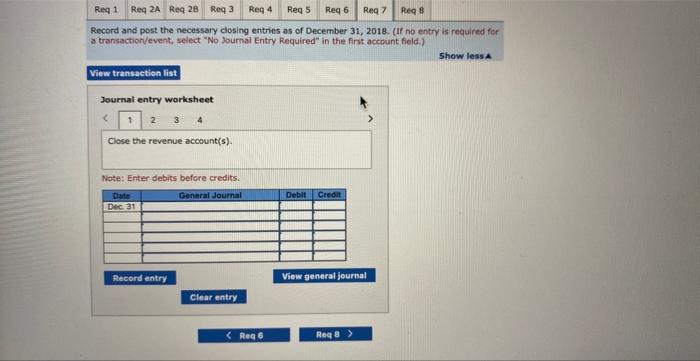

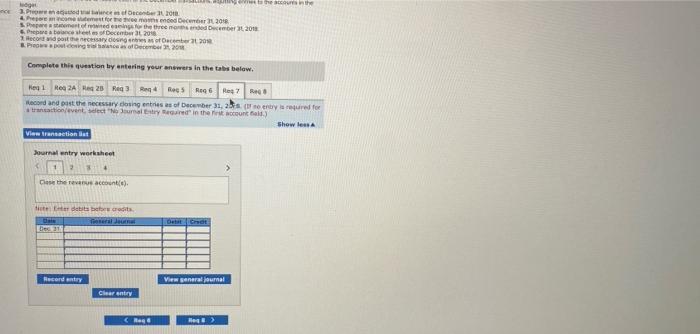

Rocord and post the necessary closing entries as of December 31,2018 . (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Show lessa Journal entry worksheet \( 3 \quad 4 \) Close the revenue account(s). Note: Enter debits before credits.

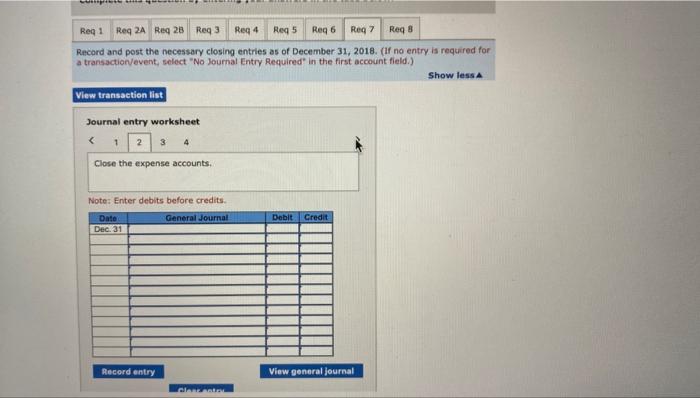

Record and post the necessary closing entries as of December 31, 2018. (uf no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Show lessa Journal entry worksheet 4 Close the expense accounts. Note: Enter debits before credits.

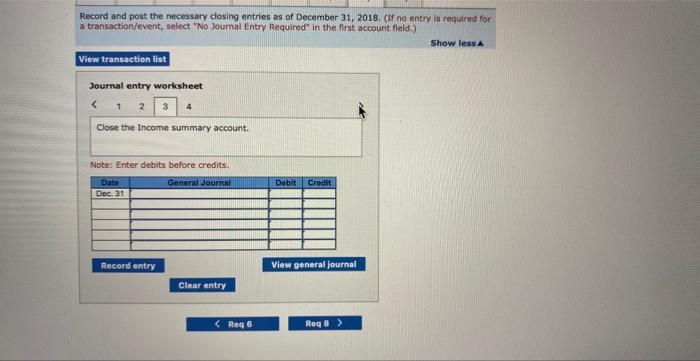

Record and post the necessary closing entries as of December 31,2018 . IIf no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Show lessa Journal entry worksheet: Close the income summary account. Note: Enter debits before credits.

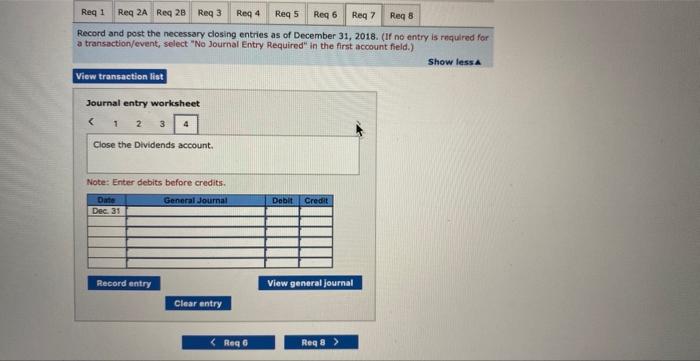

Record and post the necessary closing entries as of December 31,2018 . (If no entry is required for a transactionfevent; select. "No Journal Entry -Required" in the first account field.) Showe fess Journal entry worksheet < 1 Close the Dividends account. Note: Enter debits before credits.

After the success of the company's first two months, Santana Rey continues to operate Business Solutions. The November 30,2018 , unadjusted trial balance of Business Solutions (reflecting its transactions for October and November of 2018 ) follows. Business Solutions had the following transactions and events in December \( 2 \mathrm{CJ} B \) Dec. 2 Paid \( \$ 945 \) cash to Hillside Mall for Business Solutions' share of mall advertising costs. 3 Paid \( \$ 450 \) cash for minor repairs to the company's computer. 4 Received \( \$ 4,850 \) cash from Alex's Engineering Co. for the receivable fran Novenber. 10 Paid cash to Lyn Addie for \( \$ 2 x \) days of work at the rate of \( \$ 115 \) per day, 14 Notified by Alex's Engineering Co. that Business Solutions bid of \( \$ 7,100 \) on a proposed project has been accepted. Alex.' paid a \( \$ 2,460 \) cash advance to Business solutions. 15 Purchased \$2, 100 of computer supplies on credit from Harris Office Products. 16 Sent a reninder to Gomez Co. to pay the fee for services recorded on November. 8. 20 Completed a project for Liu Corporation and received \( \$ 6,525 \) cash. 22- Took the week off for the holidays. 26 28 Received \( \$ 3,900 \) cash from Gomez Co. on 1ts receivable. 29 Reinbursed 5 . Rey for business automobile mileage (A00 miles at \( \$ 0.30 \) per mile). 31 The company paid \( \$ 1,300 \) cash in dividends.

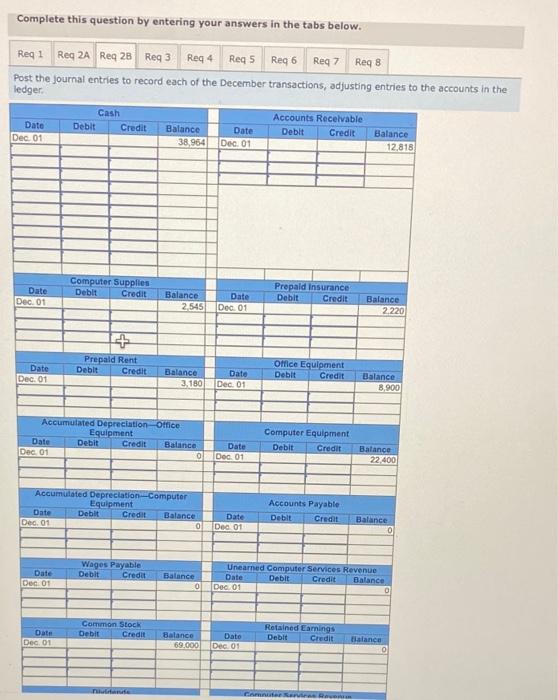

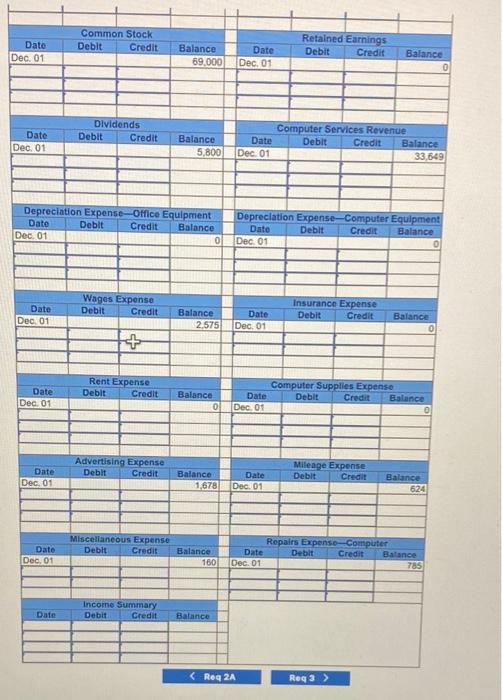

Complete this question by entering your answers in the tabs below. Post the journal entries to record each of the December transactions, adjusting entries to the accounts in the ledoer.

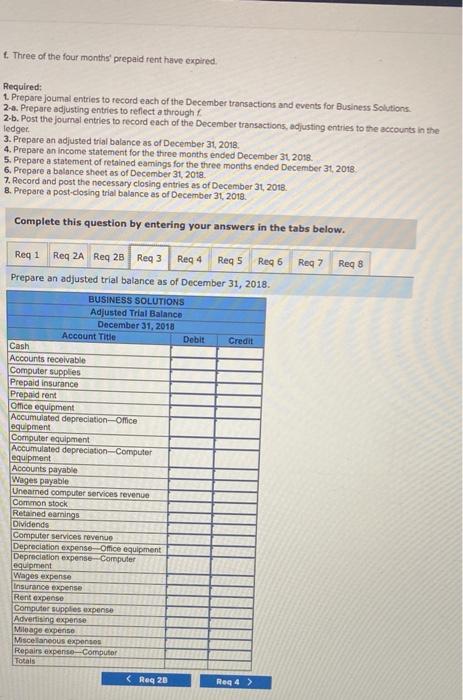

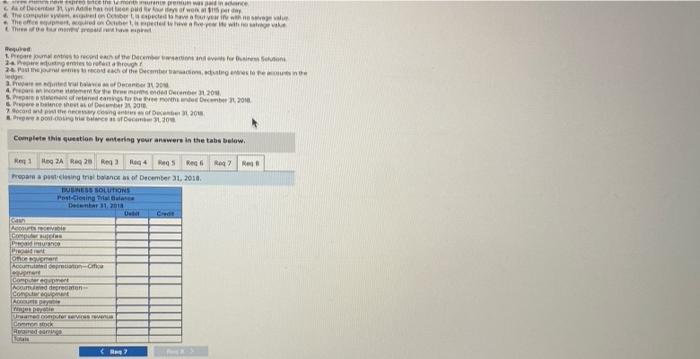

4. Three of the four months' prepaid rent have expired. Required: 1. Prepare joumal entries to record each of the December transactions and events for Business Solutions. 2-a. Prepare adjusting entries to reflect a through \( f \). 2-b. Post the journal entries to record each of the December transactions, adjusting entries to the accounts in the ledger. 3. Prepare an adjusted trial balance as of December 31, 2018. 4. Prepare an income statement for the three months ended December 31, \( 2018 . \) 5. Prepare a statement of retained eamings for the three months ended December 3t, 2018: 6. Prepare a balance shoet as of December 31, \( 2018 . \) 7. Record and post the necessary closing entries as of December 31,2018 . 8. Prepare a post-closing trial balance as of December 31, \( 2018 . \) Complete this question by entering your answers in the tabs below. Prepare an adjusted trial balance as of December 31,2018 .

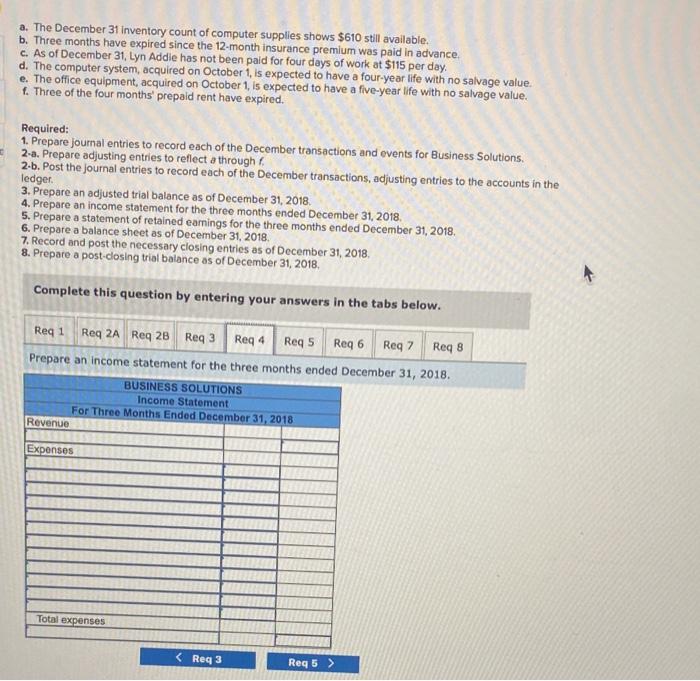

a. The December 31 inventory count of computer supplies shows \( \$ 610 \) still available. b. Three months have expired since the 12 -month insurance premium was paid in advance. c. As of December 31 , Lyn Addie has not been paid for four days of work at \( \$ 115 \) per day. d. The computer system, acquired on October 1 , is expected to have a four-year life with no salvage value. e. The office equipment, acquired on October 1 , is expected to have a five-year life with no salvage value. f. Three of the four months' prepaid rent have expired. Required: 1. Prepare journal entries to record each of the December transactions and events for Business Solutions. 2-a. Prepare adjusting entries to reflect a through \( f \). 2.b. Post the journal entries to record each of the December transactions, adjusting entries to the accounts in the ledger. 3. Prepare an adjusted trial balance as of December \( 31,2018 . \) 4. Prepare an income statement for the threo months ended December 31, \( 2018 . \) 5. Prepare a statement of retained eamings for the three months ended December 31, 2018. 6. Prepare a balance sheet as of December 31, 2018. 7. Record and post the necessary closing entries as of December 31, 2018. 8. Prepare a post-closing trial balance as of December 31,2018 , Complete this question by entering your answers in the tabs below. Prepare an income statement for the three months ended December 31, 2018 .

Reculed: 1. Prepare joumal entries to recoed each of the Deccmber transwctions and events for Butiness Solutiond: 2-a. Piepare adjuting ettries to refect a through f. 2.b. Post the journsl entries to recoed eath of the Decenbee wansactions, acfustreg entries to the accourts in the liodger. 3. Prepare an acjusted trial balance as of becember 34, 2048 . 4. Prepare an income wetatement for the three mowhs ended becember 31. 2018. 5. Prepare an stabement of retaned earnings for the three months ended Decertber 3t, 20:i. 6. Prepste a bulance sheet an of Decenber 312018 . 7. Record and post the necessary elosing entries as of Decertioer 3t. 20'a . 8. Prepare a port-cloting trai baince or of Decenber 31,2018 . Complete this question by entering your answers in the tabs below. Prepare a statement of retained earnings for the three months ended December 31,2014 :

4. Piepare an income statemers for the three months enced December 31. 201h 6. Prepare a beiarte sheet as of December It. 20 in 7. Recoid and post bie necessapy ciosing enyies as of Dwcerher 71, 209 . 4. Piesare a post-doving tiai betance af of December 31 zore Complete this question by entining your answers in the tabs belaw. Prepare a balance sheot as of Decembet 31,2018 .

Conplete this question by entering your answers in the tabs below, Show less a Sournal entry workaheet Casen the reverue accosnt:t). tiete fHet eabla befses crasita:

Riestined evject. Eowelet= this quethetlon ly ensening yesur anower in the tabs below,

Expert Answer

a. Date General journal Debit($) Credit ($) Dec 2 Advertising expense 945 To Cash 945 Dec 3 Repairs - computer 450 To Cash 450 Dec 4 Cash 4,850 To Accounts receivable 4,850 Dec 10 Wages(115*6) 690 To cash 690 Dec 14 Cash 2400 To unearned revenue 2400